March 2, 2023

At this writing, wheat may be forward contracted for harvest delivery in Medford Okla., for $8.15. The harvest forward contract price is calculated by subtracting (minus) a 50-cent basis from the hard red winter wheat July (N) futures contract price (KEN23 - $0.50).

The Perryton, Texas, harvest price is $8.20 (KEN23 - $0.45), and the Snyder, Okla., harvest price is $7.65 (KEN23 - $1). Without the Russian/Ukraine war, 2023 wheat harvest forward contract prices may have been $1 or more lower than these forward contract prices.

Expected supply and demand is used to determine price. A problem with using expected supply and expected demand to predict prices is that external factors (COVID and/or the Russian/Ukraine war) change the relationship between the supply and demand estimates and, therefore, impact resulting prices.

The impact of external factors may be shown by comparing price changes to changes in the stocks-to-use ratio (ending stocks divided by annual use shown as a percentage).

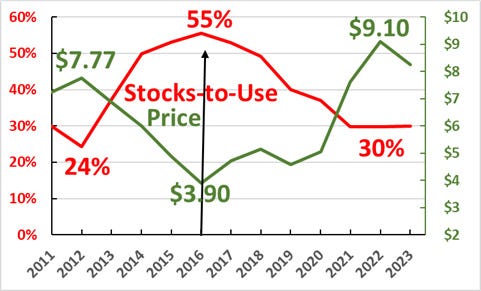

The relationship between average annual U.S. wheat prices and the wheat stocks-to-use ratios is shown in Figure 1. The prices are each wheat marketing year’s (June through May) average price. The stocks-to-use ratio is the stocks-to-use ratio for the previous year.

Figure 1. U.S. average annual wheat price and wheat stocks-to-use ratio.

Data Source: USDA/Nass The corresponding stocks-to-use ratio is the s-t-u ratio from the previous marketing year (i.e., 2012/13 marketing year price compared to the 2011/12 s-t-u ratio).

For example, the stocks-to-use ratio for the 2011/12 wheat marketing year was 24%, and the average price for the 2012/13 wheat marketing year was $7.77 (Figure 1). The corresponding stocks-to-use ratio was 55% for the 2016/17 wheat marketing year’s price of $3.90.

For the 2022/23 wheat marketing year, the projected average annual price is $9.10, and the underlying stocks-to-use ratio is 30%. A 30% stocks-to-use ratio may also be associated with the $8.15 forward contract price for 2023 harvest delivered wheat.

The last time the stocks-to-use ratio was in the 30% range was during the 2012/13 and 2008/09 (not shown) marketing years. Comparing 2008/09 and 2012/13 with 2021/22 and 2022/23 may be used to estimate the price impact of the Russian/Ukraine war.

The 2012/13 average annual wheat price was $7.24, and the corresponding stocks-to-use ratio was 30%. During the 2008/09 wheat marketing years, wheat prices averaged $6.78, and the corresponding stocks-to-use ratio was 29%. These price/stocks-to-use ratio relationships show that without changes in the marketing system, the current wheat price could be in the $6.75 to $7.25 range rather than $8.15.

Research indicates that COVID caused prices to increase from about $4.50 to $8 and that the Russian/Ukraine war caused prices to increase from $8 to $13. Some analysts believe that COVID’s price impact has been removed from today’s market prices.

The price/stock-to-use ratio relationship shown in Figure 1 may indicate that the current price impact of the Russian/Ukraine war is about $1.25. This implies that, without the war, the Medford, Okla., harvest forward contract price could be $6.90 ($8.15 - $1.25).

A review of potential prices must include the relatively poor condition of the U.S. hard red winter wheat crop and the 10% in planted acres.

Continued drought could result in relatively low yields and perhaps higher prices. Timely rains could result in higher-than-expected yields and perhaps lower prices.

An important point to remember when reviewing future wheat prices is that the war has caused higher prices. And this analysis indicates the price increase is somewhere around $1.25. The war is probably not going to end anytime soon. And if it does, it will still take a year or so for things to get back to normal.

About the Author(s)

You May Also Like