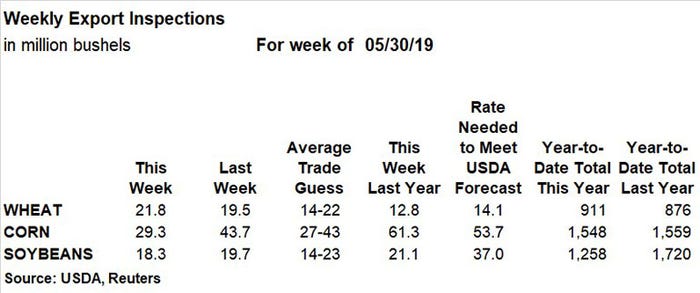

The latest weekly export inspection report from USDA this morning showed another round of mixed results, as wheat finished near the top of analyst estimates, with diminishing returns for corn and soybeans.

“Today’s export inspections offered a couple of hopeful numbers, and some disappointment too,” according to Farm Futures senior grain market analyst Bryce Knorr.

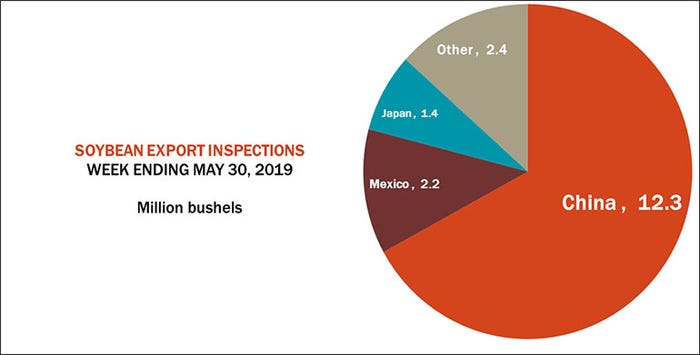

For soybeans, Chinese buyers continue to ship out their large book of previous purchases, account for 12.3 million bushels of the total for last week, Knorr notes. China still has more than 240 million bushels of outstanding sales, he says, so these weekly numbers will be watched carefully for signs those deals are in jeopardy as the trade war with the U.S. drags on.

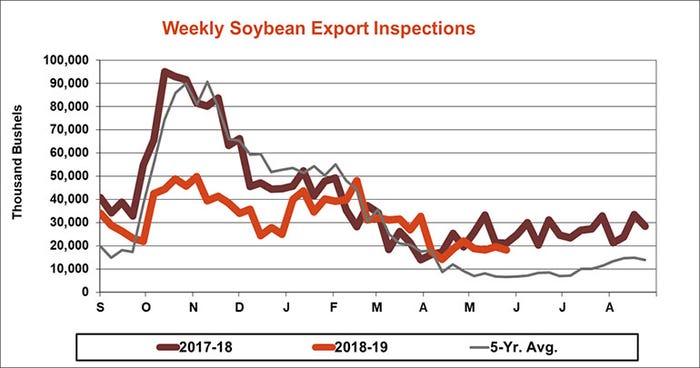

“Total soybean inspections need to pick up, something made more difficult by closure of the river system north of St. Louis for another two weeks,” Knorr says. “This is also proving a drag on corn inspections, which ran nearly 25 million bushels shy of the rate needed every week through the end of August to reach USDA’s forecast for the 2018 crop.”

Soybean export inspections reached 18.3 million bushels last week, dropping below the prior week’s tally of 19.7 million bushels but staying in the middle of analyst expectations, which ranged between 14 million and 23 million bushels. The weekly rate needed to match USDA forecasts moved higher, to 37.0 million bushels. Year-to-date totals are now at 1.258 billion bushels, remaining around 27% lower year-over-year.

China’s 12.3 million bushels led all destinations for U.S. soybean export inspections last week. Other top destinations included Mexico (2.2 million) and Japan (1.4 million), with other destinations accounting for the remaining 2.4 million bushels.

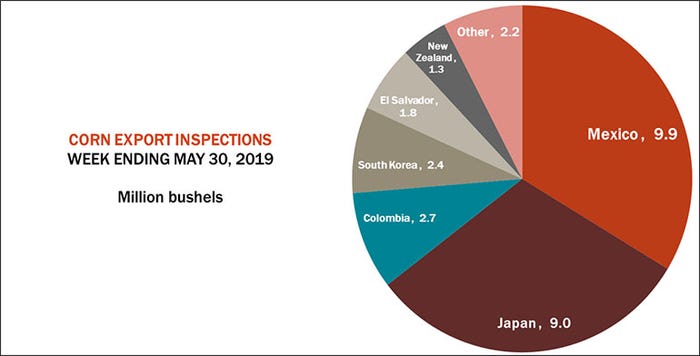

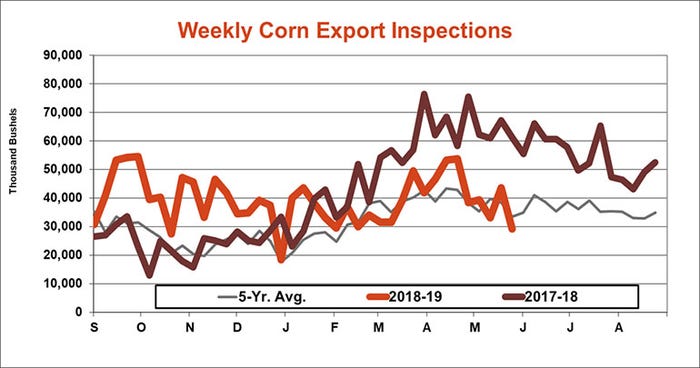

U.S. corn export inspections reached 29.3 million bushels for the week ending May 30, down noticeably from the prior week’s total of 43.7 million bushels and on the low end of trade estimates, which ranged between 27 million and 43 million bushels. The weekly rate needed to match USDA forecasts moved higher, to 53.7 million bushels. Year-to-date totals for the 2018/19 marketing year have slipped 0.7% below last year’s pace after reaching 1.548 billion bushels.

Mexico led all destinations for corn export inspections last week, with 9.9 million bushels. Other top destinations included Japan (9.0 million), Colombia (2.7 million), South Korea (2.4 million), El Salvador (1.8 million) and New Zealand (1.3 million).

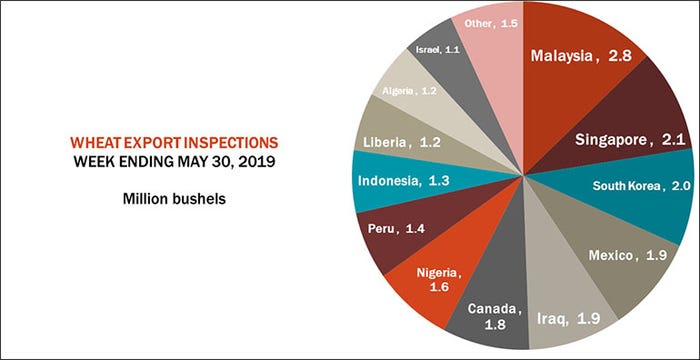

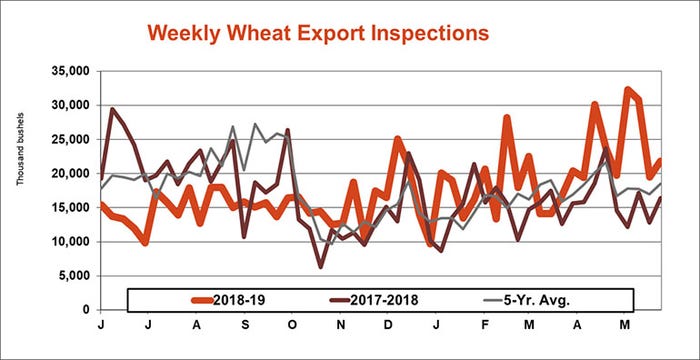

Wheat export inspections reached 21.8 million bushels last week, edging above the prior week’s tally of 19.5 million bushels and on the upper end of trade estimates that ranged between 14 million and 22 million bushels. The weekly rate needed to reach USDA forecasts moved down to 14.1 million bushels as the 2018/19 marketing year wraps up.

“Today’s report for wheat is through May 30, one day shy of the end for the 2018 marketing year,” Knorr says. “This week’s totals put USDA’s goal in reach once adjustments are made for totals collected by the Census Bureau. But final numbers won’t be known for more than a month, at which point they’ll be a footnote. The wheat market remains highly fragment, with a lot of buyers taking relatively small amounts ahead of the rush of new crop supply out of the northern hemisphere this summer.”

Cumulative totals for this marketing year stand at 911 million bushels, up 4% year-over-year.

Malaysia led all destinations for U.S. wheat export inspections last week, with 2.8 million bushels. Other top destinations included Singapore (2.1 million), South Korea (2.0 million), Mexico (1.9 million), Iraq (1.9 million) and Canada (1.8 million).

About the Author(s)

You May Also Like