Friday’s final tally of fund positions officially showed big speculators adding to bullish bets in agriculture early in the week. But these traders were already selling soybeans, even before the market broke sharply despite what seemed like a bullish USDA report.

Here’s what funds were up to through Tuesday, May 8, when the CFTC collected data for its latest Commitment of Traders put out on Friday.

![]()

New buying

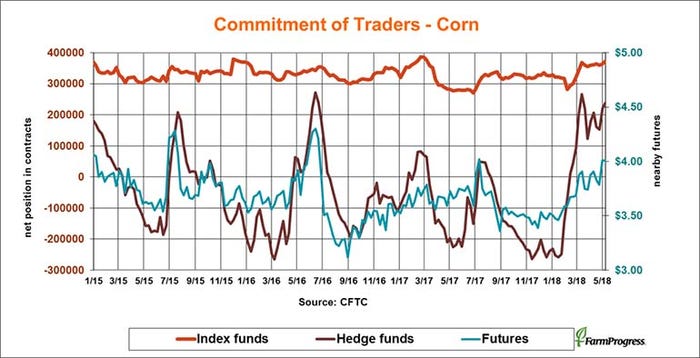

Big speculators pushed bullish bets in crops and livestock this week, but only a little, adding just 13,047 contracts to their net long position. Funds following indexes to gain exposure to commodities bought a little more though their total holdings are also well below levels from earlier this year.

Buying delays

Big speculators added corn into early this week, buying the delayed planting rally. But they start selling mid-week and kept up the liquidation following what looked like a positive USDA report.

Heading for the exit

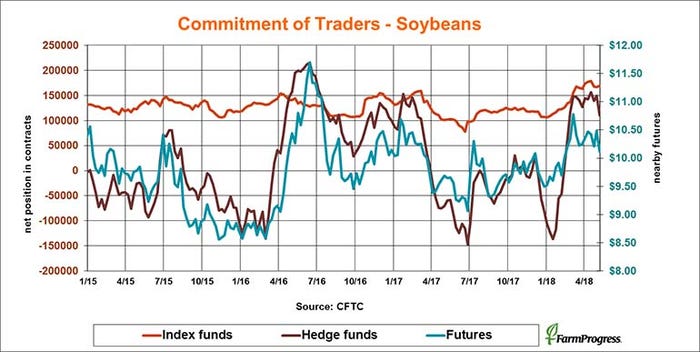

After choppy trade early this spring, big speculators made up their minds and start selling soybeans, liquidating 38,806 contracts as of Tuesday and selling more later in the week.

Out of oil

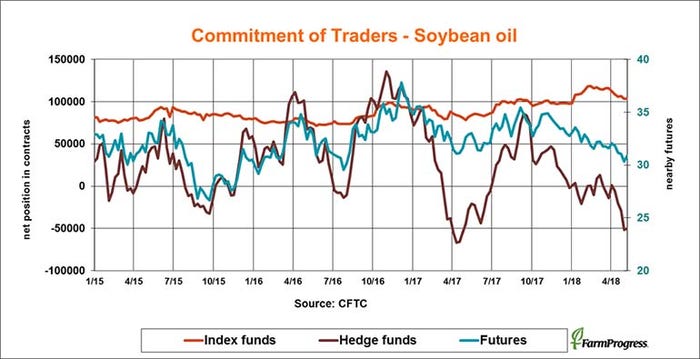

Big speculators covered a little of their big short in soybean oil this week as spread trades were unwound. But these hedge funds are still short 50,404 contracts, 1,277 less than the previous week.

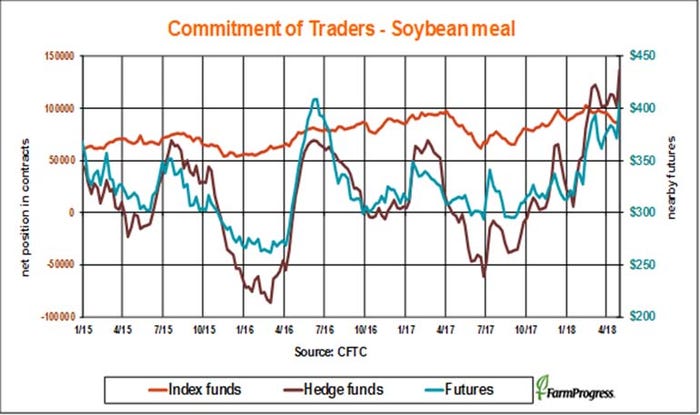

Big speculators hold a record bullish bet on soybean meal that could be in trouble.

Backing off

Big speculators established a record bullish bet in soybean meal as of May 1, but liquidated some of that position over the last week. Still, they only trimmed 6.285 contracts off their net long position.

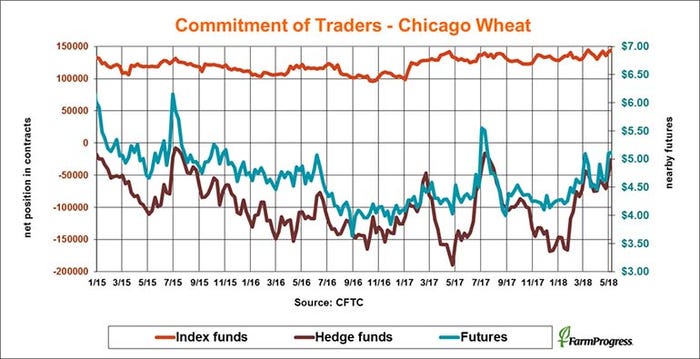

Decision time

Big speculators liquidated more of their bearish bets in soft red winter wheat as of Tuesday, moving to the sidelines ahead of USDA’s first production estimates for the 2018 crop. But even after covering 21,069 shorts they still had 25,756 to go.

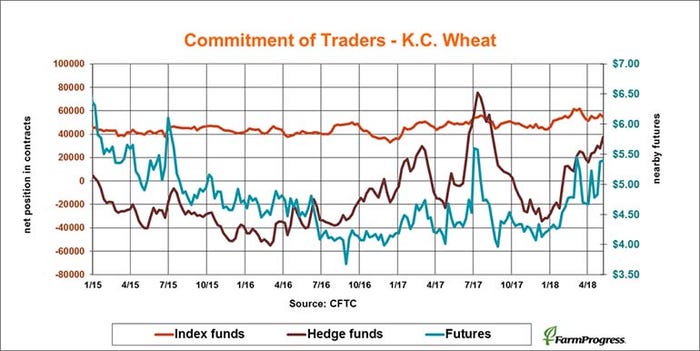

Dashed hops

Big speculators bought hard red winter wheat into Thursday’s production estimate, adding 9,234 contracts to push their net long position to its largest level in nine months.

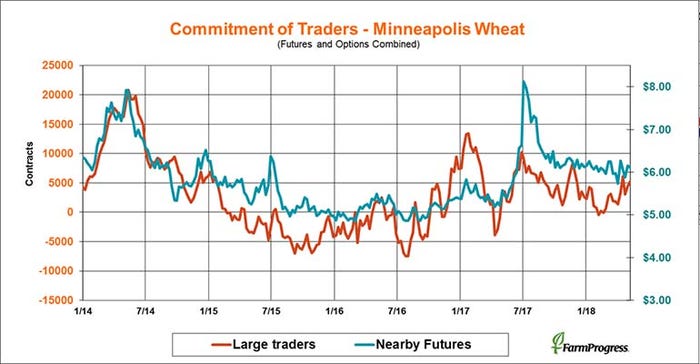

Weather play

Large traders added contracts to their long position this week as slow planting continues on the northern Plains, with worries about dry conditions also emerging in some areas.

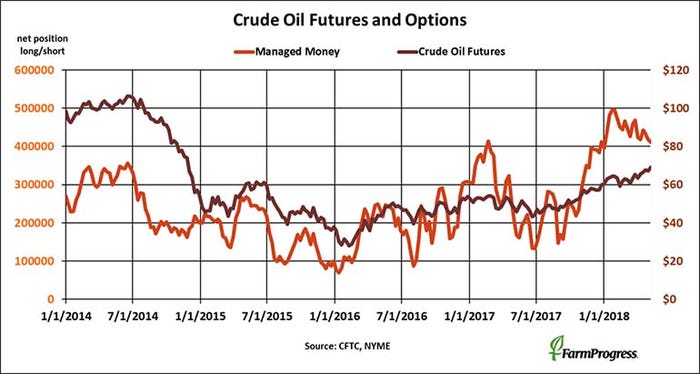

Short sided

President Trump’s decision to pull out of the Iran nuclear deal helped propel crude oil to new 3 ½-year highs this week. But money managers took profits on the rally, dumping more than $500 million worth of crude oil futures and options.

About the Author(s)

You May Also Like