American farmers have been busy gathering their corn and soybeans for the 2023/2024 season, and they're doing it faster than usual. As of September 24, they've already harvested 15% of the corn and 12% of the soybeans. However, the quality of these crops isn't great. In fact, it's the worst it's been in a decade for soybeans and the second worst for corn.

This means that while we'll soon know how much they've actually harvested, the market might go up and down because of things that happened in the past few months and because planting is just beginning in the southern hemisphere. So, we need to keep an eye on recent events and what's coming up.

Let's not forget that the 2023/2024 growing season has only just started, but a lot has already happened. A few months ago, people were worried that it might turn out like the terrible 2012/2013 season when a big part of the Midwest had a serious drought. Then, in late June, there were severe storms in the Corn Belt that helped crops recover somewhat.

At that point, we couldn't compare it to 2012/2013 anymore because the crops were getting better. But just a month later a heatwave hit, with temperatures above 100°F for several days, which messed up crops again.

These changes in the weather caused big price swings in the markets for corn and soybeans. After hitting the highest price of the year on June 21st at $6.2875 per bushel, corn prices dropped to $4.8125 per bushel on September 25, which is 23.46% lower. On the same date, soybean prices closed at $14.2425 per bushel, which is 8.37% lower than their high in July.

The weather might not affect how the crops develop until they're fully grown, but it can still mess up the harvest, the quality of the crops, the logistics of getting them to market, and the prices in different parts of the country.

South America begins planting

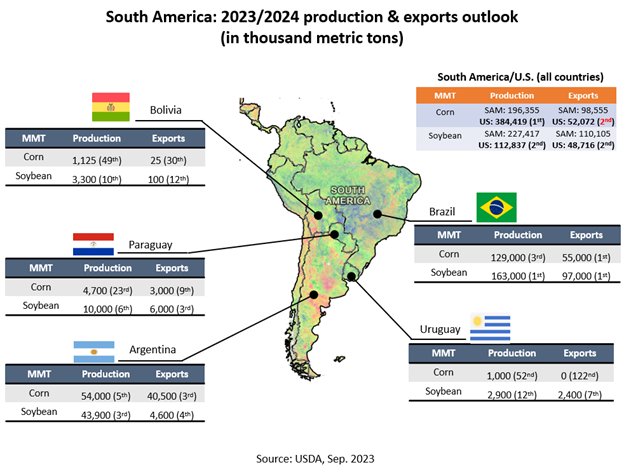

Also, while American farmers are harvesting, farmers in South America, like Argentina, Brazil and Paraguay, are just starting to plant their crops. USDA predicts that these countries will produce a lot of corn and soybeans this year, which means there will be more competition for American products on the global market.

The figure below shows what these South American countries are expected to produce and export in 2023/2024, and where they rank in the world's exports, according to the September WASDE report.

Argentina had a tough time last year because of a severe drought caused by La Niña, but things are looking better for their corn and soybean crops this year. USDA thinks it will produce 54 million metric tons of corn (59% more than last year) and 48 million metric tons of soybeans (92% more). These numbers are similar to what the Buenos Aires Grain Exchange predicts.

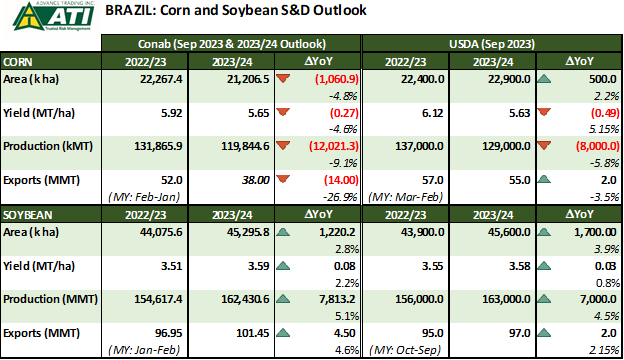

Brazil's National Supply Company (Conab) recently shared their estimates for the new season, and they'll have an official report coming on Oct. 10.

Source: Conab, USDA

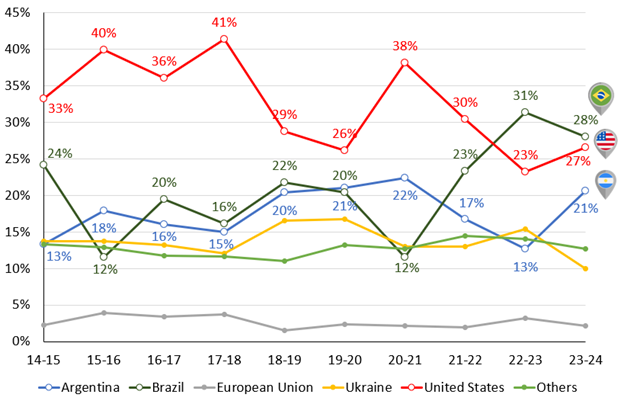

When it comes to soybeans, both the USDA and Conab expect more production and exports, with similar predictions for the area and yield. So, it seems like Brazil will continue to be the biggest producer and exporter of soybeans in 2023/24. But there are significant differences in their corn predictions. Even though both agencies expect less corn to be produced and exported in Brazil, Conab is much more pessimistic than USDA. If Brazilian corn production drops by 9.1%, they'll have less to export, which could mean more demand for American corn and a chance for the U.S. to become the top corn exporter, as shown in the chart below.

Corn exports market share: 2014/15 – 2023/24 (projection)

Source: USDA

What to watch now

There will be many different scenarios in the coming months because of the weather in South America. Plus, other things like the possibility of a recession, the situation in the Black Sea region, weather in Europe, Asia and Australia, and global politics can all affect the supply and demand of agricultural products.

In the short term, we'll be watching the U.S. market, waiting for yield reports, and looking forward to the next WASDE report on October 12. But we also need to keep an eye on what's happening in South America.

In Argentina, 5% of the expected corn crop was planted by September 20 (compared to 2% last year), and soybean planting might not start until November. According to Conab, 18.3% of the estimated area in Brazil was planted with corn (compared to 19.3% last year), and only 1.5% was planted with soybeans (compared to 1.7%). Harvest will begin early next year, and we need to pay attention to anything that could make the market more unpredictable, whether it comes from the north or the south.

Contact Advance Trading at (800) 747-9021 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like