Basis is narrowing as cash remains firm. We'll see how firm on Wednesday.

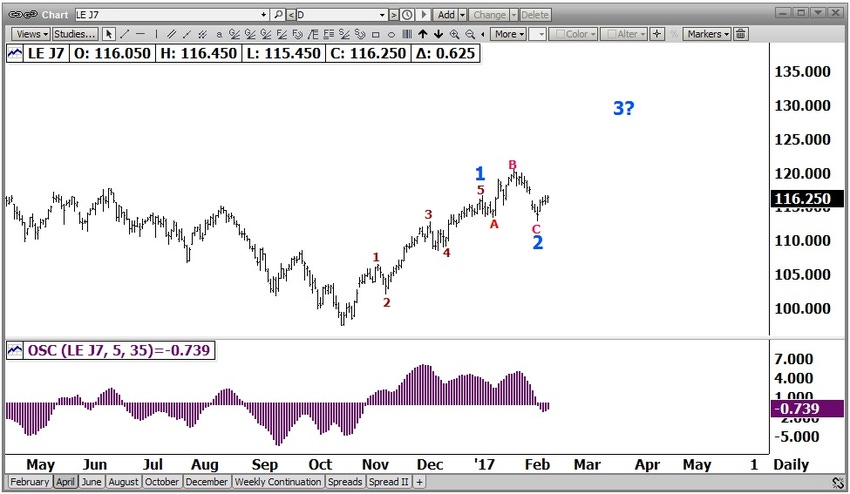

My first best guess will be around the $121.00 area. Technical indicators are turned up now. There has been nothing to change that I know of. Positive basis is wide and will narrow. Whether cash to futures, futures to cash, or meet in the middle, the basis is going to narrow. This situation is anticipated to make for some very uneventful, and potentially agitating trading.

Last, one has to be on guard for something to break loose very soon. That something is the US dollar. Whether higher or lower, it is not anticipated to remain in the current range for much longer. My analysis suggests to anticipate a lower trade in the US dollar.

Were my analysis to be incorrect and the US dollar strengthen further, the current market dynamics would be upset significantly. This is due to the thoughts that funds have been supporting commodities for the past several months in anticipation of either a move in the US dollar, or potential demand increases. Producers have welcomed their presences as they have helped to support prices at a time when supply is burdensome in most commodities.

Were the US dollar to begin moving abruptly in one direction or the other, it would begin to either solidify previous analysis, or blow it out of the water. Blowing it out of the water would be anticipated to be exceptionally ugly. Keep this on the front burner.

With basis narrowing quickly in feeder cattle, yards are left with some difficult choices. Feed yards don't enjoy the same basis they have with fats. Incoming cattle would either have to be bought lighter in weight or cheaper to offset the steep discount of back-month fat futures. Due to seasonal tendency and summer weather, the August or September contracts would be the ones of most concern to yards. Were August to trip back towards $122.50, it might widen the basis spread to a slightly more advantageous position.

An investment in futures contracts is speculative, involves a high degree of risk and is suitable only for persons who can assume the risk of loss in excess of their margin deposits. You should carefully consider whether futures trading is appropriate for you in light of your investment experience, trading objectives, financial resources and other relevant circumstances. Past performance is not necessarily indicative of future results.

About the Author(s)

You May Also Like