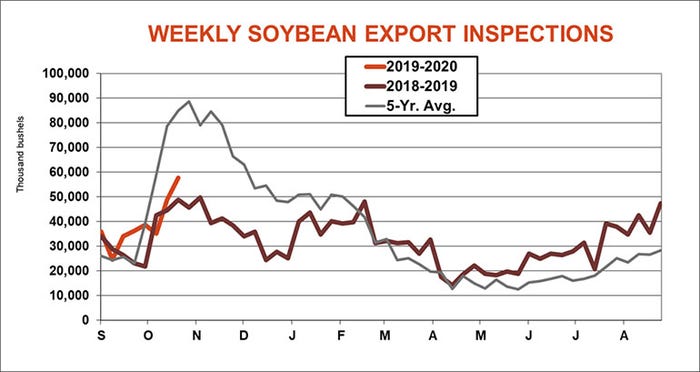

For the week ending October 24, soybean export inspections bested trade estimates and beat out the prior week’s tally. Good news, right? It’s a little more complicated than that, according to Farm Futures senior grain market analyst Bryce Knorr.

“The third week of October on average is when U.S. soybean inspections peak as the export pipeline fills with the new harvest,” he says. “This week’s total inspections were indeed a marketing year high but fell well below average levels. Part of that may be due to the slow pace of harvest, but overall demand could be an issue, too.”

Though U.S. prices out of the Gulf for November are priced around 35 cents a bushel cheaper than Brazil, that advantage disappears for new crop out of Brazil, which is 25 cheaper than the Gulf for February shipment, Knorr adds.

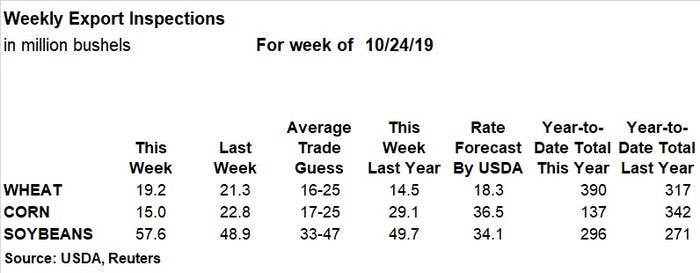

Total soybean export inspections topped 57.6 million bushels this past week, up from 48.9 million bushels a week ago and landing above the average trade guess that ranged between 33 million and 47 million bushels. The weekly rate needed to match USDA forecasts eased to 34.1 million bushels, while year-to-date totals for the 2019/20 marketing year are 9.2% higher year-over-year, with 296 million bushels.

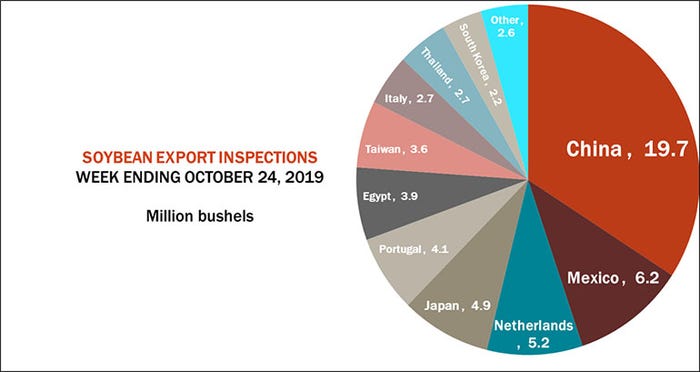

China was the No. 1 destination last week, with 19.7 million bushels. Other top destinations included Mexico (6.2 million), the Netherlands (5.2 million) and Japan (4.9 million).

“China still has around 159 million bushels of unshipped sales on the book,” Knorr notes. “Traders will be waiting USDA’s weekly sales reports and its daily wire for confirmation of new purchases. The Chinese government granted waivers on tariffs for buyers to purchase around 370 million bushels from the U.S. But so far they’ve made only 9.7 million bushels in new deals.”

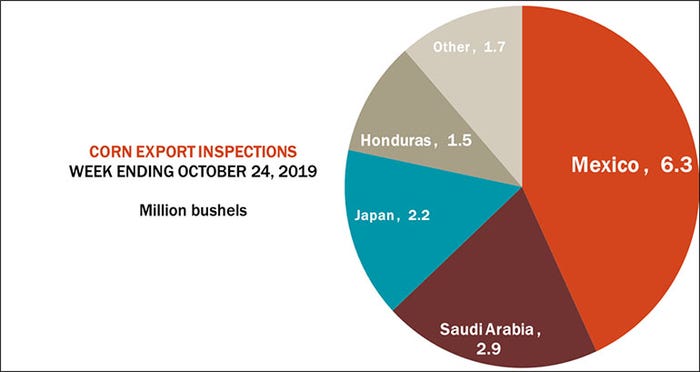

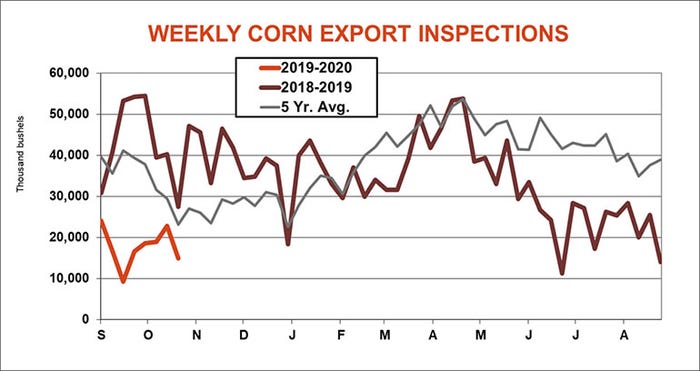

Corn export inspections slumped to 15.0 million bushels last week, meantime, falling moderately behind the prior week’s tally of 22.8 million bushels and falling short of trade estimates that ranged between 17 million and 25 million bushels. The weekly rate needed to match USDA forecasts moved up to 36.5 million bushels, with year-to-date totals of 137 million bushels already 60% behind last year’s pace.

“Corn inspections were again disappointing, falling well below average levels,” Knorr says. “Buyers continue to take shipments out of Brazil or the Black Sea while waiting to see how much – and what quality – will be available out of the U.S. after a tough growing season.”

As it often is, Mexico came in as the No. 1 destination for U.S. corn export inspections last week, with 6.3 million bushels. Other leading destinations included Saudi Arabia (2.9 million), Japan (2.2 million) and Honduras (1.5 million).

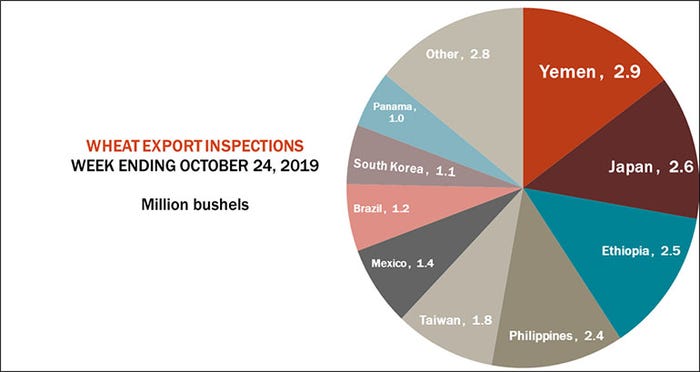

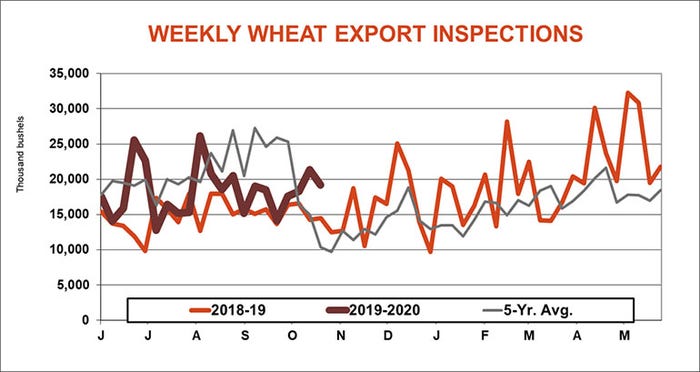

Wheat export inspections reached 19.2 million bushels last week, which was just below the prior week’s tally of 21.3 million bushels and on the low end of trade guesses, which ranged between 16 million and 25 million bushels. The weekly rate needed to match USDA forecasts crept up to 18.3 million bushels, although cumulative totals for the 2019/20 marketing year are still 23% higher than a year ago, with 390 million bushels.

“Wheat inspections slipped a little but still remain above average because October shipping slots are normally dominated by soybeans,” Knorr says. “Buyers continue to ship out purchases on a hand-to-mouth basis, taking a single cargo or less, though there are plenty of buyers on the list.”

Yemen led all destinations for U.S. wheat export inspections last week, with 2.9 million bushels. Other top destinations included Japan (2.6 million), Ethiopia (2.5 million), the Philippines (2.4 million) and Taiwan (1.8 million).

About the Author(s)

You May Also Like