USDA slashed Argentine corn and soybean output figures for the 2020/21 marketing year in Thursday morning’s World Agricultural Supply and Demand Estimates (WASDE) report. The World Agricultural Outlook Board left Brazilian production estimates unchanged in this month’s report, despite concerns over yield damage due to drought conditions. Domestic ending stocks for corn were unchanged, sending futures prices teetering between fractional gains and losses.

But rising domestic usage rates for U.S. soybeans shrunk ending stocks to a mere 175 million bushels – the tightest level since 2013. Unseasonably strong export demand for U.S. wheat led to USDA bumping up 2020/21 wheat export forecasts. Soybean and wheat futures climbed on the favorable domestic demand sentiments.

“USDA’s report was largely uneventful, since major new crop yield and acreage forecasts will not be updated until January 2021,” notes Farm Futures grain market analyst Jacquie Holland. “The wheat futures complex saw the largest gains from today’s reports.”

Corn

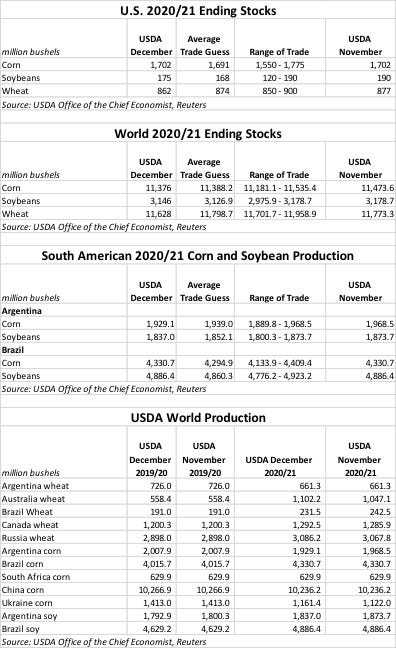

U.S. corn ending stocks held steady, at 1.072 billion bushels, with analysts expecting a modest decline on an average trade guess of 1.691 billion bushels. USDA also left its season-average farm price unchanged, at $4.00 per bushel.

USDA did not make any changes to domestic corn usage rates for ethanol, despite a 13% drop in gasoline consumption since early November.

Global corn stocks did decrease moderately, to 11.376 billion bushels, down from November estimates of 11.474 billion bushels. That was lower than the average trade guess of 11.388 billion bushels.

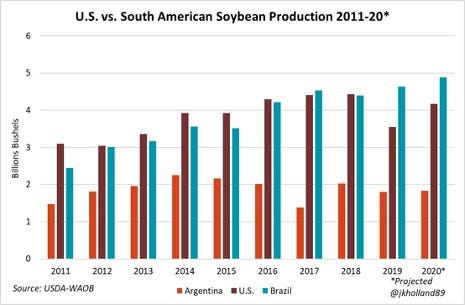

In South America, USDA left Brazilian estimates unchanged from a month ago, with 4.331 billion bushels. But the agency lowered its assessment of Argentine production to 1.929 billion bushels, falling from 1.969 billion bushels in November. La Niña conditions left some areas on the continent overly dry earlier this fall.

USDA marks total global production “virtually unchanged,” with 1,447.8 million metric tons. The agency expects lower production potential in Argentina, Canada and the European Union, with higher production likely in Ukraine. Foreign corn ending stocks moved lower, reflecting downgrades to India, Brazil, Canada, Ukraine and Egypt.

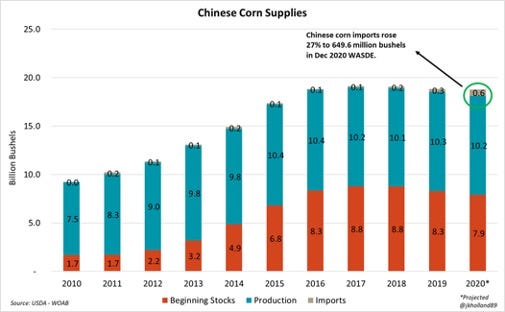

“USDA also cut beginning corn stocks in China and raised corn import forecasts by 137.8 million bushels, which may help stabilize the corn futures market after last week’s selloff,” Holland notes. “And that will be critical to pricing for U.S. corn growers, since demand from other top U.S. corn buyers is down 1.3% in the first quarter of the new marketing year.”

Soybeans

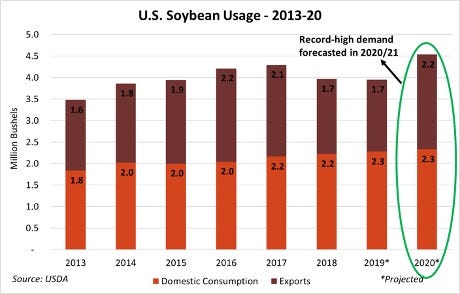

As noted above, domestic soybean stocks sank another 15 million bushels lower to 175 million bushels – falling to the lowest level in nearly a decade. The average trade guess was even lower, at 168 million bushels, but individual estimates showed some variability, ranging from 120 million to 190 million bushels. The season-average farm price trended 15 cents higher, to $10.55 per bushel.

“Record crush volumes for soybeans propelled domestic usage rates for soybeans to their highest levels in history, even though export volumes remained unchanged,” Holland says. “USDA likely erred on the conservative side of export estimates, even though international soybean export commitments stood at 1.9 billion as recently as a week ago.”

World ending stocks also moved lower, dropping from 3.179 billion bushels in November down to 3.146 billion bushels in today’s report. Analysts expected an even bigger drop, with an average trade guess of 3.127 billion bushels.

As with corn, USDA held its November estimates steady on Brazilian soybean production while lowering production estimates in Argentina, leaving Brazil’s production at 4.886 billion bushels and Argentina’s production at 1.837 billion bushels.

“USDA left Brazilian corn and soybean estimates unchanged in this month’s WASDE report,” Holland says. “But shrinking soy and corn output estimates in Argentina contributed to smaller global ending stocks for corn and soybeans.”

Wheat

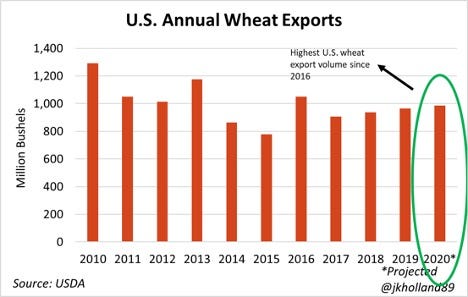

Domestic wheat stocks fell more than expected, moving from 877 million bushels in November down to 862 million bushels, which is 16% lower versus the same time a year ago. Analysts had offered an average trade guess of 874 million bushels. This is largely driven by an uptick in export estimates, which gained 10 million bushels to 985 million for the 2020/21 marketing year.

“With plentiful domestic wheat stocks on hand, USDA lowered U.S. wheat imports for the 2020/21 marketing year by 5 million bushels,” Holland says. “While U.S. livestock feeders have yet to convert to cheaper wheat feedstuffs, unseasonably strong export demand helped increase usage rates, drawing domestic ending stocks down to the lowest volume since 2014.”

“This is great news for U.S. wheat growers,” Holland adds. “As long as the dollar remains at weak levels, current prices and strong export demand will likely support an increase in acreage for the 2021/22 growing season.”

Global wheat stocks saw bigger cuts, moving from 11.773 billion bushels in November down to 11.628 billion bushels in December and bucking analyst expectations – the average trade guess predicted a moderate increase to 11.799 billion bushels.

But global wheat production is now projected to reach a record-high 28.429 billion bushels. After estimated increases to production in Russia, Canada and Australia, all three of those countries are in line to see the second-largest production totals on record. World consumption is also trending higher, now expected to reach 27.844 billion bushels.

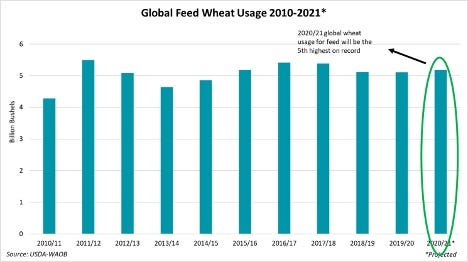

“A 3% increase in global wheat feed demand should add another layer of price support to the wheat futures complex,” Holland says. “High corn prices have driven a global shift to cheaper alternative feedstocks, with wheat as a prime candidate. At nearly 5.2 billion bushels of usage expected for livestock herds around the world, 2020/21 feed demand for wheat will be the fifth highest on record, shrinking global ending stocks by over 145 million bushels.”

Click here for more highlights of USDA’s December WASDE report.

About the Author(s)

You May Also Like