During the commodity boom that took crop prices to record levels, trying to manage risk sometimes seemed to do more harm than good. But with futures falling below breakevens, mapping out your marketing plans is a crucial part of success.

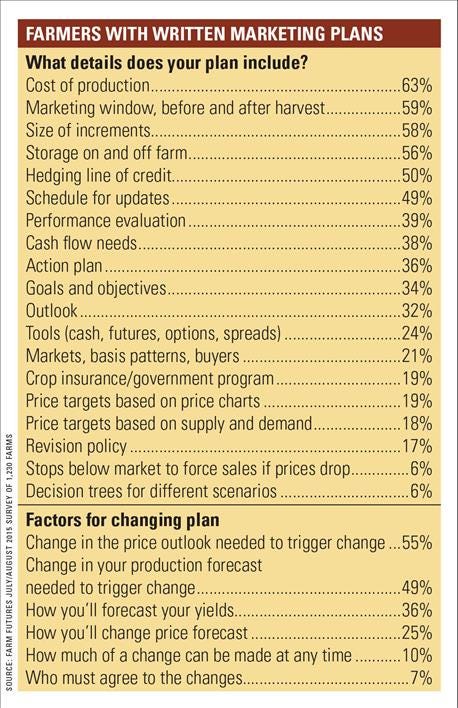

Our survey of more than 1,200 farmers ahead of harvest 2015 showed those with the most detailed plans were almost twice as likely to rank in the top 15% of profitability. And the survey also found just 1 in 4 farms even has a written marketing plan for crops and livestock.

Survey shows that those with more detailed marketing plans get better results.

One reason that it’s hard to plan sales is because so much can change. It’s one thing to pick a price where you’d like to sell. It’s another to accept the reality of a market that doesn’t care a whit about your bottom line.

Yields, prices, costs and breakevens can be dramatically different from when growers first start to plan a year’s production to delivery of the last bushel out of storage.

Their plans have lots of detail — far more than just a selling price. They analyze supply and demand along with price charts to pick selling targets and times. Costs, cash flow, storage, basis, crop insurance, government programs and potential cash markets for sales are examined.

Perhaps most importantly, they have a process for change detailed ahead of time. This helps avoid knee-jerk reactions to market volatility.

Here's what survey respondents told us about their marketing plans.

First, they stay on top of the markets, checking their plans against reality on a daily or weekly basis. That doesn’t mean they change constantly, but they don’t wait for harvest to see how they’re doing. Good growing conditions can mean more bushels to sell, increasing storage needs and lowering costs per bushel. Stressful weather can produce rallies, but also make every bushel count more. A commitment in March to sell 20,000 bushels that represents 10% of planned production could turn into a 20% sale if yields suffer. Lower yields also could make crop insurance and government programs more crucial to income.

Their plans detail how yields will be forecast during the growing season, and how big of a change is needed in both production and prices to trigger revisions to their sales tactics. They also specify who will be involved in changing the plans — a key consideration in operations with multiple owners.

Finally, successful plans include a performance review after the crop is sold. This determines whether their marketing efforts actually added value to the crop, as well as what worked and what didn’t.

Detailed planning won’t ensure a profit when prices are low, but you’ll sleep easier in a world full of anxiety.

- Knorr is senior grain market analyst for Farm Futures.

- Decision Time: Risk Management is independently produced by Penton Agriculture and brought to you through the support of Case IH. For more information, visit beready.caseih.com.

About the Author(s)

You May Also Like