March 9, 2020

The U.S. percentages of world wheat, corn, and soybean exports are significantly lower than 20 years ago. Since 2000, as a percentage of world exports, U.S. wheat exports have declined 11%, corn exports have declined 32%, and soybeans have declined 22%. This decline in U.S. exports, as a percentage of world exports, may continue.

In the following analysis, five-year averages will be used rather than a single year’s exports or production.

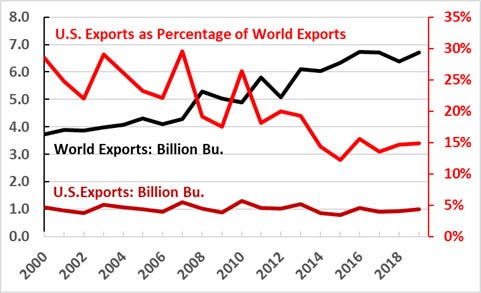

Between the 1996/97 through 2000/01 wheat marketing years and the 2015/16 through the 2019/20 marketing years, the U.S. percentage of world wheat exports declined from 27% (2000) to 14% (2019). Average U.S. wheat exports were 1.05 billion bushels in 2000/01, and they were 934 million bushels in 2019/20 (Figure 1).

Between the 2000/01 wheat marketing year and the 2019/20 marketing year, world wheat exports increased from 3.7 billion bushels to 6.7 billion bushels. World wheat exports increased 81% while U.S. wheat exports declined 11%.

Of the world’s 3.0-billion-bushel increase in wheat exports, the Black Sea exporters (Russia, Ukraine, and Kazakhstan) provided 1.9 billion bushels (63%) of the increase. Black Sea wheat exports increased from 250 million bushels to 2.15 billion bushels, a 1.9-billion-bushel increase.

Exporters whose export percentages have declined are Argentina, Canada, and the European Union (mostly France and Germany).

One reason for increased export shares by the Black Sea exporters is location. Of the top 15 wheat importers, only Mexico (10th) and Brazil (3rd) offer an ocean freight advantage to the U.S. or Argentina. For the remaining top 15 countries, the U.S. and Argentina are at a disadvantage or have equivalent ocean freight costs.

Since 2000, the number of world wheat harvested acres has remained unchanged at about 543 million acres. Because of increased yields during this time, world wheat production has increased from 21.7 billion bushels to 27.6 billion bushels (a 27% increase).

Since 2000, U.S. wheat harvested acres have declined from 58.3 million acres to 41.1 million acres (a 30% decline). This reduction resulted in an 11% U.S. loss in world wheat exports and a 17.2-million-acre loss for harvested wheat. Using the five-year average yield for 2015 through 2019, the loss in production was 833.5 million bushels (17.2 million acres times 48.4 bushels per acre) per year.

Most of the 17.2 million acres not used for wheat were allocated to other agricultural enterprises. However, the 833 million bushels of wheat per year reduction in production have been a loss for the wheat industry as a whole.

According to reports, bakers prefer 12.4% protein hard red winter wheat to mill bread flour. To meet the bakers’ requirements, flour mills are blending HRW wheat with higher protein hard red spring wheat.

At this writing, HRS wheat has a 59-cent premium to HRW wheat. Some millers also encounter extra transportation costs for the HRS wheat.

A representative from Bimbo (the largest baker in the U.S. and Mexico) recently reported that Bimbo had bought Black Sea wheat for Mexican flour mills. Black Sea wheat averages 12.5% protein, but other quality factors did not meet the baker’s requirements.

If U.S. HRW wheat protein does not average 12.4%, and if Black Sea wheat quality improves (and it probably will), Mexican flour millers may increase imports from the Black Sea region.

If U.S. HRW wheat producers do not deliver a milling quality wheat with 12.4% protein, U.S. wheat exports as a percentage of world wheat exports may continue to decline.

Figure 1: World and United States Wheat Exports and U.S Exports as a percentage of World Exports (Billion Bushels; Percent).

About the Author(s)

You May Also Like