Big speculators weren’t exactly caught leaning the wrong way by Friday’s USDA reports. They were still bearish ahead of the data dump, but they did cover some of those bets before the numbers hit and they started selling again.

Here’s what funds were up to through Tuesday, March 26, when the CFTC collected data for its latest Commitment of Traders.

![]()

Nothing but cover

Big speculators trimmed bearish bets in most ag commodities this week, covering 128,837 contracts of their net short position. But that still left the hedge funds short more than 300,000 contracts.

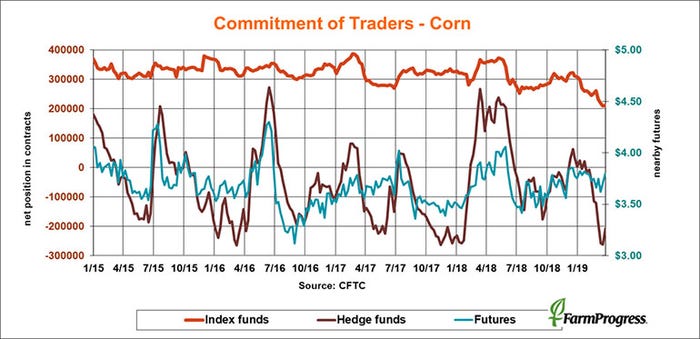

Just a blip

Big speculators bought back 54,874 corn contracts as of Tuesday, but that amounted to little more than a fifth of their bearish bets. They still held a net short position of 207,878 lots, a fairly extreme level of selling.

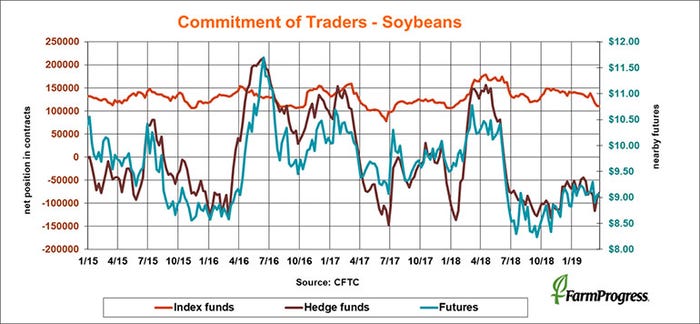

Cautious traders

Big speculators cut down on their net short soybean position for the second straight week, but knocked only 9,755 lots off the bearish bets. Another round of trade talks in Washington next week could make a difference in whether the funds stay bearish.

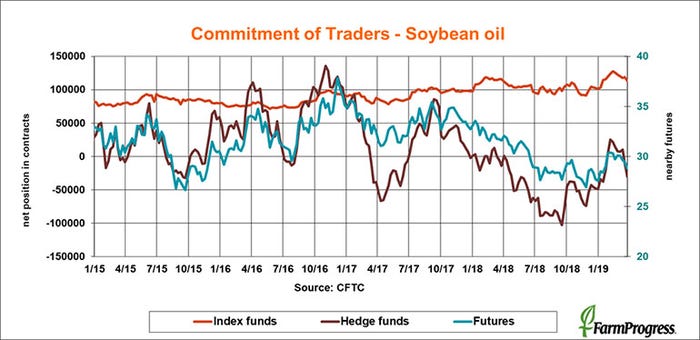

Feeling no love

Soybean oil was one of the few ag contracts hedge funds sold this week, as they turned a small bearish bet into a larger one. They extended their net short position by 20,098 contracts.

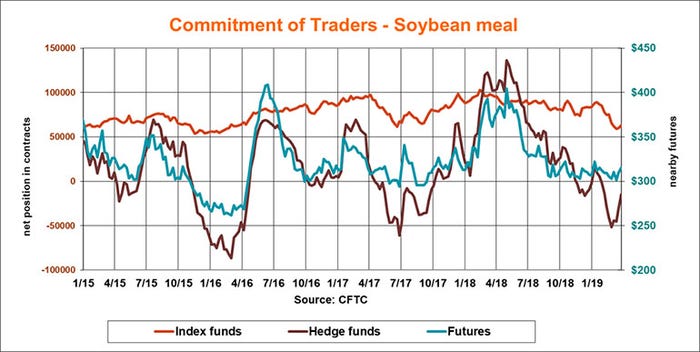

Half empty

Funds are still short soybean meal, but they moved closer to neutral before the USDA report. Big speculators bought back a net 15,257 contracts, cutting the bearish bet by more than half.

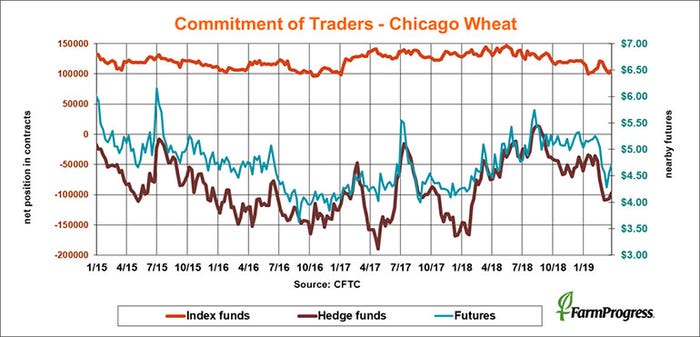

Too little, too late

Big speculators covered a little of their bearish bet in soft red winter wheat for the third straight week, buying back a net 9,828 contracts. But they were still net short 90,027 lots.

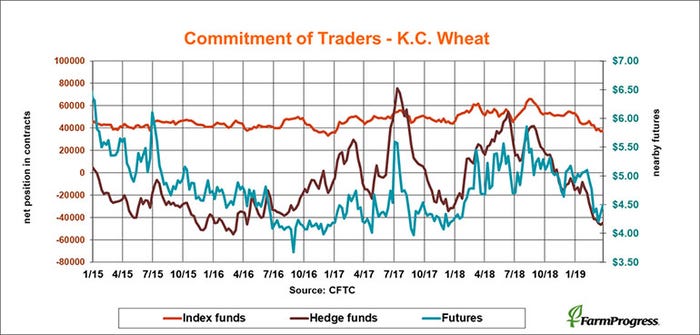

Treading water

Big speculators stopped selling hard red winter wheat this week after pushing their bearish bets to the widest level in more than three years. But the covering was light, just 1,838 net contracts.

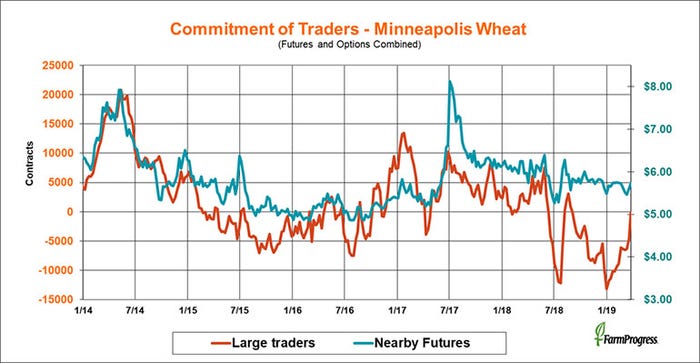

Cause for hope?

USDA forecast lower spring wheat acres than some expected, and large traders appeared to be moving in that direction too. They covered most of their bearish bets as of Tuesday.

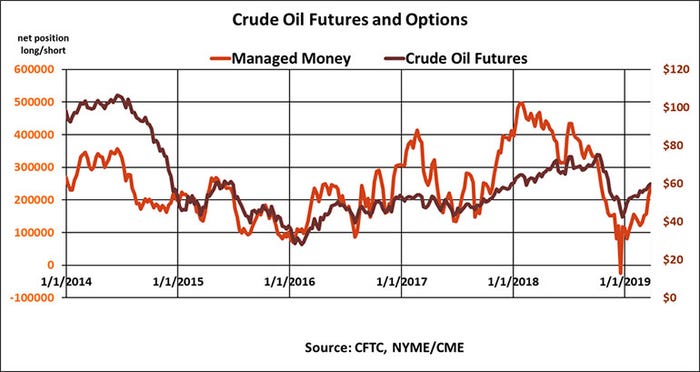

$60 or bust

Money managers bought crude oil for the fifth straight week, adding more than $1.5 billion in futures and options as prices too another run at $60.

About the Author(s)

You May Also Like