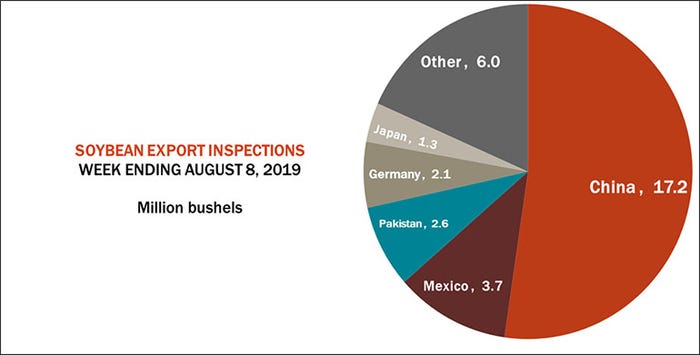

China continued to draw down its large book of outstanding soybean sales last week, according to the latest export inspection data from USDA, out Monday morning. But the country still has a long way to go, according to Farm Futures senior grain market analyst Bryce Knorr.

“Although Chinese buyers took delivery on 17.2 million bushels, that still leaves 125 million bushels left as the clock winds down to the end of the 2018 marketing year,” he says. “Total exports could still reach USDA’s forecast for the 2018 even if China cancels or rolls some of its purchases to new crop. But other countries would have to pick of the slack. So far, that’s what they’re doing, with a lot of countries taking a boatload or less.”

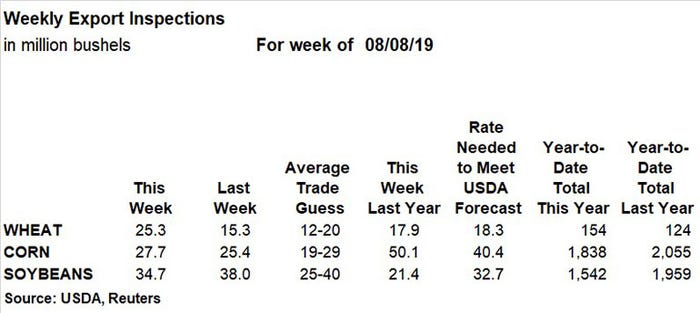

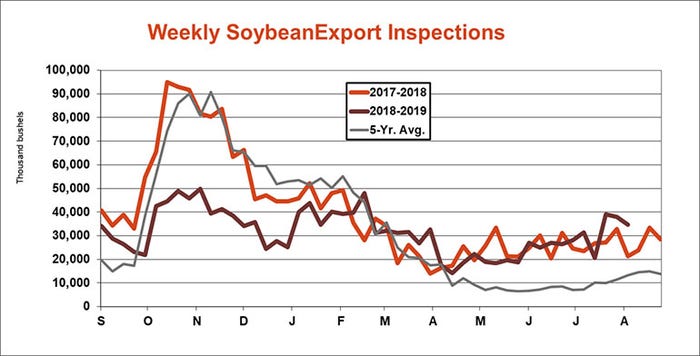

Total U.S. soybean export inspections reached 34.7 million bushels for the week ending August 8, which was slightly behind the prior week’s tally of 38.0 million bushels but on the high end of trade estimates that ranged between 25 million and 40 million bushels. The weekly rate needed to match USDA forecasts eased to 32.7 million bushels, while cumulative totals of 1.542 billion bushels in the 2018/19 marketing year are still 21% behind last year’s pace of 1.959 billion bushels.

Aside from China’s 17.2 million bushels last week, other top destinations for U.S. soybean destinations included Mexico (3.7 million), Pakistan (2.6 million) and Germany (2.1 million).

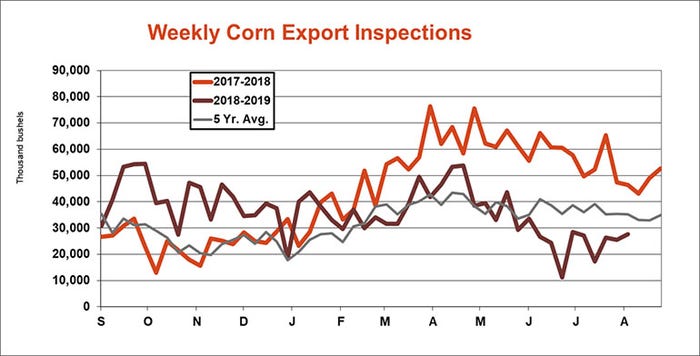

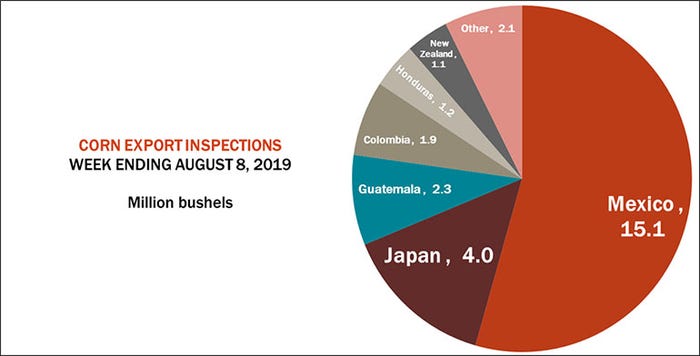

Corn export inspections saw a small rebound from the prior week’s tally of 25.4 million bushels after reaching 27.7 million bushels last week. That total was also on the high end of trade estimates that ranged between 19 million and 29 million bushels. Still, the weekly rate needed to meet USDA forecasts moved higher, to 40.4 million bushels. Cumulative totals for the 2018/19 marketing year are now at 1.838 billion bushels, versus 2.055 billion this time a year ago.

“Corn shipments aren’t bad but continue to lag the rate forecast by USDA, making it likely USDA will lower its estimate of 2018 crop sales,” Knorr says.

Mexico accounted for more than half of all U.S. corn export inspections last week, with 15.1 million bushels. Other top destinations included Japan (4.0 million), Guatemala (2.3 million) and Colombia (1.9 million).

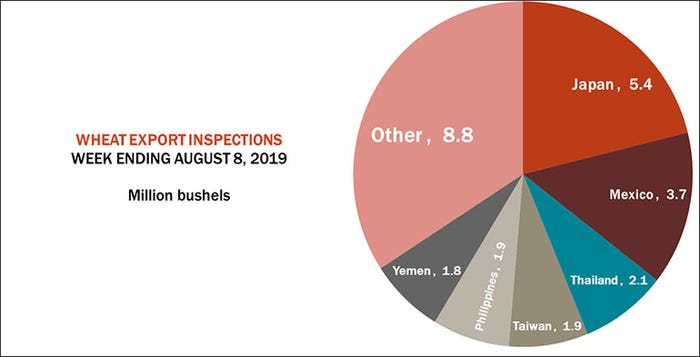

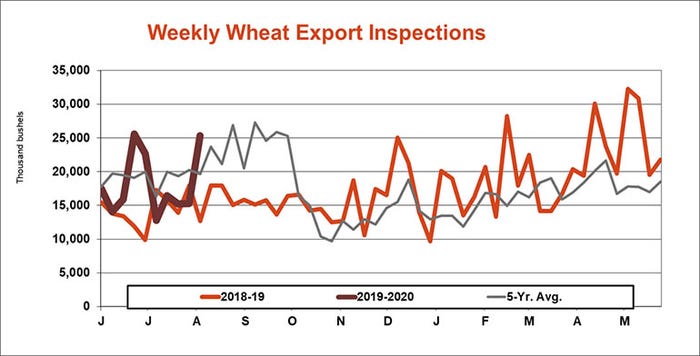

Wheat export inspections improved over the prior week’s tally of 15.3 million bushels after reaching 25.3 million bushels, moving above trade estimates that ranged between 12 million and 20 million bushels. The weekly rate needed to match USDA forecasts eased slightly, to 18.3 million bushels, while cumulative totals for the 2019/20 marketing year moved 24% higher year-over-year after reaching 154 million bushels.

“Wheat inspections are starting to show signs of life,” Knorr says. “Japan was the only destination loading out more than a single load last week, but 19 countries in all made the list.”

Japan led the way for U.S. wheat export inspections last week, with 5.4 million bushels. Other top destinations included Mexico (3.7 million), Thailand (2.1 million), Taiwan (1.9 million), the Philippines (1.9 million) and Yemen (1.8 million).

About the Author(s)

You May Also Like