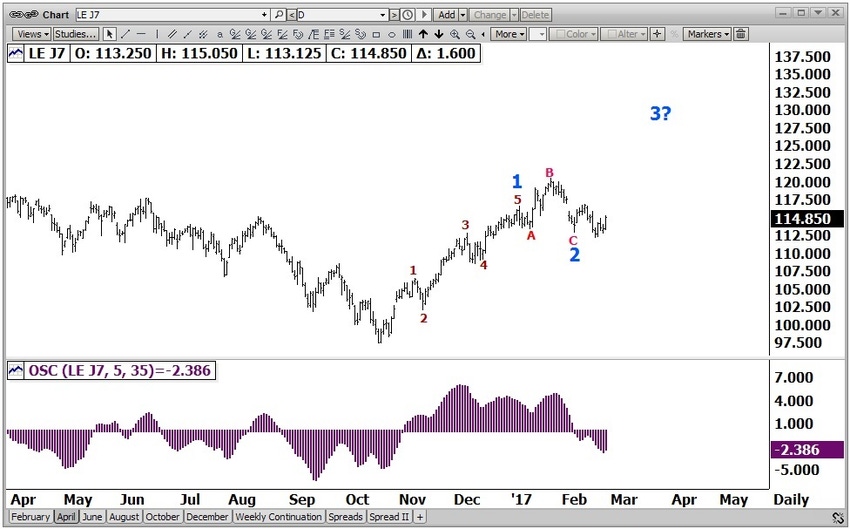

Not much new today. The wave 2 is currently labeled as a 5-wave declining wedge pattern for the fats.

It's more of an irregular/regular 3 wave zig-zag in the feeder cattle.

In my opinion only, the more skeptical traders are, using supply as their bat, the more I anticipate futures to move toward cash. The market looks ripe for a short covering rally.

If fats move above $115.00 April, it will begin to lead me to anticipate a challenge of the current wave 1 high. Technical indicators are turning up this morning. I am unsure what price or event will take place before funds begin to seed the market again, but above $115.00 April may prove an attractive technical picture.

Clearly my comments on August feeder cattle moving to $150.00 has produced fodder for many coffee table discussions or laughs. No, I've not been smoking anything, yet, and no, I've not lost my ever lovin' mind either, yet.

The unexpected can produce significant price moves and currently there is nothing expected in the feeders to move them higher. As stated earlier in the move for fats, I was noticing subtle changes in the fats. Those changes became more noticeable to the mass and hence produced the rally.

I am beginning to see some subtle changes in the feeder cattle market, and cattle market in general, that may begin to soften the stance of the bearish supply all are fixated on. An article I sent out this morning suggested a larger percentage of restaurant owners were anticipating an increase in growth. Since beef is still the main menu item, this would be anticipated to not be negative.

There are other factors I am hearing but cannot confirm at this time. Like the fats, there is a brief seasonal tendency for feeders to move higher into March. The tendency then moves lower by mid-March, the seasonal tendency reversing higher for months to come.

Recall the slight variations in chart patterns between fats and feeders. From the February low, the fats exceeded this low while the feeders did not. This makes the wave 2 of feeders look much more like a simple zig-zag correction than the more complex movement of the fats.

I perceive producers are in a very unfriendly position with lenders applying hedge pressure at a time it is perceived the subtle changes will be enough to keep prices from setting new contract lows anytime soon. While lenders may not provide funds without price protection, know that there are multiple ways to skin a rabbit that may suffice for the lender while still allowing you to potentially benefit from upside potential.

An investment in futures contracts is speculative, involves a high degree of risk and is suitable only for persons who can assume the risk of loss in excess of their margin deposits. You should carefully consider whether futures trading is appropriate for you in light of your investment experience, trading objectives, financial resources and other relevant circumstances. Past performance is not necessarily indicative of future results.

About the Author(s)

You May Also Like