By Gerson Freitas Jr.

Bunge Global SA warned investors that the profit boom over the past few years is fading faster than anticipated, causing shares of the agricultural trading giant to waver.

Adjusted earnings are expected to drop by a third this year to approximately $9 a share, Bunge said in Wednesday’s earnings statement. The full-year outlook, which would be the lowest in four years, trails the $10.42-a-share average estimate of analysts surveyed by Bloomberg.

“Looking ahead to 2024, we currently expect a less robust market environment than we have recently experienced,” Chief Executive Officer Greg Heckman said in the statement.

Bunge’s pessimistic outlook was partially eclipsed by a surprising profit growth of 14% in the fourth quarter. Adjusted net income was $3.70 per share, exceeded even the highest analyst estimate compiled by Bloomberg.

Bunge had seen profits soar to record levels in recent years as major harvest losses and disruptions caused by the war in Ukraine led to wild price moves in grains markets, proving a boon to crop traders. Prices are now stabilizing at lower levels amid a rebound in global stockpiles and fading demand, making it harder to replicate the past performance.

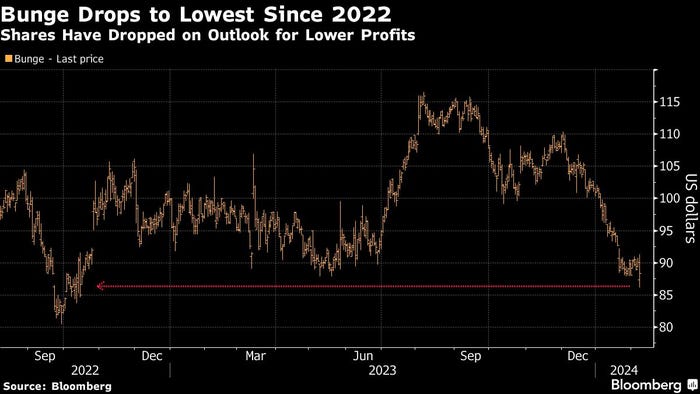

Bunge prices on Feb. 7, 2024.

Shares of the St. Louis-based company were down 1.7% to $88.47 at 12:55 p.m. Wednesday in New York, trimming earlier losses of as much as 4.4% — the lowest intraday since 2022. Bunge has fallen about 24% since a peak in August.

Farmers are reluctant to sell and consumers have an incentive to wait as forward prices are now lower than spot, Heckman said in a conference call with analysts, adding that “prices are balancing and the supply chain is not quite as tight.”

An increase in soybean processing capacity in the U.S. is also weighing on margins for meal and oil production, eroding profits for crushers. Significantly lower ethanol prices are expected to keep a lid on Bunge’s profits in 2024, according to a company presentation.

Bunge’s fourth-quarter performance was fueled by operations in South America, Europe and Canada, which more than offset lower results in the U.S. Bunge has benefited from its outsized presence in Brazil, where abundant soybean supplies have helped its exports from the world’s largest supplier amid improving crushing margins in the South American country.

To be sure, Bunge’s 2024 profits are expected to remain well above the levels seen in years prior to the recent boom. What’s more, earnings significantly exceeded its initial forecasts in each of the past three years, according to Stephens Inc. analyst Ben Bienvenu.

“This team has been historically conservative with guidance and we expect the same this year,” Bienvenu said in a note to clients.

Bunge’s 2024 earnings forecast doesn’t take into consideration the impact of deals expected to be completed this year, including the $8.2 billion takeover of Viterra Inc. Still, the close of the transaction — expected for later 2024 — shouldn’t have a significant impact on this year’s earnings, Bunge said during the call. Bunge cited “substantial progress” on the Viterra transaction.

© 2024 Bloomberg L.P.

Read more about:

FinanceAbout the Author(s)

You May Also Like