It’s time to take a closer look at Brazil’s 23/24 soybean crop planting conditions. We have passed the official starting date of September 16 where principal growing regions are allowed to begin planting.

Right now, an intense mass of warm, dry air continues to block moisture in much of Brazil’s main growing region. There is a southern Atlantic ridge that Brazil would like to see move further north. It is too far South, thereby leaving Northern Brazil predominantly dry in areas such as Mato Grosso do Sul, Goiás and the MAPITBA region.

Seasonal tendencies typically bring extreme heat up until the start of the rainy season. That is the case with many growing regions falling within the 90s (degrees F), and some areas hitting triple digits.

Southern Brazil is the exact opposite, where despite massive flooding, additional rainfall of up to 5 inches or more is forecast to fall in the next ten days. River and groundwater levels are all saturated to the point that there is no place for further rainfall to go, and therefore will likely cause continued flooding.

Farmers there have still made some progress on first crop corn, finding time to plant between rains. Such strong rainfall forecasts could see farmers boost corn acres modestly as the season progresses ahead of schedule.

More dry weather ahead?

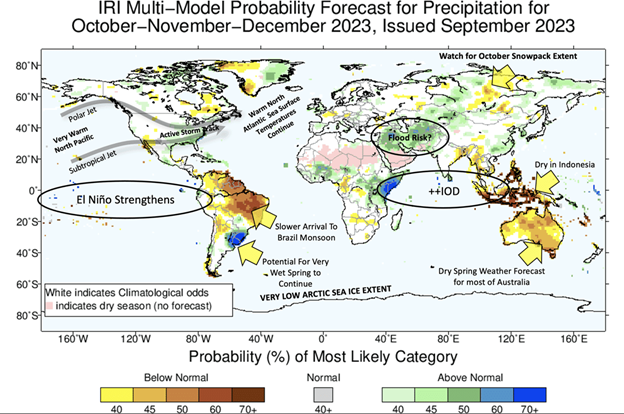

Columbia University released its most recent IRI model showing continued dry weather in Northern Brazil through the end of the year as well as a wet spring in Southern Brazil. We will have to keep monitoring this each week, as we are still very early in the planting season. Farmers in Mato Grosso typically look to ratchet up planting in early October. However, if we get to early October and the dry forecast remains unchanged, the market should begin to take notice.

In truth, late planting in Mato Grosso does not seem to affect soybean yield potential nearly as much as it does the second crop corn that follows. Brazilian farmers are keenly aware of this forecast and so will likely tiptoe into planting rather than jump headfirst. Some farmers will plant in the dust and wait for the rain to arrive.

Brazil’s growing area continues to shift further North, reducing the South’s share of total production and its impact of the market. Close to 70% of Brazil’s growing area falls outside of the South compared to 50% twenty years ago. As El Niño is known to leave a drying effect to the Northern half of Brazil, this leaves the door open for a greater yield impact compared to previous years.

The bulls of Argentina

Argentina’s 23/24 crop season predictions are extremely bullish, looking to add an additional 1 billion bushels from last season’s drought-stricken crop. To facilitate that, the country’s farmers will need abundant rainfall to begin immediately, which does not appear to be happening. Oddly enough, the heavy rainfall that arrived in Southern Brazil has thus far avoided much of Argentina’s growing regions that lie close to its border. Argentina’s corn planting progress has historically seen as much as 20% of its area planted by the end of September.

Due to dry weather the last several years, planting progress has been pushed back later and later with the bulk of Argentina’s crop being planted in the month of December. It is difficult to determine yet if we are witnessing a paradigm shift with crops going in later more and more, or the beginning of another short crop.

Matthew Kruse is President of Commstock Investments. Subscribe to their report at www.commstock.com.

Futures trading involves risk. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that CommStock Investments believes to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

Read more about:

BrazilAbout the Author(s)

You May Also Like