Corn prices are again pushing higher this morning. There's some rumors circulating that the Argentine Finance Minister, Nicolás Dujovne is going to President Mauricio Macri this afternoon with a plan to not only postpone reducing the soybean export duties but also initiating a 10% export tariff on both corn and wheat, as a way to help battle rising fiscal deficit.

Bulls are starting to talk more about dryness developing in some areas here in the U.S. There has also been more talk that the Chinese might become bigger buyers of U.S. corn once trade negotiations are completed. I'm not holding my breath but I suspect there could certainly be an outside possibility.

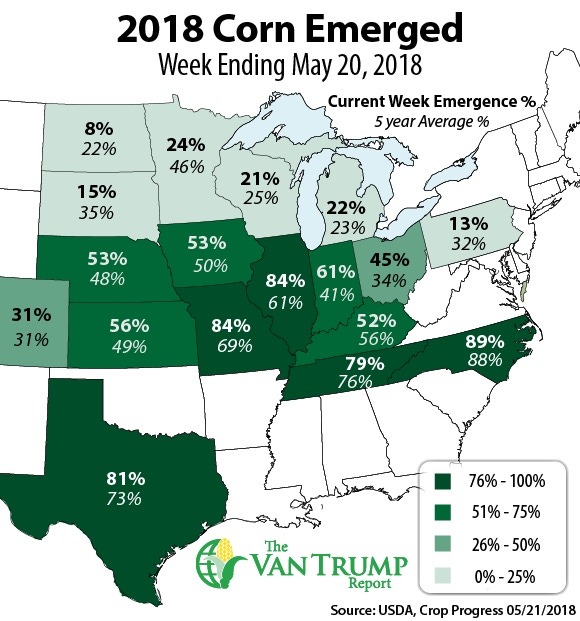

Bulls are also pointing to perhaps fewer U.S. corn acres being planted as some producers up in the Dakotas, Minnesota, Wisconsin and Michigan continue to run into weather-related delays. I think this is a legit argument and personally believe U.S. corn acres are going to be trimmed a bit moving forward. It's not just the acres to the North, but I also believe there may have been fewer corn acres planted to the South.

Let's also keep in mind the production setbacks seen in South America this year. As a producer, I've taken advantage of the recent rally by reducing a bit more longer-term price risk. As a spec, I remain a conservative bull, not adding to my current positions, rather holding for a longer-term play.

I've learned in my trading career, there are some markets where you want to add on the momentum and somewhere it's better to add to the breaks or weakness. I believe this particular market could be a bit more long-term oriented and somewhat demand driven, hence I like the thought of adding on weakness.

Longer-term bull markets will most generally give you multiple opportunities to jump on board the bandwagon...no need to race to jump on board! Just my opinion...

About the Author(s)

You May Also Like