Unusually strong demand for 2020 crops is the story of the markets so far this year. But supply should begin to control the narrative when 2021 corn and soybeans write their opening chapters in a few weeks. USDA releases its first survey of farmer planting intentions March 31, setting the stage for traders’ focus to turn to weather.

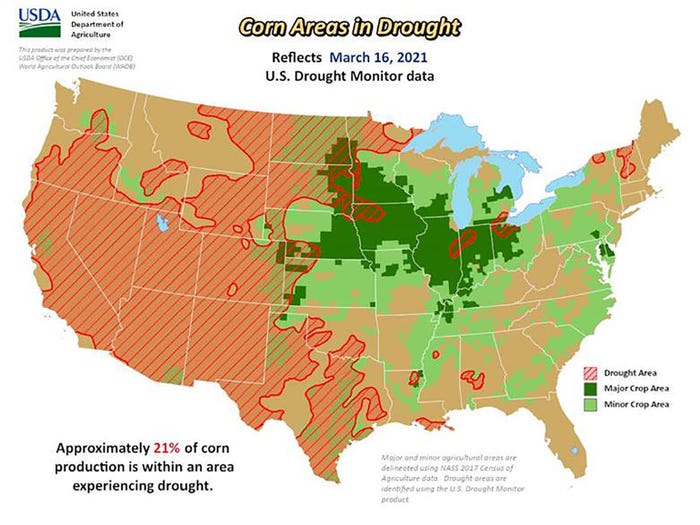

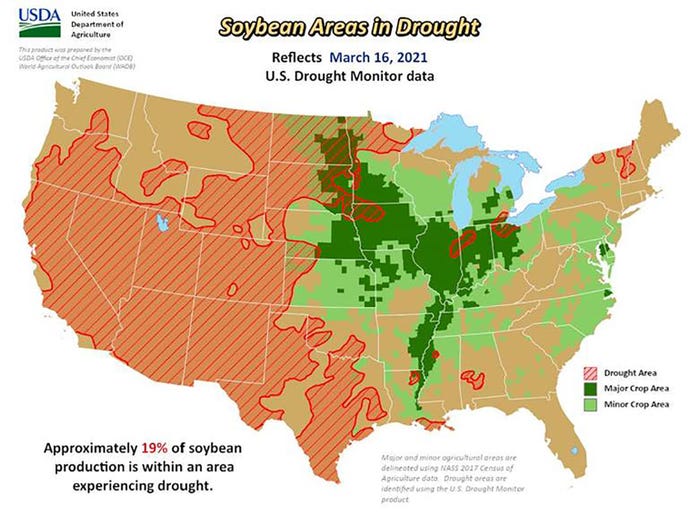

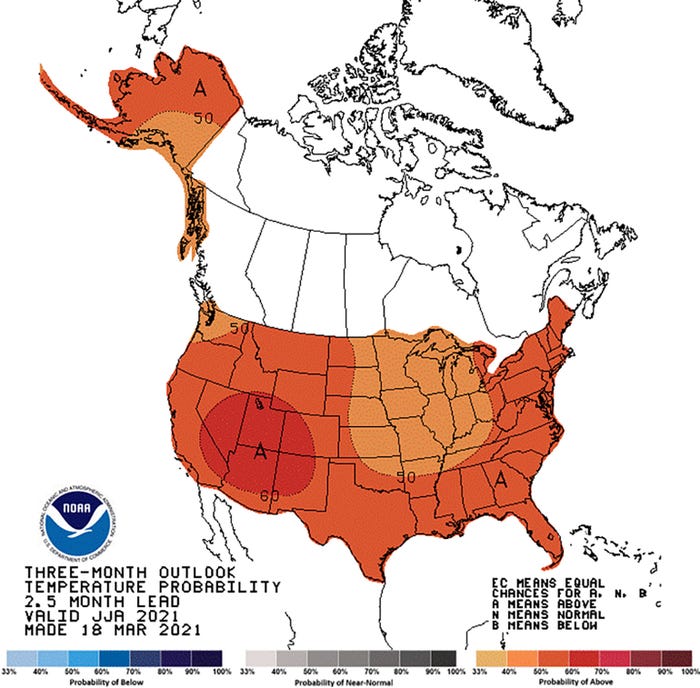

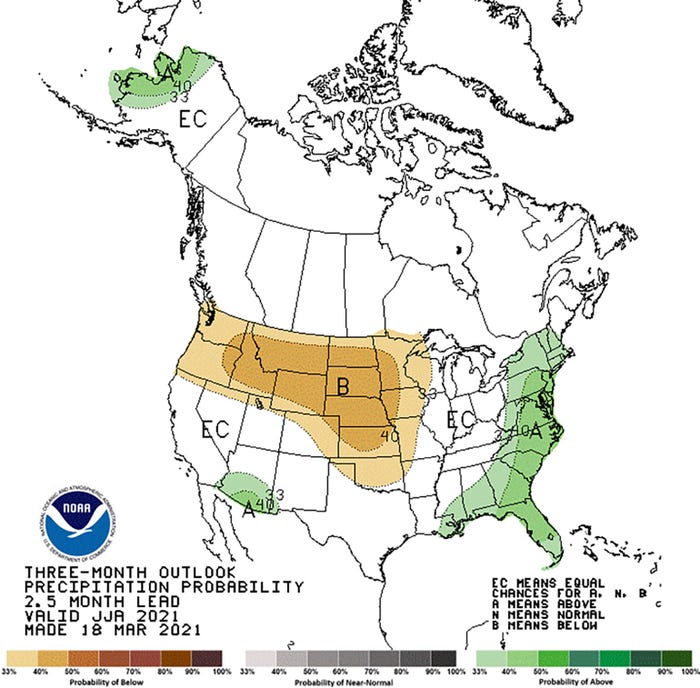

National Weather Service forecasts for spring and summer released last week call for above normal temperatures to persist across the country, with below normal precipitation lingering in parts of the western growing region for corn and soybeans. About one in five acres are already in areas seeing dry conditions. If that’s a recipe for weather rallies during the growing season, producers could get a chance to sell new crop corn futures for $5-plus, with soybeans topping $13.

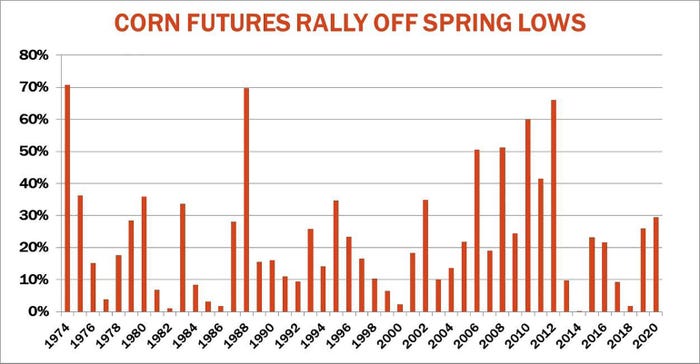

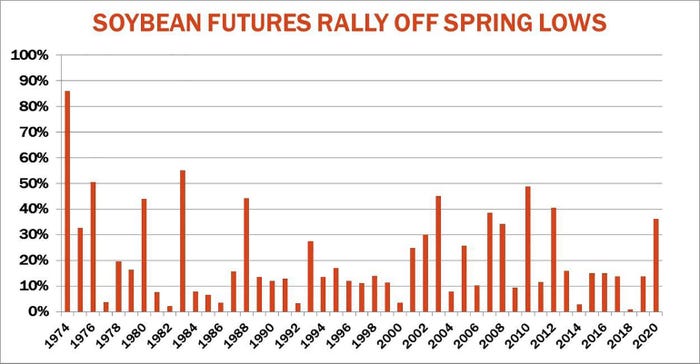

Historical odds going back to 1974 do favor some type of rally off spring lows for both December corn and November soybean futures. These rallies topped 5% for both markets 85% of the time, and bigger gains are not unusual either. Moves more than 13% off spring lows occurred 66% of the time for corn with soybeans registering a 60% chance.

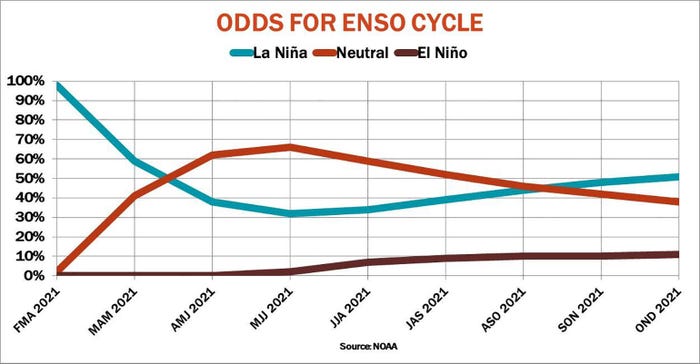

One factor could be the status of the El Nino/Southern Oscillation (ENSO) cycle of water temperatures and atmospheric conditions in the equatorial Pacific that can have a big influence on weather patterns globally, including the U.S. El Nino summers with warming of the Pacific are associated with wetter conditions in the Midwest that tend to boost yields. By contrast, some of the bigger droughts in the U.S. occurred during summers with La Nina -- when equatorial Pacific waters cool.

The current La Nina perhaps contributed to some of the weather extremes seen around the world so far in 2021. However, this month’s forecast from the NWS calls for neutral conditions to develop by summer, with neither El Nino or La Nina. That makes rally potential much more of a dice roll.

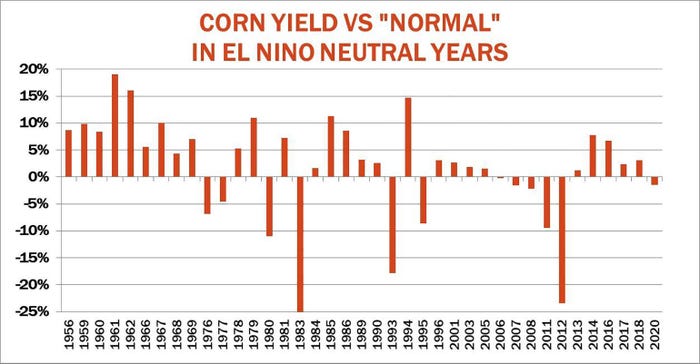

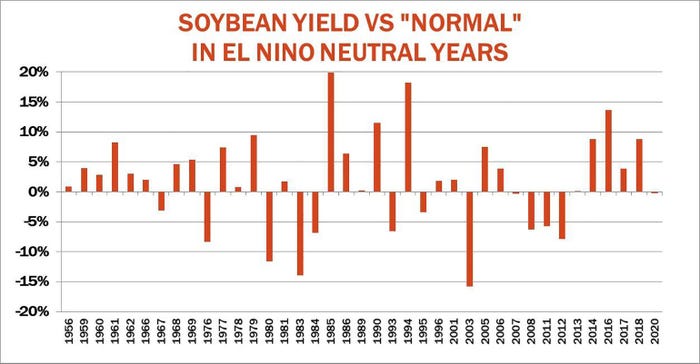

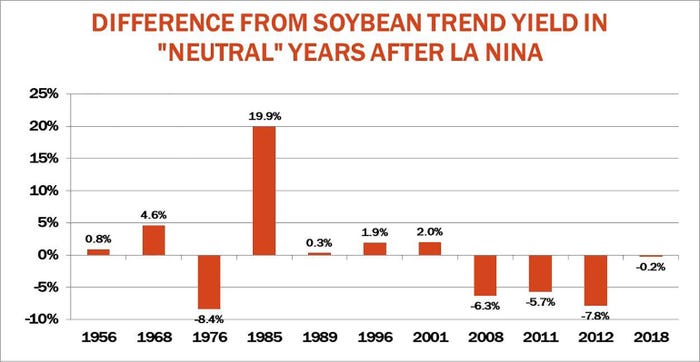

There’s no statistically significant correlation between neutral ENSO summers and soybean yields and only a weak link connecting higher corn yields with these conditions since 1950. When neutral ENSO summers follow a winter La Nina – the pattern forecast for 2021 – soybeans show a slight statistical tendency for higher yields with no connection for corn.

Lessons from the past

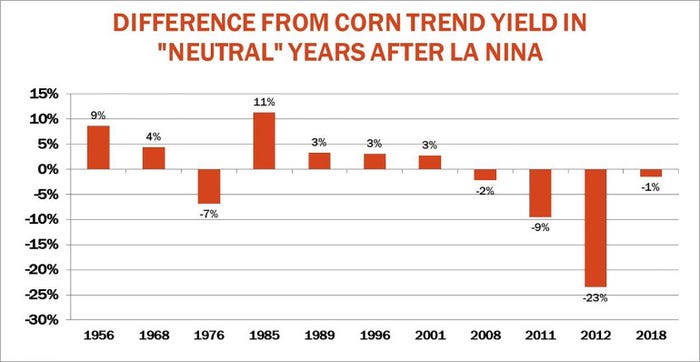

Still, the most recent iteration of a neutral summer after La Nina winter was memorable. Damage to corn yields in 2012 was on par with some of the biggest droughts on record, including 1988 and 1983, and the 1974 frost-plagued crop. But big crops have also occurred during this phase of the cycle, including 1985, when new records were established for both corn and soybeans.

Of course, what benefits farmers most is a year with big yields and a good summer rally to sell. Weather moves can develop even in years when production booms too. Gains off summer lows during years with neutral summer after La Nina winter averaged 24% for corn and 20% for soybeans – nothing to sneeze at.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like