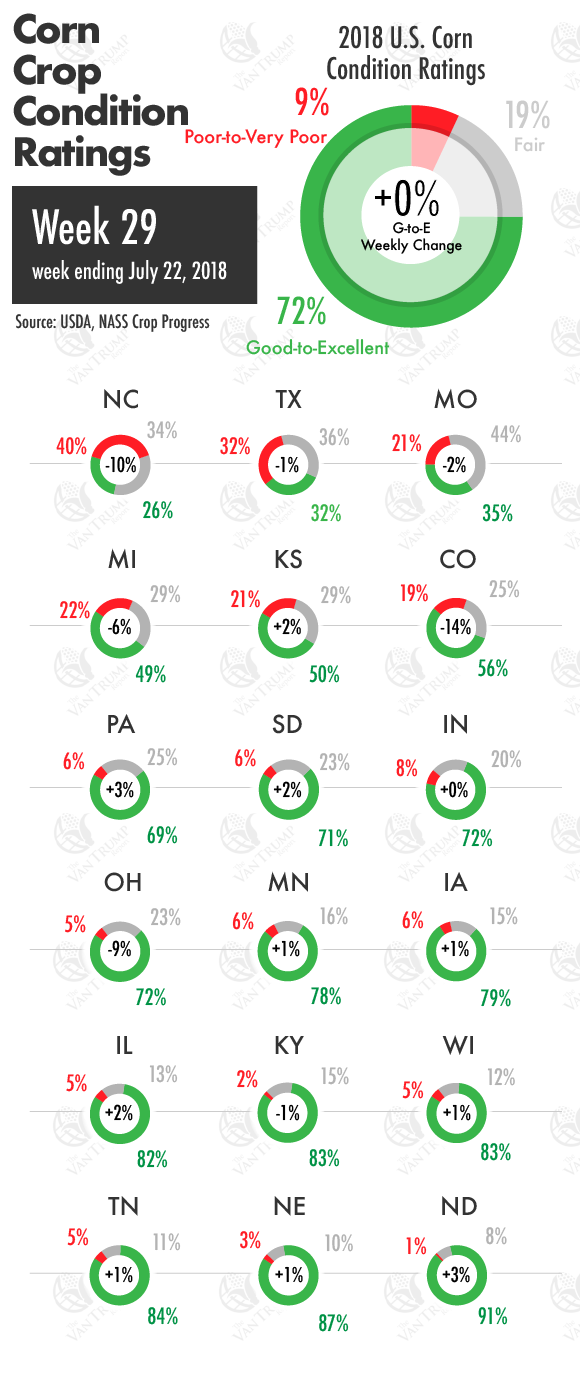

Corn prices are backpedaling a bit this morning as traders debate the USDA's "unchanged" weekly crop-conditions. The bulls were obviously looking for the weekly condition estimates to deteriorate a bit from the previous week.

Bears are pointing to the fact even though the crop conditions were left "unchanged" at 72% rated "Good-to-Excellent", the USDA actually took 1% away form the "Good" category and switched it to the "Excellent" category. There were also net overall improvements in some of the big production states like Iowa, Illinois, Nebraska, Minnesota, the Dakotas, Kansas and Missouri. Despite the slightly improved conditions, Bulls continue to argue that the crop has advanced too quickly.

Bears on the other hand, see that as being a good thing and reason to argue less acres will be negatively impacted by frost or early winter conditions. There is some positive news circulating in regards to perhaps improved trade relations with Mexico and their newly elected President.

From what I understand, Andrés Manuel López Obrador, Mexico’s newly elected President, sent a conciliatory letter to President Trump, saying, he is ready to start a new stage in U.S.-Mexico relations. This has to be considered good news, even though the trade is much more eager to hear an updated response from the Chinese.

Strong demand for U.S. corn continues to remain the driving factor to the upside. I just worry that eventually, "demand" alone will not be enough to carry the market. As a producer, I remain patient but still would like to get another 10% to 20% of our estimated new-crop price risk reduced between now and late-October. Another +10 to +20 cents higher and I will become a lot more serious about considering my next new-crop sale.

My previous new-crop sales target was up near $4.40 vs. the DEC18 contract, based on the current trade uncertainties, I'm probably going to be taking a very hard look if the market can push back to between $3.80 and $3.90 per bushel. I hate to take a -50 to -60 cent hit in comparison to my previous sales target, but the landscape of the market has certainly changed during the past couple of months and I can't allow myself to get stubborn and or stuck using my previous thoughts in the new market.

With what looks like it could be another new record yield here in the U.S. and deeper global trade uncertainties, I don't really feel comfortable taking longer-term risk on much more than 40% of my estimated new-crop production. I've already reduced the price risk on 50% of my production at fairly good levels, hence the reason I can afford to feather in a few smaller and weaker sale in the $3.80 to $3.90 range.

I just feel like during the next few months the corn market could trade anywhere between $3.20 and $4.00 per bushel, based primarily on political headlines that I have no ability to forecast and or control. I just don't want my hand forced to price bushels at the lower end of the range should a negative trade headline appear as my "time" or marketing window starts to expire.

About the Author(s)

You May Also Like