Another war in the Middle East, hotter than expected U.S. inflation, and a $5 jump in crude oil used to be the news that roiled markets already beaten up by the pandemic, trade wars and turbulent stock prices. But rather than heading to the exits, traders didn’t jump at the bait of more crazy headlines, instead rallying Wall Street �– and more importantly for farmers – helping seasonal trends try to confirm harvest lows in the wake of a friendly report from USDA last week.

Indeed, corn and soybean futures surged Oct. 12, after the World Agricultural Supply and Demand Estimates cut production for both crops, even though the data was friendly – but not THAT friendly. But the market’s ability to keep on its blinders allowed for the idea that prices have bottomed, at least for now.

For the record, USDA cut its estimate of corn yields by eight-tenths of a bushel to 173 bushels per acre, trimming 70 million bushels off the size of the crop. Along with lower beginning inventories at start of the marketing year Sept. 1 revealed by recent Grain Stocks, that cut projected supplies by 160 billion bushels. The balance sheet’s bottom line carryout fell by only 110 million bushels due to weaker demand, and still would be historically large at 2.111 billion bushels.

The government’s latest surveys of farmers and their fields trimmed a half-bushel of soybean yields, which slipped to 49.6 bpa. But increased Sept. 1 beginning inventories and reduced exports left projected carryout unchanged at 220 million bushels, though that represents the small number of days’ supply since 2015.

Both crops’ production and carryout estimates came in only a little lower than expected. So, the exaggerated response was likely spurred by traders covering short position in hopes of a seasonal bottom. Large speculators were selling going into the data dump, particularly in corn, where their bearish bets were the largest in more than three years.

Harvest lows?

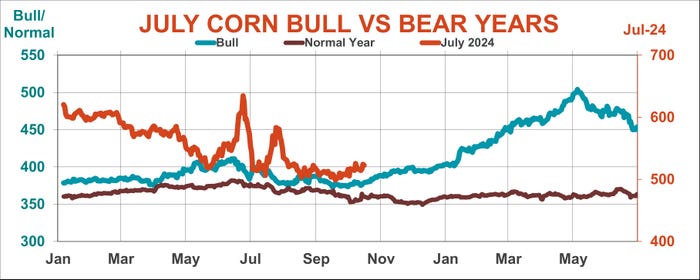

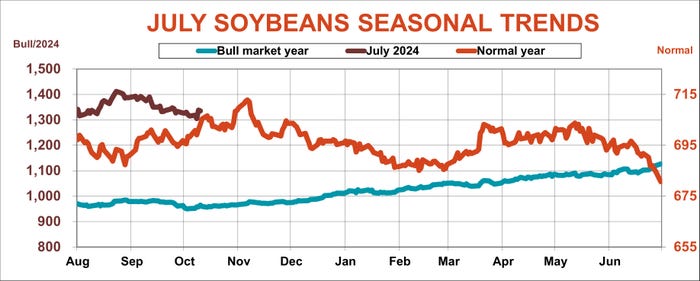

Harvest is, of course, the time when crop prices typically bottom, and recent lows for November soybeans and December corn came just a week from the averages over the past 50 years. But that doesn’t mean growers filling bins should expect any rallies to last. For longer term prospects, July futures is a gauge to watch. Most years, prices start to fade again in November, with corn on average the first to falter, around the time of the next WASDE in November.

Despite that trend for corn, USDA actually raised its average cash price projection for the crop by a nickel, to $4.95. My own model isn’t as optimistic by 50 cents, especially with a strong dollar acting as a damper on prices of many commodities. Moreover, both supply and demand could change. USDA updates production in a month, while some of its usage forecasts may also turn out too strong.

Livestock feeding is always tricky to pinpoint, and the government’s increase for the 2023 marketing year could be blindsided by a shrinking cattle herd and fewer bred hogs as consumers wrestle with lingering inflation. The export outlook also may not turn out as sunny was USDA forecasts. While much of that depends on production elsewhere, especially South America, early sales in the first month of the season are better than last year, but not as strong as the USDA outlook.

How much corn will be used to make ethanol is another question for demand. USDA says plants will use 123 million more than last year. But the forecast released by the Energy Department the day before USDA sees lower ethanol production and usage for gasoline blending, as high prices curb driving and the conversion to electric take a toll.

Soybean diplomacy?

Extended post-harvest rallies in soybeans typically take either production surprises or stronger than expected export demand or crush.

I’m still not convinced biodiesel will be quite the tonic for crush USDA believes while exports as usual hinge on China and competition from South America. Both could spell trouble.

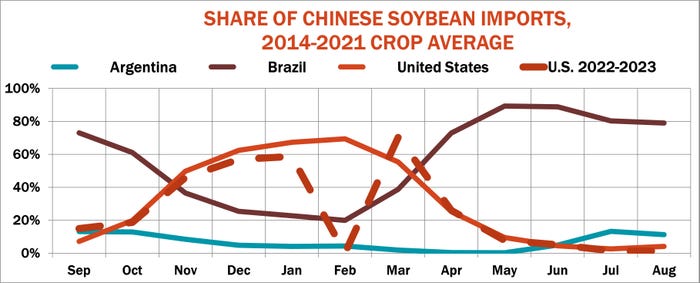

USDA sees Argentine production rebounding from last year’s disaster, with Brazil as expected to keep relentlessly adding acreage. But even if the U.S. stays competitive, will China cooperate? U.S. sales to China normally begin to pick up after harvest, hopes threatened this year by record low water levels on the Mississippi River that restricts barge loads and raises freight costs.

Chinese data released Friday also wasn’t encouraging. Its September soybean imports fell 13.6% from August and came in 7.3% less than the previous year. Most of those shipments came from Brazil, too. Though U.S. shipments were up, total commitments for the entire marketing year to China are down nearly 40%.

Though it’s still too early to tell if that’s a lasting trend, improvement could depend on relations between the U.S. and China healing from tensions over the past two years. While the U.S. continues to tighten restrictions on technology transfers, both sides are at least talking again, with top officials from the Treasury, Defense and State Department again meeting with counterparts from China.

Whether that leads to goodwill deals, it’s at least a start, though poor hog feeding margins in China and cheaper Brazil soybeans could restrict any big gestures with meaningful long-term impact. Trade isn’t as much about free markets these days as it is about politics, especially in a world filled with intrigue – and potential for more tumultuous headlines that throw forecasts into the dumpster.

Knorr writes from Chicago, Ill. Email him at [email protected].

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

Read more about:

WASDEAbout the Author(s)

You May Also Like