February 1, 2024

January has brought a steady stream of reports for livestock market analysts to digest. This began with hay stocks the second week of the year and will culminate on January 31st, when USDA releases their inventory estimates for 2024. As I write this week’s article two days ahead of that release, I wanted to quickly review what we learned from USDA’s January Cattle on Feed Report, which came out on January 19th. Cattle on Feed estimates have always been significant, but even more so recently, as they were a major driver behind the market decrease that was seen in the fourth quarter of last year.

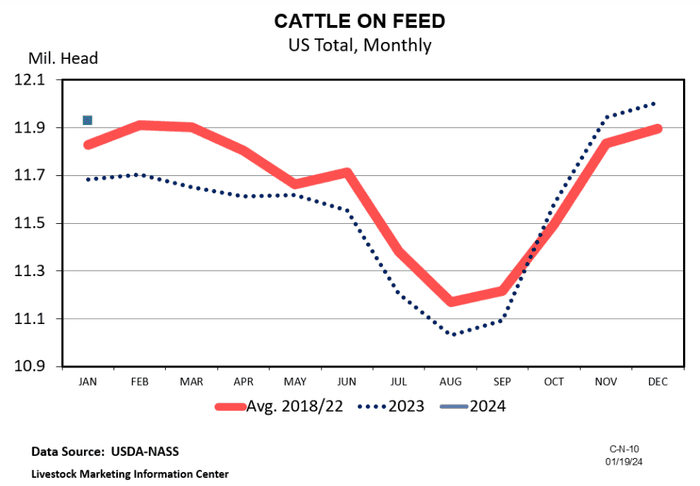

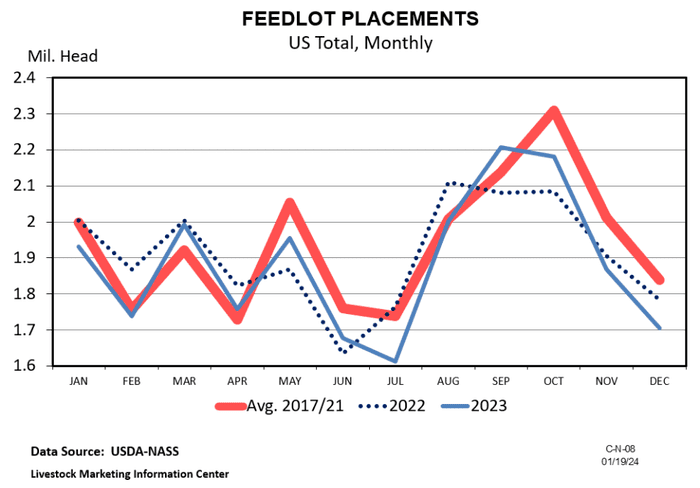

Total feedlot inventory was estimated at 11.9 million head. As has been the case since October, cattle on feed numbers continue to exceed year-ago levels. On its face, this has been surprising as the cowherd has been getting smaller for several years and the number of cattle outside of feedyards was thought to be relatively small in the second half of 2023. We previously discussed the high placement levels seen in September and October and the impact that had on feedlot inventories. I still think fall weather led to some early domestic placements, but increased live cattle imports can’t be ignored. A sizeable increase in imports from Mexico was seen this fall with a good portion of them being larger cattle that may have been placed directly on feed. Placements have been nearer expectations the last couple of months, coming in at 4% below year-ago levels in the January report.

Total feedlot inventory was estimated at 11.9 million head. As has been the case since October, cattle on feed numbers continue to exceed year-ago levels. On its face, this has been surprising as the cowherd has been getting smaller for several years and the number of cattle outside of feedyards was thought to be relatively small in the second half of 2023. We previously discussed the high placement levels seen in September and October and the impact that had on feedlot inventories. I still think fall weather led to some early domestic placements, but increased live cattle imports can’t be ignored. A sizeable increase in imports from Mexico was seen this fall with a good portion of them being larger cattle that may have been placed directly on feed. Placements have been nearer expectations the last couple of months, coming in at 4% below year-ago levels in the January report.

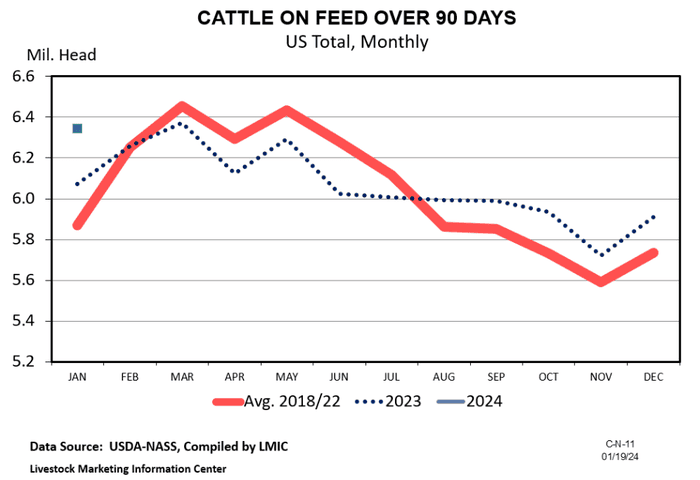

There is another factor worth mentioning when one examines total on-feed inventory. Slaughter weights were increasing counter-seasonally during the last couple months of last year. Cheaper feed in the 4th quarter was likely the driving factor, but this ultimately means that cattle were on feed for a longer period of time. This seems to be supported by increased estimates of cattle on feed over 90 and 120 days and also partially explains the higher feedlot inventories. Monthly on-feed estimates are only for feedlots with one-time capacity exceeding 1,000 head, so it will be interesting to compare this to the annual report on Wednesday.

There is another factor worth mentioning when one examines total on-feed inventory. Slaughter weights were increasing counter-seasonally during the last couple months of last year. Cheaper feed in the 4th quarter was likely the driving factor, but this ultimately means that cattle were on feed for a longer period of time. This seems to be supported by increased estimates of cattle on feed over 90 and 120 days and also partially explains the higher feedlot inventories. Monthly on-feed estimates are only for feedlots with one-time capacity exceeding 1,000 head, so it will be interesting to compare this to the annual report on Wednesday.

Finally, I would mention the steer-heifer breakdown as of January 1, 2024, which is an estimate that is only made quarterly. The number of heifers on feed was higher than the last quarter and higher than January of 2023. While heifers as a percent of on-feed inventory declined slightly in January, it remains just under 40%. During expansionary times, the percentage of heifers on feed tends to be in the low-mid 30%’s. A number near 40% does not suggest that heifer retention is ongoing and continues to suggest that expansion is not immediately visible on the nearby horizon. Now all eyes will turn to Wednesday’s cattle inventory report, which will likely have longer-run implications.

Finally, I would mention the steer-heifer breakdown as of January 1, 2024, which is an estimate that is only made quarterly. The number of heifers on feed was higher than the last quarter and higher than January of 2023. While heifers as a percent of on-feed inventory declined slightly in January, it remains just under 40%. During expansionary times, the percentage of heifers on feed tends to be in the low-mid 30%’s. A number near 40% does not suggest that heifer retention is ongoing and continues to suggest that expansion is not immediately visible on the nearby horizon. Now all eyes will turn to Wednesday’s cattle inventory report, which will likely have longer-run implications.

Source: University of Kentucky

About the Author(s)

You May Also Like