Lackluster export inspections last week reflect both the time of year and what an unusual year it’s been, according to Farm Futures senior grain market analyst Bryce Knorr.

“For wheat, slow shipments are not unusual as buyers wait to judge the quantity and quality of the class of wheat they’re buying,” he says. “For all three crops, closure of the river system north of St. Louis continues to divert shipments to other ports or delay them until barges start moving again.”

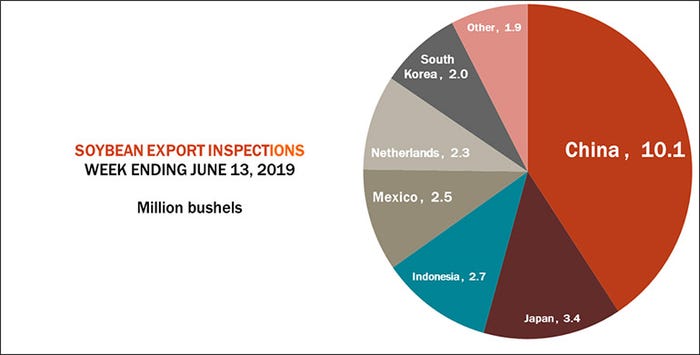

Despite these bottlenecks, Chinese buyers continue to take delivery of purchases made during the thaw in the trade war earlier this year as anticipation mounts ahead of the G-20 Summit at the end of the month, when President Trump and President Xi of China may or may not sit down to discuss the confrontation, Knorr adds.

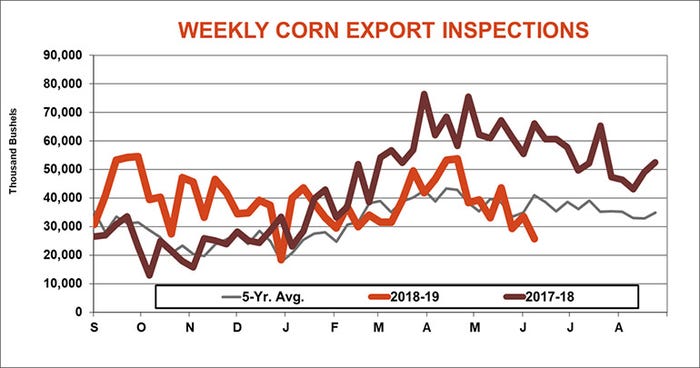

“With some 200 million Chinese purchases still on the books and a record level out outstanding soybean sales to all customers, corn is taking a back seat due to limiting shipping capacity,” he says. “But the slow pace in corn shipment also likely reflects rationing by foreign buyers due to higher prices and ideas new crop availability will be limited. So those customers are busy arranging deals with the competition, especially from Brazil.”

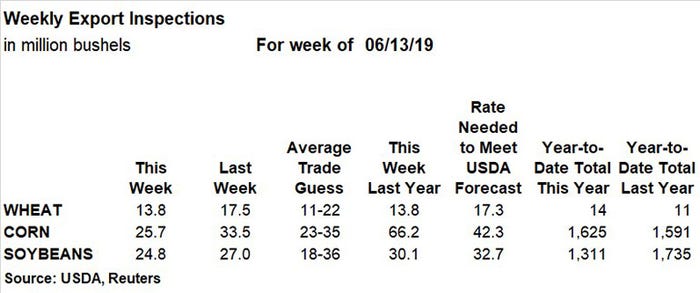

Corn export inspections reached 25.7 million bushels for the week ending June 13, which was moderately below the prior week’s tally of 33.5 million bushels and on the low end of trade estimates that ranged between 23 million and 35 million bushels. The weekly rate needed to match USDA forecasts moved higher, to 42.3 million bushels. Marketing year-to-date totals for 2018/19 remain slightly ahead of last year’s pace, with 1.625 billion bushels.

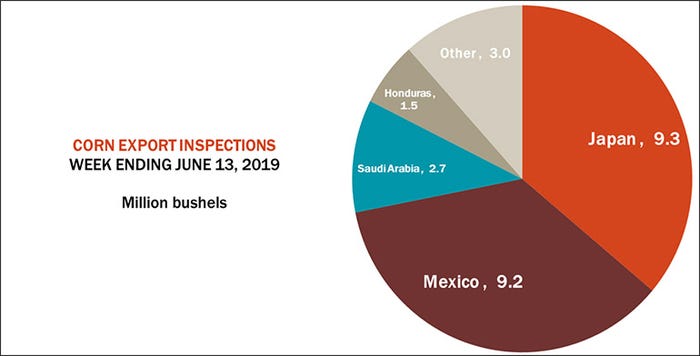

Japan was the No. 1 destination for U.S. corn export inspections last week, with 9.3 million bushels, followed closely by Mexico (9.2 million). Other top destinations included Saudi Arabia (2.7 million) and Honduras (1.5 million).

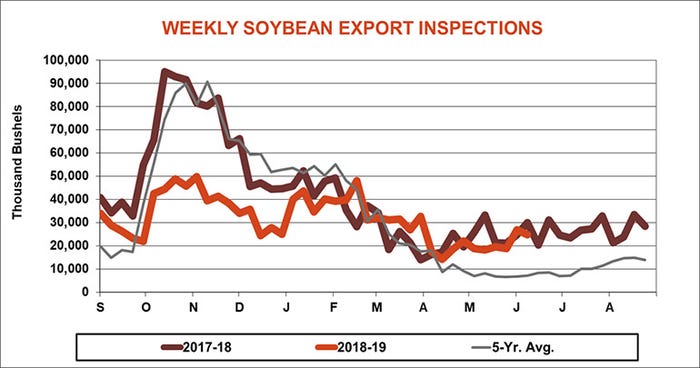

Soybean export inspections were for 24.8 million bushels last week, slipping below the prior week’s total of 27.0 million bushels and landing in the middle of trade guesses that ranged between 18 million and 36 million bushels. The weekly rate needed to meet USDA forecasts is now at 32.7 million bushels, and cumulative totals for 2018/19 are down 24% year-over-year, at 1.311 billion bushels.

China was the No. 1 destination for U.S. soybean export inspections last week, with 10.1 million bushels. Other top destinations included Japan (3.4 million), Indonesia (2.7 million), Mexico (2.5 million) and the Netherlands (2.3 million).

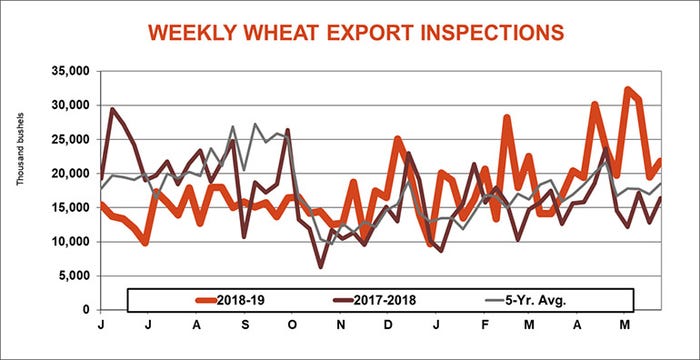

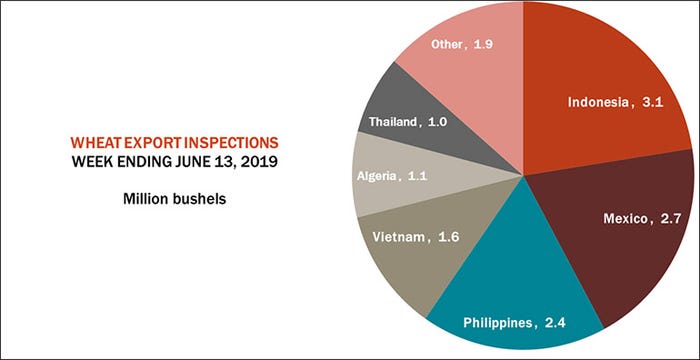

Wheat export inspections are now in their first full week of the 2019/20 marketing year, tallying 13.8 million bushels. That was on the low end of trade estimates that ranged between 11 million and 22 million bushels, and moderately below the prior week’s tally of 17.5 million bushels. Year-to-date totals this marketing year are at 14 million bushels, starting a bit faster than the prior year’s pace of 11 million.

Indonesia was the No. 1 destination for U.S. wheat export inspections last week, with 3.1 million bushels. Other leading destinations included Mexico (2.7 million), the Philippines (2.4 million), Vietnam (1.6 million) and Algeria (1.1 million).

About the Author(s)

You May Also Like