After selling relentlessly in July and August, big speculators finally had enough in the wake of the Sept. 12 USDA reports, which triggered at least a little short covering by hedge funds.

Here’s what funds were up to through Tuesday, September 17, when the CFTC collected data for its latest Commitment of Traders released Friday.

![]()

Turnaround time

Big speculators are still short crops and livestock, just not as much as the previous week. In all hedge funds trimmed bearish bets by 49,615 contracts, around 10% of their total.

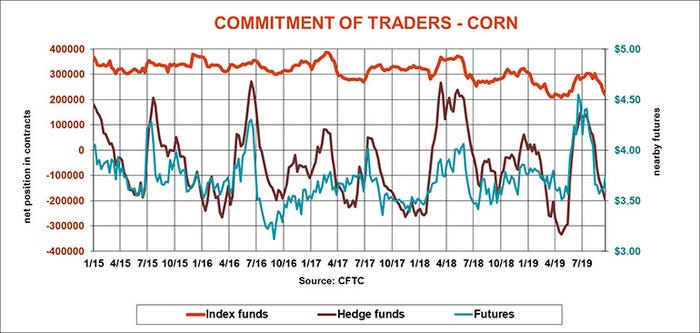

What rally?

Corn prices rebounded this week but big speculators were still selling according to the CFTC data. Hedge funds added 28,693 contracts to their net short position. Investors following commodity indexes also liquidated 14,662 of their net long position.

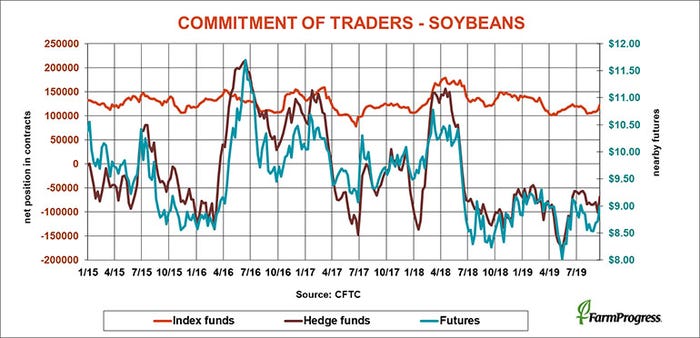

Run for cover

Big speculators went into the Sept. 12 reports short, a mistake they quickly started to correct over the past week. Hedge funds are still short but they cut bearish bets by 32,456, around a third of their stake.

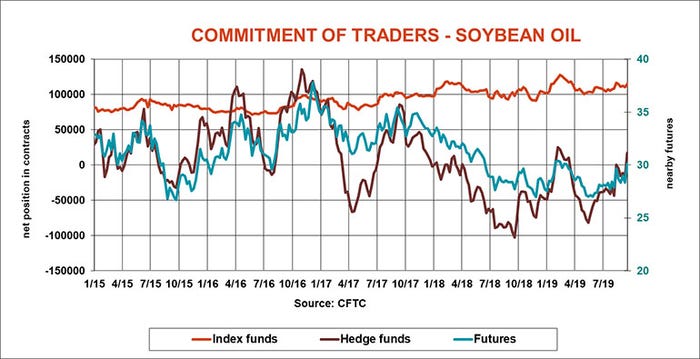

Falling in line

Hedge funds were slow to jump on the vegetable oil market that showed signs of life recently in Asia. Their attitude changed this week as they bought a net 34,2444 contracts to flip to a bullish bet on the product.

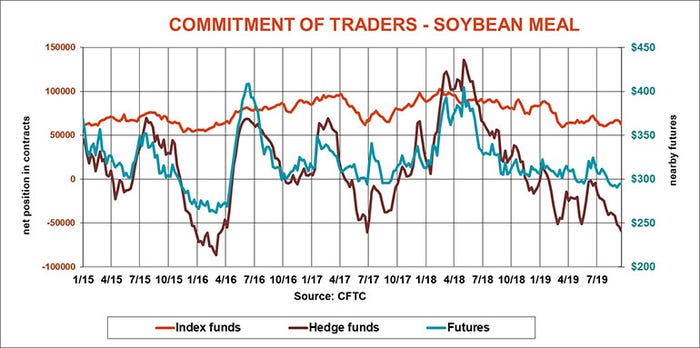

Short straw

Big speculators remain bearish on soybean meal, adding another 4,986 contracts to extend their net short position to its widest level in more than two years.

Pause button

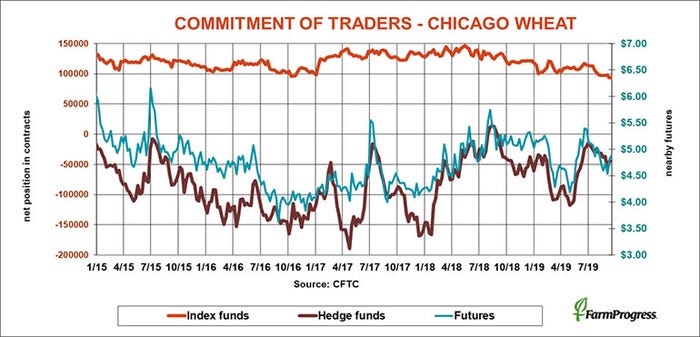

Big speculators bought back a little of their bearish bet in soft red winter wheat, but only a little – just 714 net contracts.

Tithe that binds

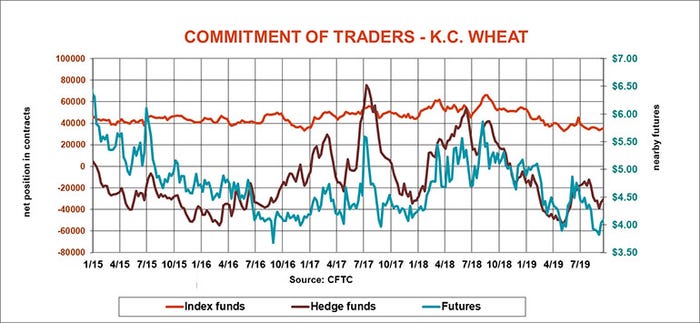

Large speculators covered a tenth of their bearish bet in hard red winter wheat this week, buying a net 3,311 contracts.

Room to move

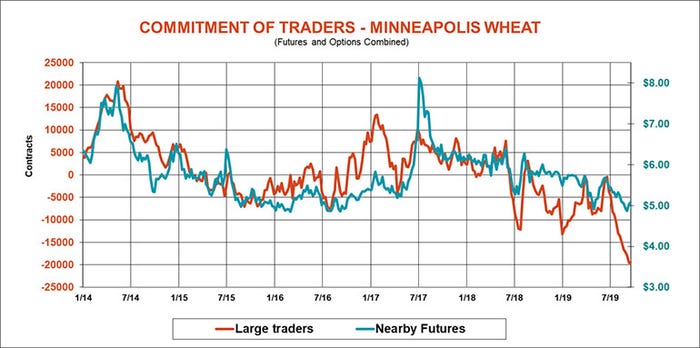

Large traders finally stopped selling in Minneapolis after pressing bearish bets to a series of records. Short-covering was light, just 161contracts.

Right place

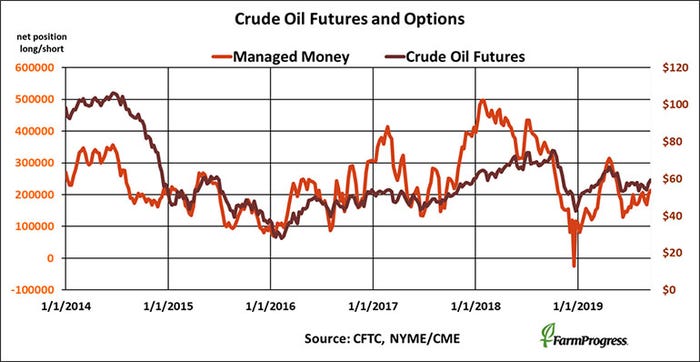

Money managers jumped on the crude oil market again this week as futures rocketed higher. These funds added $726 million in crude oil futures and options to their net long position.

About the Author(s)

You May Also Like