The trading year isn’t quite over yet. But it’s safe to say for most of those in the markets, 2023 felt like circling the drain.

That’s especially true for grain farmers, whose prices suffered some of the biggest losses of any widely traded contracts.

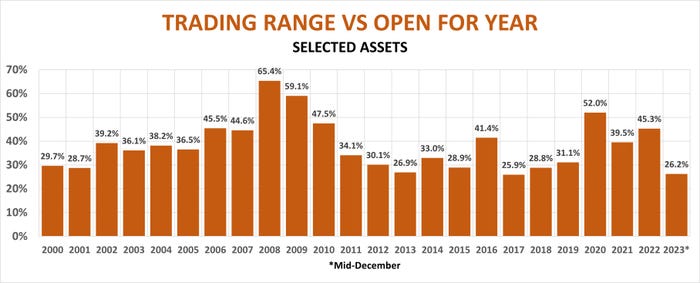

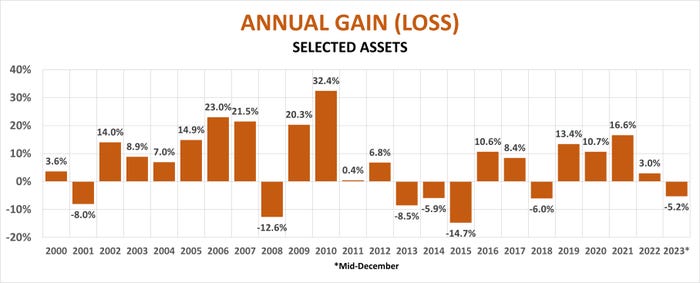

Though average results from La Salle Street to Wall Street were lower over the last 12 months, 2023 is turning out to be one of the least turbulent years of the past quarter century. Despite multiple wars and a roller coaster ride for inflation and interest rates, the average trading range for more than a dozen popular assets, from crops to crude oil, was the second lowest since 2000.

Less volatility than normal was the rule, not the exception. This was true for corn, soybeans and wheat. As these futures crowded the bottom of the field, we were reminded that volatility is not always bad for growers who depend on a certain amount of frenzy from speculators to drive prices higher.

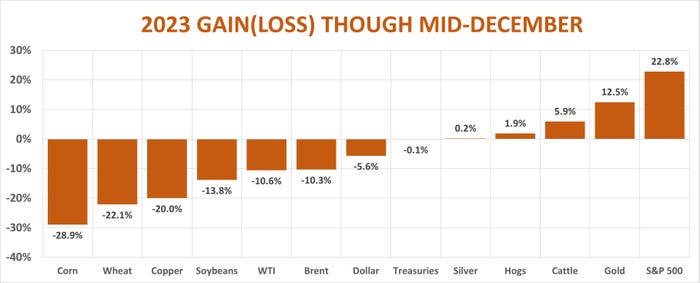

So here’s the tale of the tape, at least through mid-December, when many market participants hang it up for the holidays.

Lump of coal

The corn market’s wilt was the largest of any of these contracts, with nearby futures down 28.9% from the opening bell after the New Year’s break. Lower than expected yields didn’t support prices, thanks to expanded acreage that produced another big crop that faced sluggish demand from U.S. and world economies still trying to prove their mettle. Runner-up wheat lost 22.1%. while soybeans were the fourth biggest loser with a 13.8% loss. Only copper, a bellwether for struggling China, with a 20% downturn, kept the Chicago markets from taking the bronze medal, in addition to the two top spots on the podium of pain.

Concerns about demand also raised fears of oversupply in the crude oil market, despite additional production cuts from OPEC and its allies, including Russia. Losses for West Texas Intermediate, the U.S. benchmark, and Brent Crude Oil Continuous Contract, its international counterpart, also hit double digits.

The downturn in petroleum and grain prices helped cool red-hot inflation, the highest in 40 years, which prompted a rapid rise in interest rates and other measures by the Federal Reserve Board of Governors. That cooling and other indicators are encouraging to The Fed, which appeared on the verge of taking a victory lap after its latest meeting on monetary policy last week. Economic projections from participants called for an average of three cuts in rates next year, with officials seeing lower inflation and stronger growth than previously forecast.

Dollar bounces

The apparent attitude adjustment at the central bank ended a wild ride for two bellwether assets. The U.S. Dollar Index and 10-Year Treasury Notes were the only two of the assets tracked to experience larger than average 2023 trading ranges. Both normally are trademarks of tranquility, which is why investors flock to them as safe havens.

But the greenback and Treasuries were anything but shelter from the storm this year.

The dollar usually trades in tandem with interest rates, moving higher when rates rise due to buying from investors seeking higher returns from securities backed by “the full faith and credit” of the largest economy in the world. So, as expectations of interest rate cuts mounted, the dollar suffered, falling in July to its lowest level since April 2022.

Despite better data on inflation, renewed hopes for a “soft landing” from a resilient economy helped the dollar bounce back regardless of red flags from credit agencies worried about gridlock in Washington. But the currency renewed its retreat following the latest Fed meeting and comments from Chairman Jerome Powell the market viewed as dovish.

All that glitters

Consumers with more cash tend to eat more meat, so the news supported livestock prices, lifting hogs and cattle to year-on-year-gains. But while silver was flat on industrial demand, the upbeat end to the year made gold and the stock market the biggest winners of year by far.

A weaker dollar tends to support commodities denominated in the currency, which helped the precious metal to 12.5% gains, even though investors also buy gold as a bulwark against inflation. In this case a weaker dollar supported gold as a store of value against a currency with less buying power.

But the hands-down winner for 2023 was the stock market, as investors cheered what seemed like the best of all worlds: lower inflation and better growth that would boost corporate profits. Indexes varied due to their individual constructions – the S&P 500 Index was up nearly 23%, benefiting from a Santa Claus rally that took the benchmark to its highest level since January 2022.

After four years of gains for soybeans, and five for corn, a pullback in 2023 was not unexpected for crops. But recent history does ring a bit of an alarm for 2024. Since 2013, one year of lower futures was followed by another. And annual price ranges for both corn and soybeans topped 40% on average since 2000 – a reminder to get ready for another year of gyrations.

Knorr writes from Chicago, Ill. Email him at [email protected].

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like