February 23, 2017

Has the tide turned for row crop producers? Profitability is looking better for cotton, corn and soybeans.

Tennessee producers at Extension meetings appear to have a guarded optimism toward 2017 production. While there may be many reasons for that optimism, there are at least three that stick out:

No. 1 - Prices have remained stable to slightly higher. For soybeans and grain, this seems to fly in the face of large supplies and projected ending stocks. We would have to go back 10-12 years for the last time ending stocks were this high for soybeans and corn. At that time, season-average-prices were in the $6 - $7 bushel range for soybeans and $2 bushel for corn. So prices are holding up much better than expected and some may say poised for a downfall. While that may be the ultimate case, it is unlikely to happen before planting.

Producers may want to look closely at forward pricing their crop in increments, taking advantage at any rallies or good up moves. Buying put options for downward price protection to set a floor price may also want to be explored. Revenue crop insurance base prices will be established this month so producers should also look closely at their crop insurance alternatives before the sales closing date. In Tennessee, that is March 15.

No. 2 - Tennessee has had above-average per acre yields for cotton, corn and soybeans the last several years. This in effect has caused the average yields to go up. The state average yields I use in monthly profitability updates are 12 percent higher for cotton, 13 percent higher for corn and 10 percent higher for soybeans than those I used three years ago.

No. 3 - Costs don’t appear to be increasing. While it may be a guessing game on input prices until we actually get into the growing season, we are seeing some reductions.

Fertilizer prices have been reduced, and more importantly producers and suppliers have come to the realization that input costs need to be closely watched. I am seeing more interest from producers and suppliers on using more generics through either a branded generic product or true generic product in the production system. Generics are not certainly the answer for everything but they can have a place.

In projections for the monthly profitability update, I have reduced the seed and chemical cost from our University of Tennessee Extension budgets that came out in January. Cost has been lowered $27 per acre for cotton, $31 per acre for corn and $52 per acre for soybeans. Suppliers have realized that producers are shopping around prices more and that is helping keep everyone in the same range. For the new dicamba-tolerant technology crops, producers and suppliers should follow all labels and not use generic products that are not consistent with label requirements.

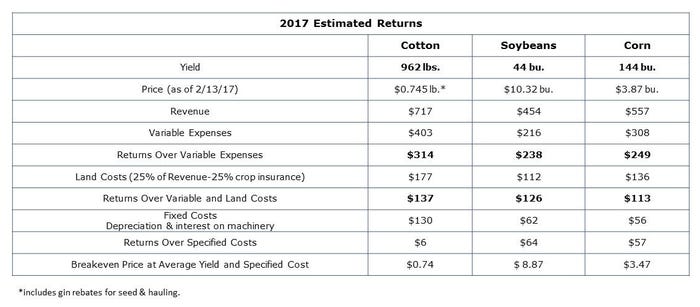

Plugging in current forward prices for fall delivery and adjusting the production costs results in the following profitability changes since my January profitability update: cotton improved $50 per acre, $35 per acre for soybeans and $49 dollars per acre for corn.

The fixed cost

Producers set up to raise the Big 3 in Tennessee should look at a diversified crop mix. The net returns to the producer will depend somewhat on the fixed cost in the operation and whether any major equipment purchase has been made. While there has been more interest in cotton and soybeans at the expense to corn, I see that corn still has a strong place in our production system and rotation.

For producers with cotton equipment, cotton acres look to belong in the crop mix. However, it would be difficult to purchase the equipment necessary to raise and harvest the cotton crop and still maintain a profitable level.

These are general projections which can give a direction of profitability when measured over time. Producers should examine their own yield history or averages, their own cost projections on their production system, and look at their land costs whether cash rent, share rent or owned ground. Lastly, factor in equipment costs as well as any past year’s carryover to determine profitability and breakeven prices.

Producers should consider the benefits of whole-farm financial planning to give them a complete picture of the farms financial viability. In Tennessee, for more on crop budgeting or whole farm financial planning, contact your local Extension office or call the MANAGEment Information Line at 1-800-345-0561.

About the Author(s)

You May Also Like