January 27, 2016

What if you had a great idea that could really boost productivity for your operation, but the very process of bringing that technology into the business might upend other processes on your farm? It might take you a little time to move to the new technology right?

That's exactly what's happening with Enogen, the innovative corn line from Syngenta that is helping ethanol plants boost production. Chris Tingle head, Enogen marketing, sat down with a few of us from Penton Agriculture recently to discuss the process of rolling this technology into the market. It was a frank discussion about all the steps involved and that actual in-depth marketing steps needed to move this to market.

Enogen corn, which has a special enzyme bred into it, needs to be identified. Syngenta is now 'color coding' the product so ethanol plants know the corn they get has the key trait that boosts efficiency. (Photo: Syngenta)

Enogen corn, unlike #2 yellow corn, needs special handling. It's corn enzyme tech means it's best for use in an ethanol plant, not in other applications. And of course it only takes about 15% of the corn in an ethanol plant to be from Enogen to get the benefit from the technology. "We pay a 40-cent premium for Enogen corn, but that doesn't mean a farmer is going to see that premium from all of his corn," Tingle says.

In fact only a portion of the corn a farmer produces would be Enogen in the operating radius of an ethanol plant. So while it might sound like "big money" if an ethanol plant moves to Enogen in its process, the premium comes because that corn also needs some added stewardship too.

Tingle explains that the process of bringing an ethanol plant into the Enogen fold takes a lot of steps that start with the plant's operating board. Here is a summary of the process in a few steps:

Targeting the plant

There are 165 dry-grind ethanol plants operating in the United States right now and Syngenta isn't just running out to all of them. "We talk about our portfolio and where there is a match for the region where the plant operates," Tingle says. That takes time, and the company is working through the steps. Growth has been strong with more than 35 plants now operating with the Enogen system across the counry.

Evaluating the technology

The plant has to evaluate the technology - the Enogen enzyme - in its own process. Tingle explains that really no two dry grind ethanol plants are identical. Each is using its own enzymes and processes. But once the plant verifies that the tech will provide the promised benefits, it's not an immediate start with the new tech.

Right hybrid for the region

Syngenta is doing the math and the match on the hybrids for a region and the ethanol plants in the same region that might be right for using the new technology. Once a plant wants to sign on, and is ready to work with the company, the next step is to work with the farmers to provide the promised product. That also includes making sure the local seed adviser can support the growing business in the region from selling Enogen corn.

"The worst thing that could happen," Tingle says. "is to bring on a plant in an area where we are not able to deliver the enzyme because the seed adviser couldn't keep up." That’s a bad news scenario but there's a good-news side to it too.

Tingle says that in some markets Syngenta brand corn is picking up significant sales because growers want the Enogen and there is a "lock-step" sale for that tech for the farmer to buy non-Enogen corn from a Syngenta supplier - Golden Harvest or NK.

Not for every grower

More than half the plants using Enogen today are in Nebraska, often in areas where the growers are also raising white corn or waxy corn for specialty markets. In essence they have an understanding of the need for identity preservation and the steps involved. There are two things that have to happen - first the grower has to be committed to some form of identity-preserved process; and second, there has to be a stronger retailer in the market to support this program.

Following those steps and engaging all parts of the value chain pays off. Tingle says right now Syngenta has an 85% retention rate for farmers who supply ethanol plants that take the new corn. "When you think about the grower relationship, the logistics, this is a rewarding process," Tingle says.

The logical draw for a plant is no more than 40 to 60 miles, the premium is only 40 cents per bushel and more distance would eat up the benefit to the grower, Tingle says. "We work very closely in the market with growers, at a micromarket level," he says.

You can learn more about Enogen online where Syngenta talks about the special enzyme and the way the technology works in an ethanol plant. That may be important if the tech is coming to a plant near you in 2016.

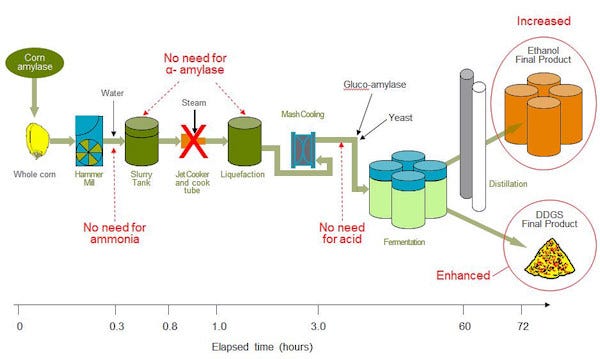

This process diagram shows the many places where having Enogen in the process can change the economics of an ethanol plant.

You May Also Like