What keeps you up at night? Politics, war and even family can be the stuff of bad dreams. But corn growers confronting uncertain markets and weather as planting picks up likely have the same boogeyman: What happens if a crop disaster strikes or prices plummet after several years of profitable production?

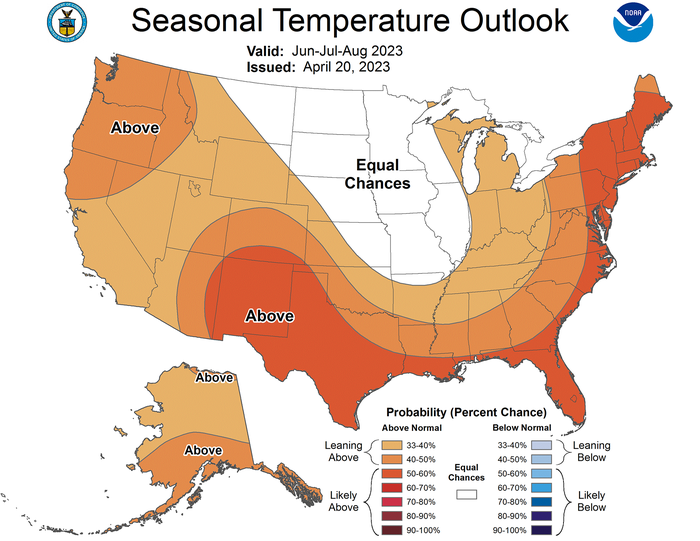

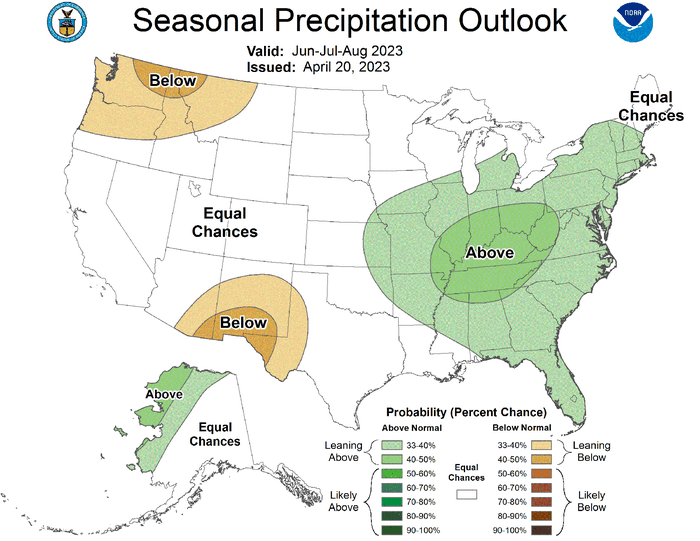

This year, there may be even more urgency to that question, thanks to the expected return of El Nino warming in the equatorial Pacific. Summer forecasts out last week confirmed the weather phenomenon’s influence I discussed recently, calling for normal to above normal rainfall and no extreme heat for the growing region – a recipe for above average yields that helped pummel December corn futures below chart support levels to make nine-month lows.

While 90-day forecast maps did show potential for above average temperatures in the eastern and southern Corn Belt, most of the affected area would only see readings one or two-tenths of a degree above normal. That’s not enough to make a difference on yields, especially if predicted rainfall arrives.

Stress test

How do you make sure the weather doesn’t wallop your farm’s profitability, or even long-term future? Consider taking a page from financial regulators, who require large banks to perform stress tests to make sure a worst-case scenario doesn’t lead to a rerun of the 2008 financial crisis. Preparing for Armageddon helped most U.S. financial institutions weather the most recent storm, after a couple lenders failed in March.

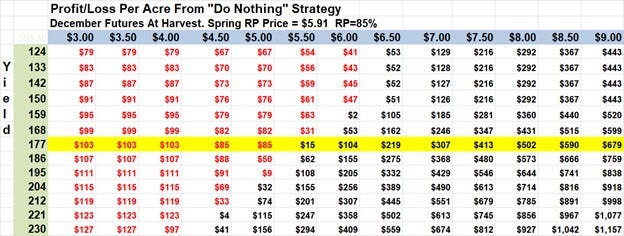

A good place to start is to create a sensitivity analysis showing how profits are affected by different combinations of prices and yields. The Data Table function of spreadsheet programs like Excel make this relatively easy, though it can get a bit complex if you also factor in protection from crop insurance and government farm programs like ARC as well as marketing strategies. But the results are worth some pencil-pushing

Here’s a table showing how a farm with average expected yields and costs would fare by selling off the combine, making no pre-harvest sales but taking ARC and 85% revenue assurance coverage. There’s plenty of red ink if prices and/or yields fall, but room for profit too. The yellow line shows what happens if yields come in at 177 bushels per acre, the long-term trend forecast for 2023.

Wheel of fortune

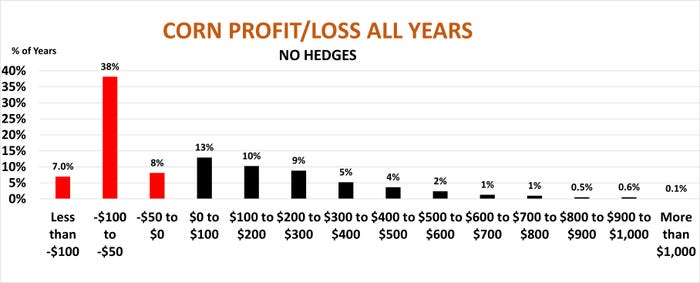

The table illustrates what happens with a given price and yield, which is a start. But it doesn’t tell you the odds that any of those combinations might occur. To find that answer, I used what’s known as a Monte Carlo simulation. My “wheel of fortune” generated 2,000 different outcomes based on variables randomized by historical patterns for national corn yields, production, demand and prices. It also took into account the difference between U.S. yields and those experienced on an individual farm. That’s important, because your farm’s yield can vary widely from what happens on the national level.

The results aren’t a crystal ball of what will happen. But they do show that odds that a given outcome could happen. The Monte Carlo simulation can’t predict a dice roll, but does show the odds of coming up snake eyes.

Based on data back to 1950, the simulation indicates a 47% chance of turning a profit by selling off the combine this fall, assuming ARC participation and 85% Revenue Assurance coverage. But the average profit came in at $80 per acre, a figure distorted by several factors.

Similar to the data table results, expected outcomes ranged from a loss of $135 to a profit of $1,025 per acre. The low end of the range tends to be limited by safety net programs – corn prices can only go so low, while their upside has lots of potential.

Years with windfall profits topping $500 didn’t occur often, but they did happen 6% of the time. Demand can turn out better than expected, giving growers more to sell at higher prices. And even when drought strikes the average farmer, any individual grower could experience a banner year of production if those fields got rain.

In the 1988 drought year, for example, U.S. yields were 72% of normal. But some counties of Nebraska enjoyed record or near-record production because they received timely rains or benefited from irrigation.

So, while the average was $80 in profit, the median may be a more revealing number. The median is the middle of the range, with 50% above and 50% below. This metric showed a loss of $22.

Hedges help

Hedging can improve those odds significantly, even with futures toward the bottom of their recent range. Locking in a price on 80% of expected production with a futures or hedge-to-arrive sale at $5.63 – a price available for most of last week -- produced a profit 79% of the time. While results ranged from a $100 loss to profit topping $700 an acre, the average was $137 with a median of $127.

El Nino trap

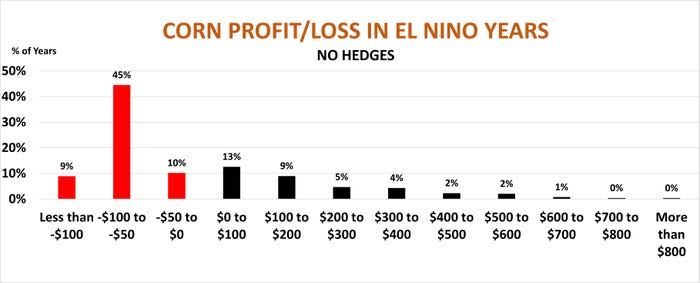

With El Nino expected, hedging could be even more important for 2023. I also ran simulations based on yields in the 15 El Nino summers experienced in the U.S. since 1950. Based on trends in those years, U.S. yields averaged 186.5 bushels per acre, compared to 179.4 in all years. The higher yields also depressed prices. The average cash price in the simulations for El Nino summers was $4.58, compared to $4.97 in the all-years runs.

With prices below the cost of production, odds for a profit decreased noticeably, falling to 36%. The range of profits ran from a loss of $135 to a profit of $890, with the average a profit of $32 but the median showing a loss of $54 per acre.

Risk vs. reward

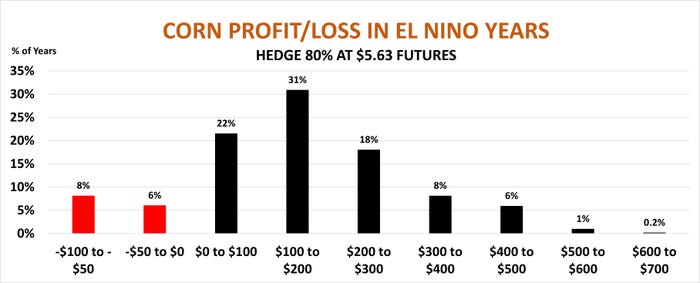

As a result, hedging this year could be even more important – and profitable. Pricing 80% of expected production at $5.63 generated profits 86% of the time. Big yields gave producers more bushels to sell, even though average cash prices were lower, and also cut the cost of production per bushel. And, lower futures prices increased hedging profits, giving the sales more bang for the buck.

Under this simulation, profits averaged $151 per acre, with the median at $135. Profits ranged from a loss of $99 to a gain of $656.

This doesn’t mean hedging is without risk. But if farmers enjoy good yields as expected, the rewards may be well worth the risk.

Knorr writes from Chicago, Ill. Email him at [email protected].

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like