January 8, 2019

Liam Condon, president, Bayer Crop Science, offered what he called an appetizer of a tech update as he and colleague Bob Reiter, head of research and development, made a presentation to media Tuesday, Jan. 8. And while there were some familiar portions in this appetizer dish, there were also some new treats to tease farmers about this company’s combined future.

Bayer completed its acquisition of Monsanto at the end of August, and the teams are working on new tools and pulling together tech from both sides to aim for key global targets – mainly to boost productivity to meet a rising need for food. Condon references the growing demand for food as population rises another 2.5 billion by 2050, but he added that climate change is also part of the challenge.

“It’s getting warmer, dustier and this is having negative impacts on productivity and harvest going forward,” he observes. For the new Bayer, the key is pulling together a lot of technology in crops, crop protection, biologicals and digital ag to create that added productivity.

Late in 2018, Bayer announced its Climate Corporation group would launch Seed Adviser in a limited launch for 2019 expanding to more farmers in Iowa, Illinois and Minnesota; research will expand to include Wisconsin, Indiana and Missouri. This data-driven tool helps farmers target the right seed to specific acres on their farm based on a range of agronomic and farming practices. Just after the announcement, Climate released 2018 results from a limited trial of the tool and found a yield advantage of 9.1 bushels per acre versus what the farmer would have planted without Seed Adviser recommendations.

Condon has shared that the new company will also focus on sustainability and divide efforts into two areas:

smallholder farmers, working to enable more than 100 million of this group by 2030;

reduce the ecological footprint of farming.

�“We believe it is possible to advance a carbon neutral future of agriculture,” Condon says. “Today agriculture is seen as part of the problem, contributing to climate change.” He notes that innovations can generate ways agriculture can be part of the solution of climate change. The company will be working to flesh out the tactics for this approach.

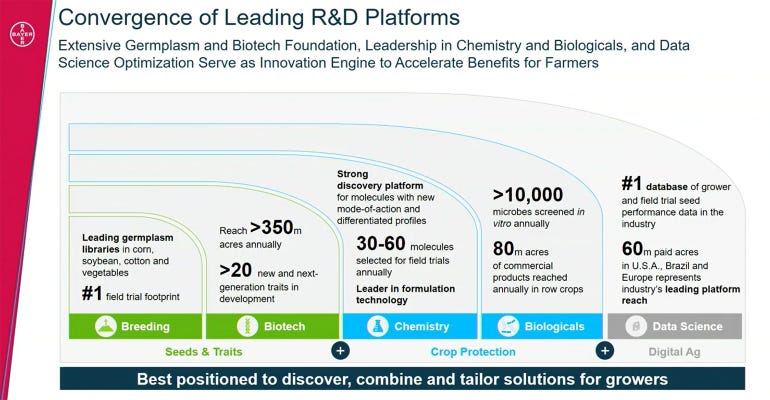

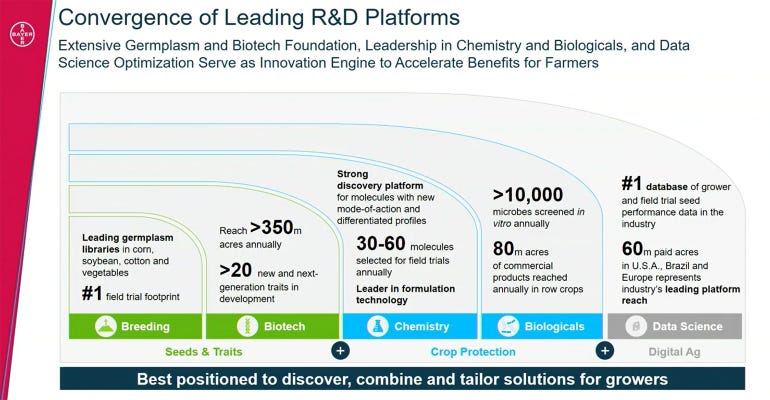

RICH PIPELINE: The new Bayer, which brings in research from Monsanto, shows a solid market position across several areas. Bob Reiter, R&D head at Bayer, shared highlights of work the company is doing.

Looking ahead at new products

Reiter is leading a diverse technology effort at Bayer that covers a wide range from biotechnology to biologics, from crop protection to big data. And in each area, Reiter sees opportunity. The company has a rich pipeline of new products heading toward the market, including one seed development area that may surprise farmers – short-stature corn.

“This is a little like the Green Revolution in rice and wheat that Norman Borlaug pioneered, [which] made a foundational shift in how those crops were produced and helped growers unlock additional productivity,” he says. “If we reduce the overall stature of the corn crop, it brings real solutions for the farmer.”

In the next two to three years, farmers will get a look at this work in the field as Bayer brings out short-statured trials with corn including specific trait packages. Reiter explains that short-statured corn is less susceptible to a range of issues including stock lodging and green snap. “In the wrong conditions, estimates on stalk rot shows 5% to 25% lodging through the season and depending on the geography. These are substantial losses we can mitigate,” he says.

Another benefit of shorter corn is the ability to apply fungicides or in-season nutrients more easily with existing equipment. You can get into a shorter crop in field.

Finally, short stature corn can be planted in higher populations. “Higher density can increase yield potential for the grower,” Reiter says. “We know that the primary goal for many growers is to get more plants in the field to get more grain. A shorter stature crop will have the potential to tolerate higher densities than a traditional crop would.”

Beyond the new corn, Reiter pointed to increasing work in biologicals which will open new ways to control disease and pests in crops. Bayer had a solid portfolio of biologicals, and the BioAg alliance Monsanto had with Novozymes continues, bringing new potential in this space as well.

“The other area we are exploring is the ability to unlock yield potential where microbials can enhance nutrient availability and increase yield for customers,” Reiter adds.

On the genetic pipeline, Bayer continues work on RNA-interference technology for a new mode of action in control of rootworms. Reiter noted this is still moving through regulatory approval. In addition, there’s XtendFlex, which will add new herbicide modes of action to Roundup Ready 2 Xtend technology already in the field (conferring glyphosate and dicamba tolerance on soybeans and cotton).

And for cotton growers, the pipeline includes a trait that helps control chewing and sucking pests including thrips and lygus in cotton. It would be the first trait of its type offered in the market.

While Condon called today’s tech media briefing an appetizer, it appears even this opening course offers farmers a range of choices for increasing productivity in their operations today and in the future.

About the Author(s)

You May Also Like