Severe drought hit all of Argentina, leading me to review my first production estimates from December. I've reduced my soybean production estimate for Argentina to below 45 mmt to now below 40 mmt. In fact, it will probably be close to 38.5 mmt.

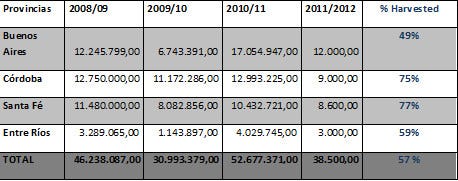

Satellite images from the vegetative period and the quick at harvest suggest that losses will be greatest in the following Argentine provinces: Buenos Aires, Cordoba, Santa Fe and Entre Rios. These States are the TOP 4 Soy producers that were hit by the drought, giving Argentina and southern Brazil some of the worst growing conditions in last 5 years.

Brazil to Import Soybeans?

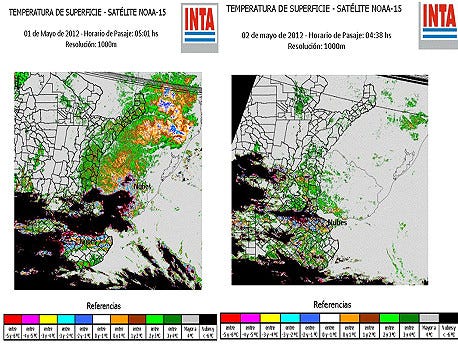

Furthermore, Argentina experienced two frosts after the crops had encountered the drought, the second of which occurred the first two days of May. The graphs below show low temperatures from INTA (National Institute of Agricultural Technology).

The frost period lasted more than 2-1/2 hour on the morning of May 1 and more than 1-1/2 hour on the morning of May 2. The hardest hit area was in the provinces of Buenos Aires and Entre Rios.

Taking the drought and frost into consideration, I've adjusted my production estimates as shown in the table on this page, with numbers showing metric tons of production.

We may see more cuts as the harvest advances, with additional losses most likely in Buenos Aires province, where harvest is around 50% as of April, 26.

We don't discount the possibility of additional cuts to Argentina's production.

Taking the drought and frost into consideration, I've adjusted my production estimates as shown in the table on this page, with numbers showing metric tons of production.

We have heard a lot of rumors in Brazil this week, with projections that it’s soybean crop will fall below 64MMT (my estimates is 62.5MMT), the second largest soybean exporter could import soybeans from Argentina and U.S. to feed its huge domestic market. We have some reports from big crusher companies, that they don’t work with grain exports this year, but they will bet in domestic market, principally in the soymeal market. It’s a difficult year for live cattle and poultry producers, with higher costs of food and lower prices of final product.

I would like to thank MR. Juan Pablo Canon From Argentina.

Joao Carlos Kopp, of Porto Alegre, Brazil, has been an agricultural consultant since 2008 and a grain marketing consultant since 2010. He client base includes farmers in Mato Grosso that produce about 4 million bushels of soybeans and 2 million bushels of corn annually, while working with companies in Rio Grande do Sul that exchange about 4 million 60 kg bags of soybeans per year. Joao is the first broker at an independent brokerage firm in Brazil to trade in the U.S. commodity market.

About the Author(s)

You May Also Like