As farmers know all too well, USDA reports often provoke big market moves. In the wake of bullish USDA’s Jan. 12 numbers, corn and soybean futures surged to the highest levels since saying goodbye to the fumes of rallies from the 2012 drought.

Both markets faced a gut check over the past couple of weeks. Corn recovered, making new highs while soybeans struggled to regain even half their retreat.

Where prices head from these lofty levels likely will reflect what USDA economists say about supply and demand in coming months. With forecasts already calling for tightening stocks left over at the end of the marketing year Aug. 31, even small changes could have a large impact on what happens into spring. So, here’s a look at how these crop balance sheets could change.

Corn question marks

USDA in January slashed 150 million bushels off its forecast for 2020 crop ending stocks. The 1.552 billion bushel surplus would be less than a 40-day supply, the tightest since 2013-2014. All three components of demand – livestock feeding, exports and industrial usage – are riddled with uncertainty for number crunchers.

How much corn is fed is always the toughest number to track. USDA doesn’t count the actual number of bushels consumed by critters. Instead, it imputes the number from changes in quarterly grain stocks, which are themselves estimates based on surveys. Exports and industrial demand like ethanol can be tracked on a weekly or monthly basis. So USDA assumes grain that can’t be accounted for wound up in feed rations.

The government in January said less corn would be fed due to higher prices. Still, feed usage would total 5.65 billion bushels according to the latest estimate.

For this to happen, the livestock industry faces significant price rationing. USDA’s estimate of Dec. 1 stocks suggests feed usage in the first quarter of the marketing year was about the same of the previous year. To reach USDA’s 2020 estimate, 260 million bushels of demand need to be cut. History suggests prices could be high enough to cut even more – another 135 million bushels -- off feeding as operations turn to other alternative feeds or cull unprofitable animals. That would take feed usage down to 5.515 billion.

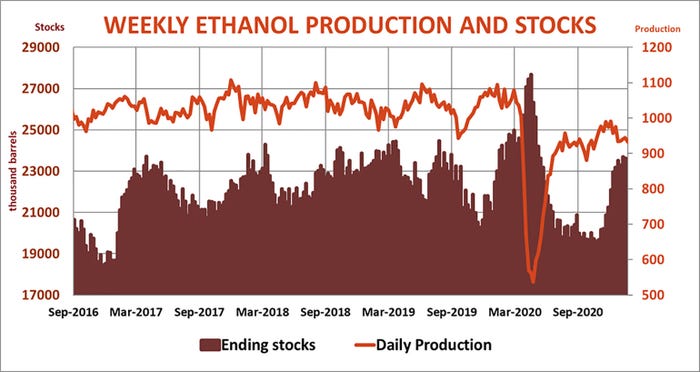

Demand from ethanol plants, however, could be stronger than USDA forecasts. The government Jan. 12 cut its forecast by 100 million bushels due to rationing. But so far, higher prices don’t appear to be reducing output.

To be sure, operating margins in the industry remain week, with increased corn feedstock costs offsetting higher revenues from biofuels and byproducts. Demand for blending with gasoline is still under pressure as the pandemic constrains driving. Still, the EIA forecasts a 4% increase in ethanol production this year, even though gasoline consumption could rise only 1%.

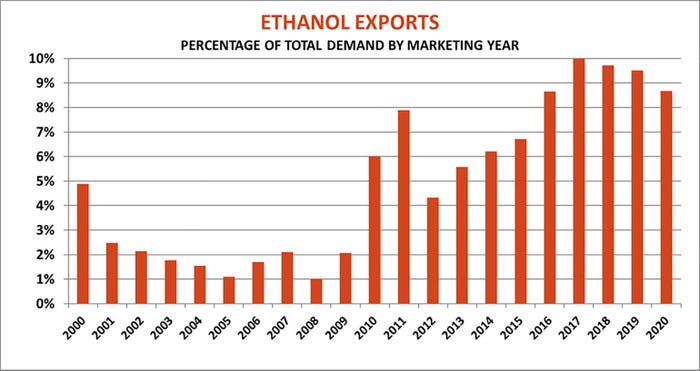

The swing factor could be ethanol exports, which account for 10% of demand. Data for the first quarter of the marketing year shows export demand is holding. Whether it increases likely depends on whether China ramps up purchases.

To date, China accounts for less than 3% of total U.S. ethanol exports, more than the previous two years when sales plummeted during the trade war. The high-water mark for U.S. ethanol sales to China came in 2015-2016, when those deals accounted for 20% of the total. Unfortunately, though ethanol production data is reported weekly, export sales lag a month behind; numbers for December come out at the end of this week.

Despite the uncertainty, my model indicates total ethanol demand could be 100 million more than USDA’s January estimate. The agency Monday’s put total December corn usage for ethanol at 430 million bushels, compared to 432 million in November.

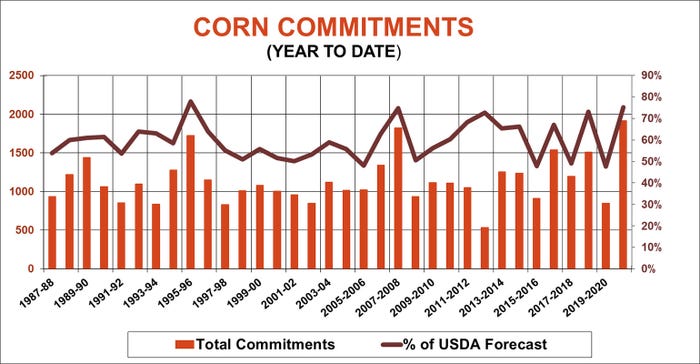

China, of course, is at the heart of the biggest question mark in corn demand: exports. Total Chinese purchases of 2020 crop corn are forecast to hit a record 690 million bushels. Total U.S. shipments and outstanding purchases to all customers already total more than 2.2 billion bushels. That record pace thus far in the marketing year translates into total sales of 2.67 billion, 121 million more than USDA’s last forecast.

Whether that bullish potential is achieved likely depends on what happens to the crop in South America, where drought cut Argentine production already and could trim Brazil’s output as well.

These potential changes to demand could knock another 100 million bushels off carryout if confirmed by USDA. That relatively small difference would be enough to take my targeted selling range for futures to $5.52 to $6.11. Without the adjustments, my model puts that range at $5.33 to $5.88. March corn hit $5.5575 on Monday.

Soybean squeeze?

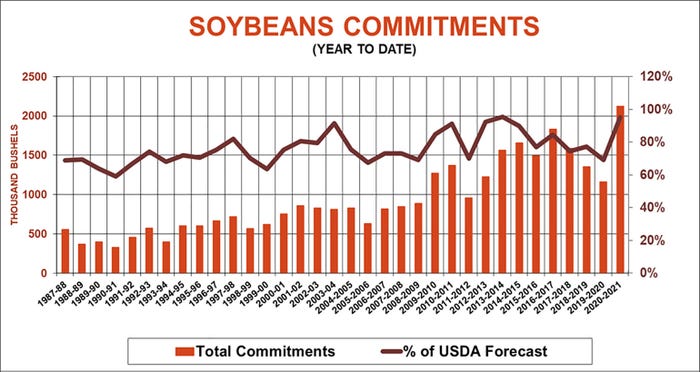

USDA in January reduced its forecast for soybean carryout to just 140 million bushels thanks to record crush and exports. Whether that estimate holds – or gets tighter still – depends on whether the fast start to consumption continues for the remainder of the marketing year.

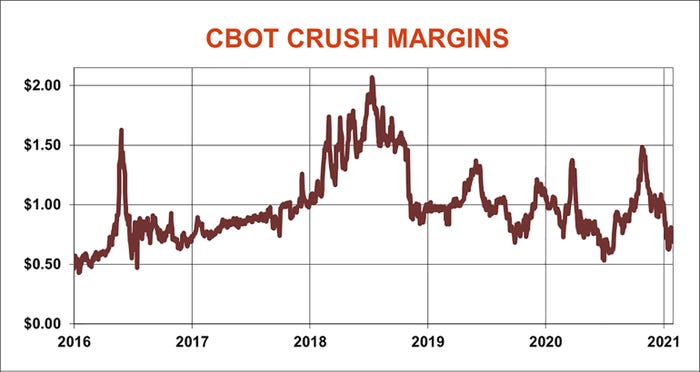

USDA Monday reported December crush of 193.8 million bushels, a record for the month, bringing the total for the marketing year up 6.1% compared to 2019-2020. USDA predicts just a 1.6% increase when all is said and done, implying the hot early pace will slow down. That may already be happening; crush margins in January slipped 26% from December, after falling 16% from November.

Argentina’s ability to export its new crop production after drought and labor strife could be the swing factor for U.S. crush. Questions remain about the size of the crop in Brazil as well, where late planting slowed the start of its shipping season.

Strong buying from China helped push U.S. soybean commitments to a record 2.28 billion bushels so far, more than 95% of USDA’s current forecast for the entire marketing year. Brazil typically takes over the market after its harvest, but China continued to book U.S. cargoes last week. News out of China may be scarce next week, however, when markets close for Lunar New Year Feb. 11-17.

Nearby soybean futures moved through my projected selling range of $12.79 to $13.77 after their January report surge, hitting $14.365. This suggests the market believes ending stocks could be tighter than USDA projects without more price rationing – or a deterioration in the U.S.-China trade detent.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like