The price of money is anticipated to remain the same, at least until December. The likelihood of the Fed doing something two days prior to the election in November is nil.

Therefore, there is a sigh of relief that for all the weaker commodity prices, as the price for money will remain weak with them.

Metals and energies benefited the most from this decision. Until there is a greater gain in the Australian and Canadian dollars, the impact on beef will be minimal. Nonetheless, the cattle market is moving higher on its own accord. Packers are attempting to throw everything they can at the market to slow the price advance.

A trade of $112.00 or better should pull the October to the $111.00 area in quick fashion.

I anticipate the burner to be turned up a little toward the end of the day.

The anticipation of a higher cash trade is keeping futures elevated this morning. A trade of $112.00 or better will be anticipated to pull the October to the $111.00 area in quick fashion.

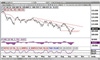

I continue to anticipate a move to $116.00 October.

I don’t know what will happen next. A great deal will depend on how it gets there and what may or may not have changed in the interim.

Feeders appear to have found some strength of their own this morning. I perceive that so many cattle were pulled off recent sales that the higher price may be needed to have them turned loose. Like the fats, it is also the grind of shorts out of their positions.

Nothing new has developed that I can see. I continue to anticipate a firming feeder market, but not much more than that.

An investment in futures contracts is speculative, involves a high degree of risk and is suitable only for persons who can assume the risk of loss in excess of their margin deposits. You should carefully consider whether futures trading is appropriate for you in light of your investment experience, trading objectives, financial resources and other relevant circumstances. Past performance is not necessarily indicative of future results.

About the Author(s)

You May Also Like