Grain futures traded mixed after release of USDA’s latest World Agricultural Supply and Demand Estimates (WASDE) report, which showed higher than expected corn production offset by lower soybean output and carryout.

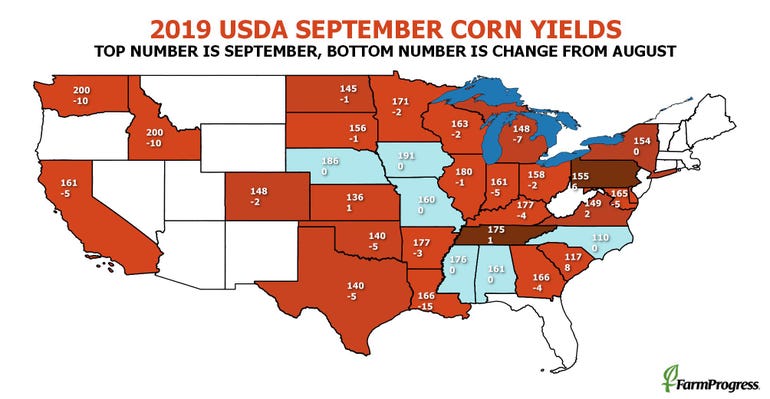

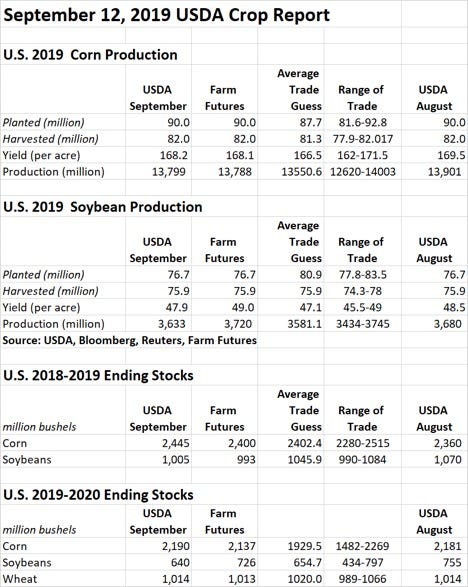

USDA left corn planted and harvested acres unchanged from its August assessment, at 90 million and 82 million acres, respectively. Analysts anticipated a decline to 87.7 million planted acres and 81.3 million harvested acres, in contrast – although Farm Futures correctly deducted the agency would hold those estimates steady.

USDA did cut per-acre yield estimates, however, from 169.5 bushels per acre in August down to 168.1 bpa. That had the agency also downgrading its total production estimates, from 13.901 billion bushels a month ago down to 13.799 billion bushels.

“USDA’s numbers for corn production were in line with my estimates made this week after a few signs of lower yields began emerging in crop ratings and the Vegetation Health Index,” according to Farm Futures senior grain market analyst Bryce Knorr. “As I anticipated, the agency made no changes to its acreage estimates – it’s too early for that, though harvested acres could eventually be down significantly. Old crop carryout was raised more than anticipated with weaker exports and usage for ethanol, which caused new crop carryout to be up slightly.”

Corn ending stocks for 2018/19 ticked more than 100,000 bushels higher, moving from 2.360 billion bushels in August up to 2.445 billion bushels. Estimated corn ending stocks for 2019/20 saw a more modest increase, moving from 2.181 billion bushels a month ago up to 2.190 billion bushels.

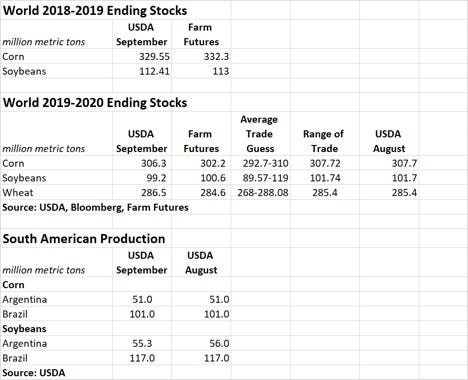

World ending stocks for 2019/20 are on the downward slide, according to USDA. The agency pegged world ending stocks at 12.114 billion bushels in August, moving that tally down to 12.058 billion bushels this month.

The numbers aren’t really bearish for corn, when all is said and done, but growers should remember this is very much a supply market, Knorr says.

“Demand is challenged, and that won’t change unless production overseas fall dramatically in the year ahead,” he says. “Still, production could be another 600 million less than USDA forecast. Trouble is, we won’t know if that’s true until combines start rolling. If USDA does cut production down the road, say in November, growers should be ready to sell rallies to profitable levels rather than gamble the crop will keep getting smaller.”

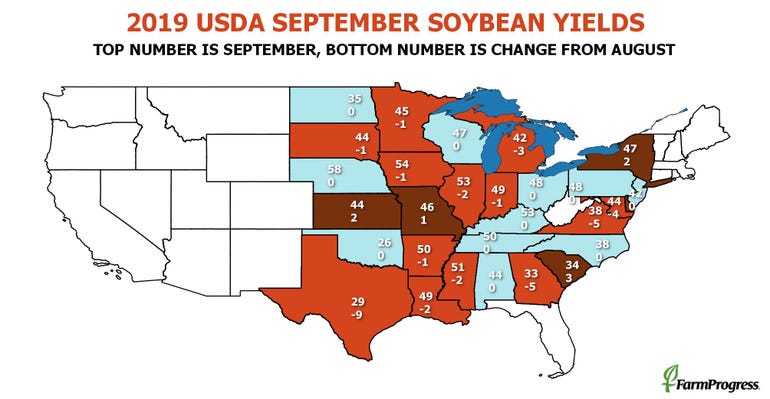

As with corn, USDA held steady its soybean planted and harvested acres, with 76.7 million and 75.9 million, respectively. The agency docked per-acre yield estimates by six-tenths of a bushel, meantime, moving from last month’s projection of 48.5 bpa down to 47.9 bpa. That leaves total production estimates down slightly, from 3.680 billion bushels down to 3.633 billion bushels, versus analyst estimates of 3.581 billion bushels.

Soybean ending stocks are on the decline, according to USDA. The agency’s assessment of 2018/19 ending stocks moved from 1.070 billion bushels a month ago down to 1.005 billion bushels. And 2019/20 ending stocks dropped from 755 million bushels a month ago down to 640 million bushels.

World ending stocks for 2019/20 are also trending lower, moving from 3.737 billion bushels in August down to 3.645 billion bushels this month.

The soybean data should support short-covering by funds, helped by today’s breakout on the November chart, Knorr says.

“Improved old crop demand was in line with my ideas, and final 2018 stocks could get a little smaller after USDA releases its final production estimate for last year at the end of September,” he says. “Lower new crop yields will require additional confirmation, so watch crop ratings and the VHI for clues. South American weather could also come into play if rains don’t return in Brazil this month so growers can begin planting.”

USDA offered some mixed news on wheat domestic and global ending stocks. U.S. stocks held steady, at 1.014 billion bushels, while world ending stocks increased from 10.487 billion bushels in August up to 10.527 billion bushels.

“As I expected, the agency made no change to its domestic wheat balance sheet,” Knorr says. “Exports are off to a decent start, but improvement will take smaller production in Argentina and Australia.”

The agency also includes South American production estimates in its monthly WASDE reports, and these numbers were little changed for September. Argentina’s soybean production estimates dipped slightly, to 2.032 billion bushels, with the country’s corn production estimates steady at 2.008 billion bushels. Brazil’s corn and soybean production estimates were unchanged from August, at 3.976 billion bushels and 4.299 billion bushels, respectively.

Read more about:

Crop ConditionsAbout the Author(s)

You May Also Like