Acreage/yield numbers for 2013 big questions for peanut industry

The big questions now hanging over the peanut industry are just how big a cut there has been in acreage this year and what the carryover will be going into the new marketing year that starts August 1. “Those numbers will have a definite impact on the price producers receive for their peanuts in 2014,” says Marshall Lamb, director of the USDA/Agricultural Research Service National Peanut Research Laboratory at Dawson, Ga.

Coming off a record 2012 peanut crop and a precedent-setting carryover, the big questions now hanging over the industry are just how big a cut there has been in acreage this year and what the carryover will be going into the new marketing year that starts August 1.

“Those numbers will have a definite impact on the price producers receive for their peanuts in 2014,” says Marshall Lamb, director of the USDA/Agricultural Research Service National Peanut Research Laboratory at Dawson, Ga., who spoke at the Mississippi Farm Bureau Federation’s summer peanut commodity meeting at Hattiesburg.

“The Georgia Peanut Commission, at their recent board meeting, polled their farmer director members about acreage and came up with just over a 50 percent reduction in that state. In Alabama, we hear that acreage could be down as much as 40 percent. In Mississippi, there could be a 40 percent to 50 percent decrease. Texas is still dry, but they’re accustomed to that.

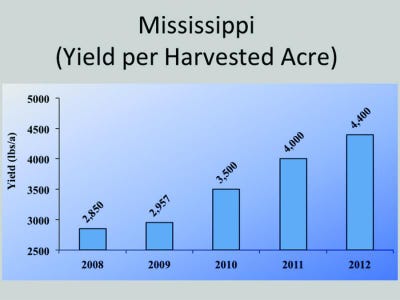

MISSISSIPPI PEANUT YIELDS have been steadily increasing, reaching an all-time record in 2012.

“The USDA still is saying U.S. acreage will fall by 27 percent, but I think we’ve already passed that mark. It’s basically a crap shoot now, trying to figure the actual acreage decline and what the final yield will be. The first key number will be the FSA certified acreage report in August, which will take that speculation out of the market.”

If the carryout projection is greater than 1 million farmer stock tons (FST), Lamb says, “Markets will be oversupplied and depressed into 2014. If we have more than 800,000 but less than 1 million FST, we’ll still be oversupplied, but it can be corrected in 2014. If we’re at 600,000 FST but less than 800,000 FST, markets will be tight and contracting will be vigorous for both the 2013 and 2014 crops. If it’s less than 600,000 FST, we’ll be undersupplied, and there will be aggressive contracting for both the 2013 and 2014 crops.”

Despite the late planting and some prevented planting, Lamb says, “The crop in Georgia/Florida/Alabama is off to a good start, with good stands and good soil moisture — everything is looking good. But a lot can happen between now and harvest, and the final acreage/yield combination will dictate where the market goes.”

These wide swings in production that have characterized the peanut sector since the end of the government program “are not healthy for growers, shellers, or the overall industry,” Lamb says.

“I wish there was something we could do about these up-and-down cycles. I’ve talked to a lot of big manufacturers and they say if they could count on a steady supply, they’d be looking at opening some new plants. But they’re scared of these big swings. It’s something we’re going to have to try and manage. I would love to see a two- to three-year moving average-type contract. I think it would be helpful for a lot of people.”

Despite the big carryover from the 2012 crop, Lamb says, “It’s not a depressing story. We were able to clear a lot of those peanuts because of China’s purchases, and we’ve made a sharp downward acreage adjustment this year. Now, we just have to be patient and see how things play out in terms of actual acreage and yield.”

About the Author(s)

You May Also Like