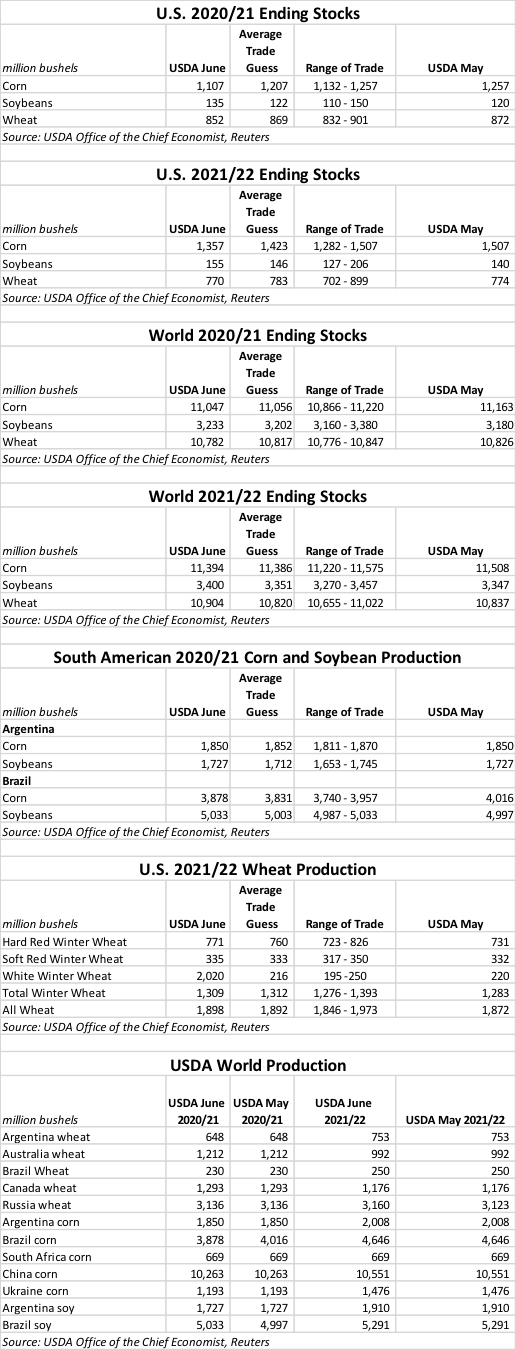

USDA fed corn bulls in the June 2021 World Agricultural Supply and Demand Estimates (WASDE) report released this morning. The World Agricultural Outlook Board (WOAB) slashed 2020/21 corn ending stocks by 150 million bushels – about 100 million more than analysts were expecting – on rising export and ethanol demand. A reduced corn crop from Brazil also lent bullish strength to the corn complex while wheat futures were mixed following higher estimates for the 2021 winter wheat crop in the U.S.

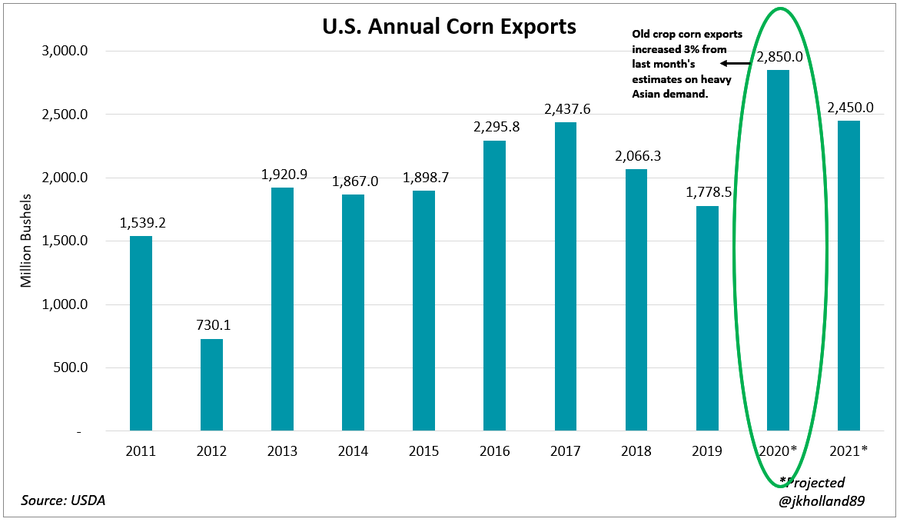

“Old crop corn stole the show in today’s WASDE report,” says Farm Futures grain market analyst Jacquie Holland. “March and April 2021 featured the largest two monthly corn export loading volumes – and revenues – in recorded history and USDA took that to heart. Strong Chinese demand – as well as rising overall global feed demand – triggered USDA’s upward revisions to the U.S. corn export forecast for 2020/21.”

Corn

USDA lowered 2021/22 corn ending stocks by 150 million bushels after noting a 75-million-bushel boost in ethanol demand and a 75-million-bushel uptick in export estimates. That was a more bullish demand than analysts expected, leaving ending stocks at 1.357 billion bushels versus the average trade guess of 1.423 billion bushels.

“Export inspection data for the month of May … implies continued robust global demand for U.S. corn, despite high prices,” USDA noted in today’s report. The agency kept the season-average farm price steady, at $5.70 per bushel.

“As summer travel season heats up and more Americans take to the roads in the post-pandemic era, ethanol production has largely returned to pre-pandemic levels over the past month,” Holland notes. “Added capacity has returned online after idling during the pandemic and refiner and blender usage of ethanol continues to rise.”

Both moves will shrink U.S. corn supplies to the tightest level since 1995/96, Holland adds. A smaller Brazilian crop due to ongoing drought stress and late planting issues with the safrinha crop further tightened global supplies as the corn supply situation begins to look increasingly more like that of soybeans, she says.

“As drought conditions persist in the Upper Midwest and farmers battle slow emergence rates, corn futures will likely give soybeans a strong run their money in the coming weeks,” Holland concludes.

Meantime, USDA’s global coarse grain outlook assumes higher production, marginally higher trade and larger ending stocks compared to May. Overseas 2021/22 ending stocks moved slightly higher after increases in Pakistan and South Africa were partially offset by reductions in Canada.

In South America, USDA sees some eroding production potential in Brazil, lowering its May estimate of 4.016 billion bushels down to 3.878 billion bushels this month. Production estimates for Argentina held steady, at 1.850 billion bushels.

Soybeans

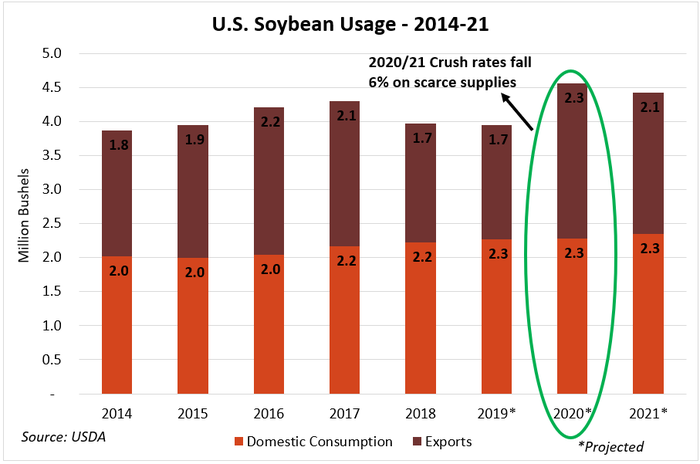

USDA assumes higher soybean supply and use projections for 2021/22. Soybean crush estimates in the current marketing year were lowered by 15 million bushels to 2.175 billion bushels “based on a lower forecast for soybean meal domestic disappearance and higher soybean meal imports.” High prices and stiff competition overseas for soyoil means a 400-million-pound reduction in exports.

“USDA walked back record highs for 2020/21 U.S. soybean crush volumes as processors scramble to source feedstocks from dwindling on-farm stocks following an aggressive export and crush season earlier in the 2020/21 marketing year,” Holland says. “Cash offerings at crush plants in the Eastern Corn Belt have ranged between $0.45-$1.10/bushel over futures prices in recent days, reflecting scarce supplies and strong usage rates.”

Processing rates will likely decline until the 2021 crop is harvested, though it will face stiff competition from export markets at that time which could offer farmers some lucrative harvest pricing options, Holland says. U.S. ending stocks widened back to the second-tightest level on record thanks to the lower crush rates.

“More biodiesel production capacity is expected to come online in the coming years as the demand for green energy – especially for commercial vehicles – soars,” she says. “Even with tight capacities, the demand forecasts suggest that high soybean prices may be around for a while.”

Soybean ending stocks for 2021/22 rose more than expected, moving to 155 million bushels versus the average trade guess of 146 million bushels. Those are still historically tight stocks, however. World ending stocks for 2021/22 also moved above analyst estimates, going from 3.347 billion bushels in May up to 3.400 billion bushels this month.

USDA made some slight revisions to its South American soybean production estimates. While Argentinian production held steady from last month, at 1.727 billion bushels, Brazil moved modestly higher – now at 5.033 billion bushels.

Wheat

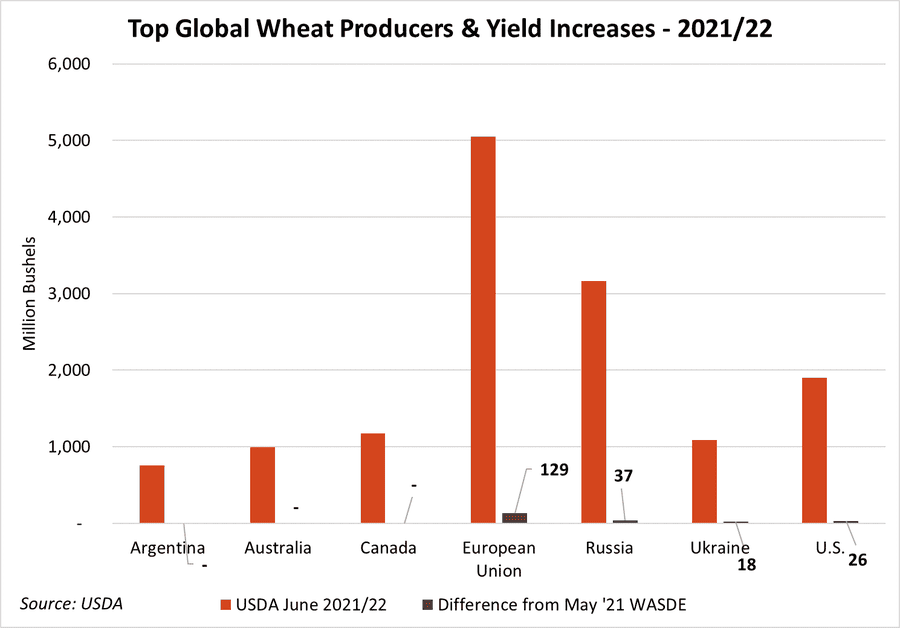

For wheat, USDA assumes “larger supplies, higher domestic use, unchanged exports and slightly lower stocks.” Ending stocks for 2021/22 moved from 774 million bushels in May down to 770 million bushels, in contrast with the average trade guess of 783 million bushels.

Further, USDA predicts all-wheat production will reach 1.898 billion bushels this year, an upward revision of 26 million bushels after the agency saw an uptick in HRW and SRW production. All-wheat yield estimates are at 50.7 bushels per acre, which is 0.7 bpa higher than May estimates.

USDA kept its season-average farm price estimates steady, at $6.50 per bushel.

Globally, USDA is bullish for production in several key regions, including the European Union, Russia and Ukraine, which all moved higher from a month ago. Total world production in 2021/22 is predicted to reach a record total of 29.189 billion bushels. Ending stocks are estimated at 10.906 billion bushels, with China accounting for nearly half (48%) of that total.

“But rising livestock and human food demand increased global wheat consumption rates to 29.1 billion bushels, leaving global wheat stocks at the tightest level since the 2016/15 season,” Holland notes. “Ending global stocks for 2021/22 increased slightly higher than analyst expectations on the higher production as Chicago futures inched lower on the prospect of higher global soft wheat competition in the export market.”

Click here to read the full June WASDE report.

About the Author(s)

You May Also Like