Big fund managers are risk-takers but they don’t go whole hog on all markets, all the time. These players added longs to some bullish bets but cut back holdings in others.

Here’s what funds were up to through Tuesday, April 17, when the CFTC collected data for its latest Commitment of Traders put out on Friday.

Helping hand

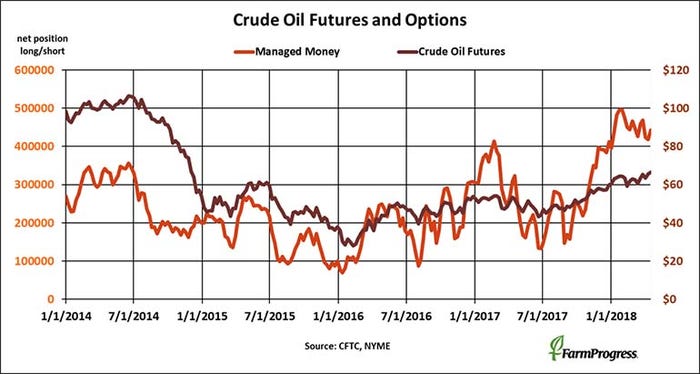

Crude oil futures hit their highest price in more than three years this week, getting an assist from money managers, who added nearly $1.65 billion to their net long position. But overall their holdings are trending lower, even futures move higher.

![]()

Still cautious

Big speculators trimmed bullish bets on agriculture this week, cutting 52,084 contracts from their overall bullish bet on crops on livestock. Hedges funds were mixed on grains, while adding hogs and cotton and cutting beef. Investors seeking to own commodities through index funds were light buyers.

Cutting back

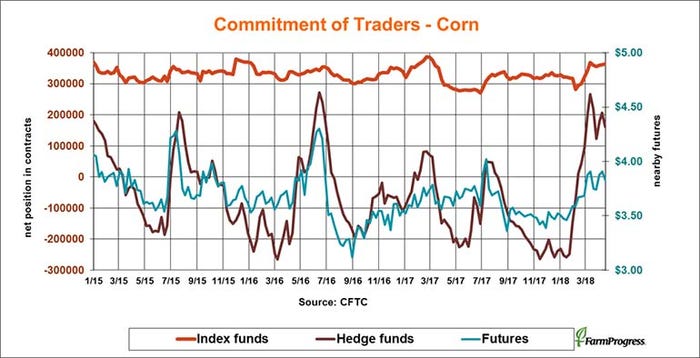

Corn prices retreated as big speculators trimmed 45,014 contracts off their bullish bet this week, but they’re still long a net 161,932 contracts.

Ginned up

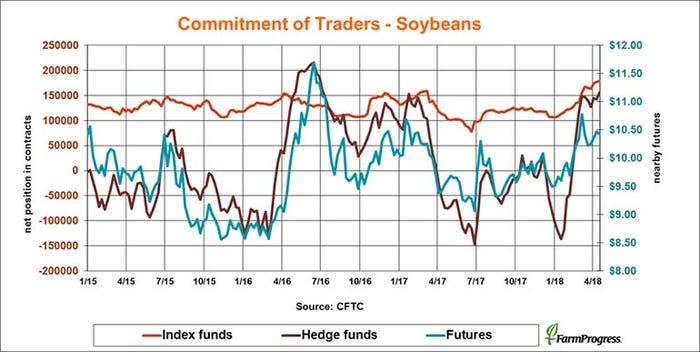

Big speculators bought a net 14,212 contracts of soybeans this week, even though prices were headed lower. These hedge funds built their bullish bet to its biggest level since Independence Day 2016. Index traders haven’t been this long in more than seven years.

Still selling

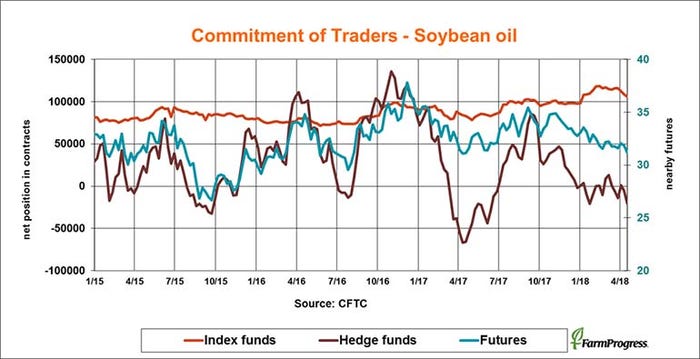

Big speculators sold soybean oil again last week, adding 14,281 contracts to their modest net short position. Oil remains the week link of the soy complex.

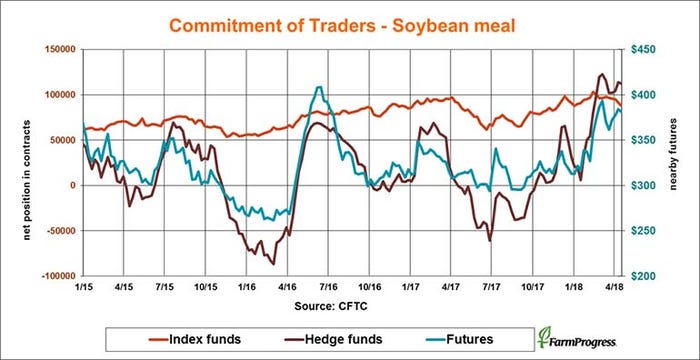

Trimmed sales

Big speculators have been bullish on soybean meal throughout 2018, driving a rally on the drought in Argentina. But hedge fund managers took a little profit this week, selling a net 1,378 contracts.

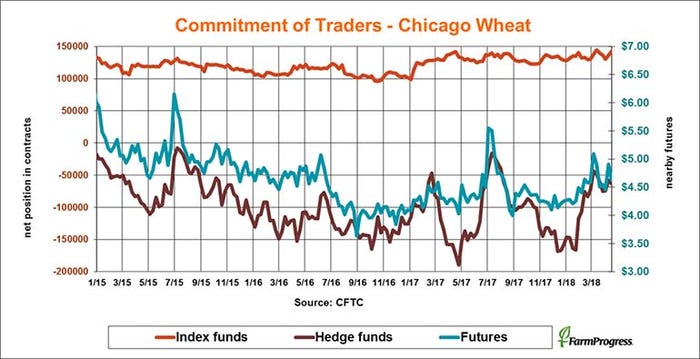

Back to basics

Big speculators have been short soft red winter wheat for nearly four years, and they sold again this week, adding 5,063 contracts to their net short position. Index traders were buying again, increasing their holdings by another 6,005 contracts.

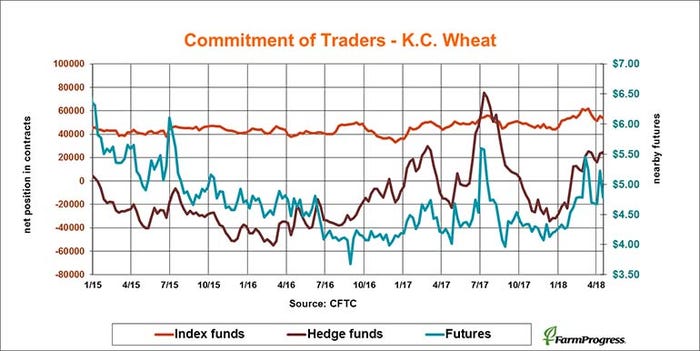

Last call?

Big speculators bought a little hard red winter wheat this week, adding 1,250 contracts to their net long position even as prices cratered on forecasts for wetter weather on the southern Plains.

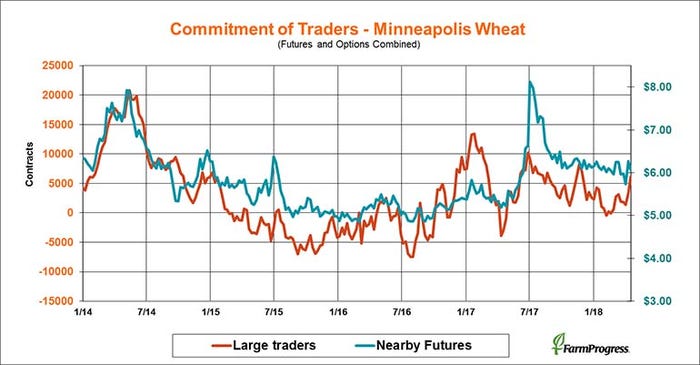

Big guns

Large traders bought Minneapolis wheat this week, adding nearly 80% to their small net long position. Turns out they were long and wrong as prices fell.

About the Author(s)

You May Also Like