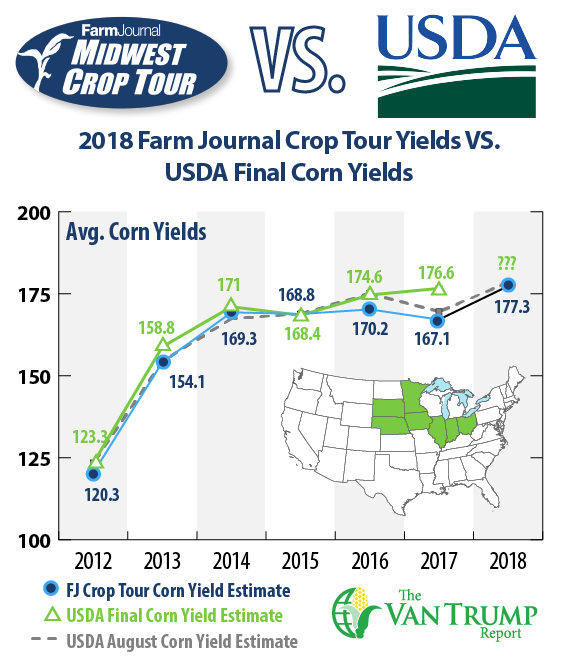

Corn traders are fully digesting the Pro Farmer Midwest Crop tour results. Final tour estimates project the U.S. yield at 177.3 bushels per acre with a total crop of 14.504 billion bushels.

The USDA is currently estimating the U.S. crop will yield a record 178.4 bushels per acre and produce a total crop of 14.586 billion bushels. Which is actually still the smallest U.S. crop in the past three years. In 2017 we produced 14.604 billion bushels, in 2016 we produced 15.148 billion. Also better than the past two years, is the fact ending stocks are currently estimated 1.68 billion bushels, rather than the +2.0 billion in both 2016 and 2017.

Total demand remains strong and we actually planted fewer corn acres than we have the past couple of years, about -1 million fewer than in 2017, and about -5 million less than 2016. the question moving forward is how many corn acres will we plant in 2019? There's a lot of early talk that we could add +5 to +6 million next season. The bears quickly crunch the numbers and find +6 million more corn acres with an average national yield of 175 bushels per acre could bring an additional +1.0 billion bushels into the equation. They are also pointing to a slight increase in Argentine corn acres. Obviously, weather will remain a huge "wild-card", but as always the bears start off using cooperative conditions and the market tends to pause and think about the possibilities.

Unfortunately, the market can often stay with this mindset until real weather worries show up on our doorstep or in the forecast for fields of South America. In other words, I'm a bit concerned that this period of time where the market tries to transition from the tail end of the U.S. growing cycle to the South American growing cycle can be without widespread weather headlines.

Hence leaving the market perhaps to ponder thoughts upon thoughts of increase supply. I'm not sure how long this will last, but historically we tend to bottom somewhere between mid-August and mid-September, I'm hoping that's the case this year and prices soon start to turn back around.

From a technical perspective, psychological support at $3.50 is still in play. Beyond that level, there's talk of much more major support in the $3.20 to $3.30 range. The upside of the range still seems to be in the $3.90 to $4.10 area.

The opinions of the author are not necessarily those of Corn+Soybean Digest or Farm Progress.

About the Author(s)

You May Also Like