Moods change quickly in the commodity market. Last week’s Commitment of Traders showed funds buying ag, even though they were already selling by the time the report came out. Today’s tally from the CFTC showed that sell, even as markets started to turn around today.

Here’s what funds were up to through Tuesday, May 15, when the CFTC collected data for its latest Commitment of Traders put out on Friday.

![]()

Trimming risk

Big speculators sold across the board in crops and livestock this week, buying only contracts in markets where they covered short positions as part of spread-type plays. In all these hedge funds trimmed a net 73,679 contracts off their bullish bets, though they’re still net long.

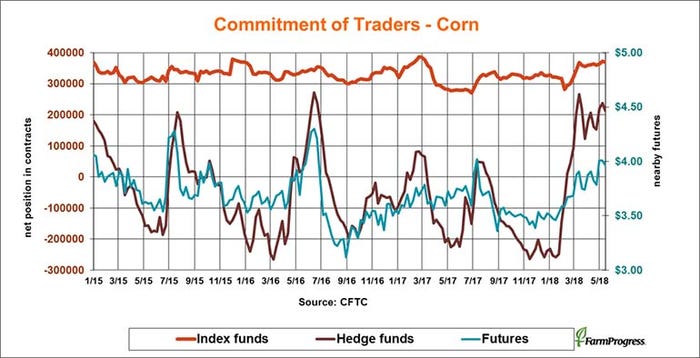

Planting profits

Big speculators took profits on long corn positions this week after USDA said farmers made better than expected planting progress. In all they cut 24,205 contracts off their net long position.

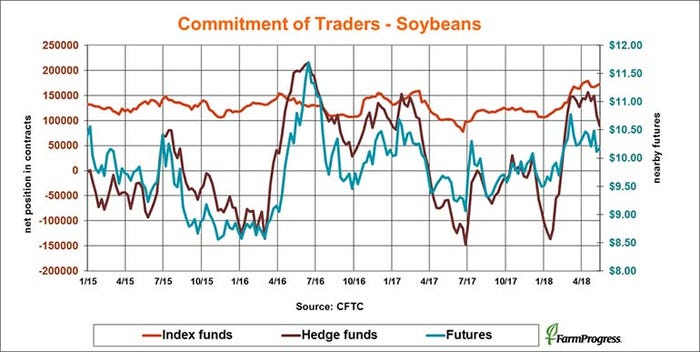

Bailing out

Big speculators sold soybeans for the second straight week, cutting 21,064 contracts off their bullish bets as prices fell. Investors trying to add commodities to their portfolio through index funds were modest buyers however.

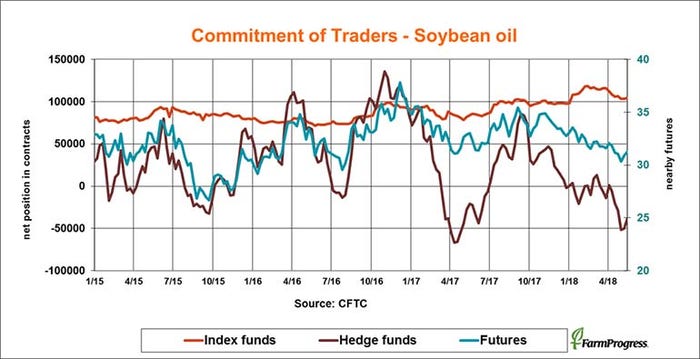

Under cover

Big speculators have been bearish on soybean oil this spring, but they covered a little of that short positon this week, unwinding trades with beans and meal. Funds bought back 11,302 contracts but are still net short 38,802 contracts.

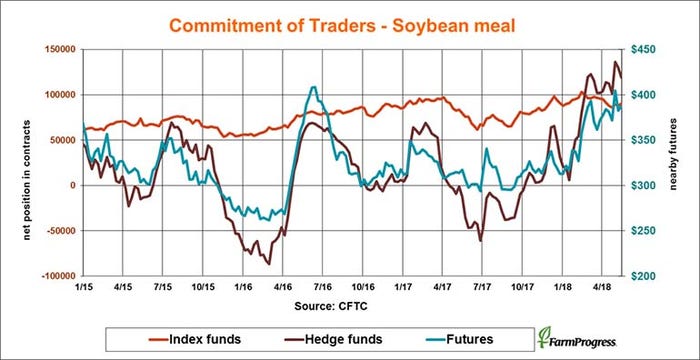

Backing off

After pushing their bullish bets on soybean meal to record levels this spring, big speculators took profits again this week, liquidating another 10,538 contracts. They’re still net long 119,206 contracts after 10 months of buying.

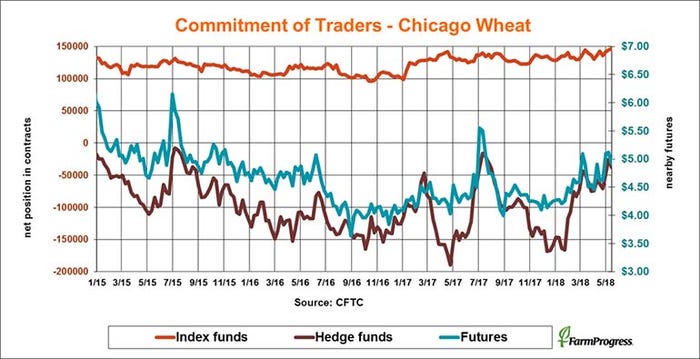

Fake out

Big speculators are long-term sellers of soft red winter wheat. But after covering much of that bearish bet this spring, they started selling again this week after USDA again reported improving crop conditions. The downtrend ended abruptly later in the week when vegetation health index maps showed the crop was still deteriorating.

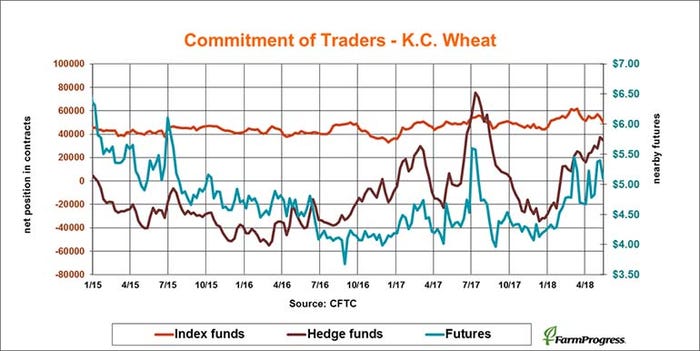

Wheat whiplash

Big speculators pushed their bullish bet on hard red winter wheat to the largest level in nine months in the previous CFTC report. This week they took a little profit early in the week, only to resume buying on Friday when prices surged.

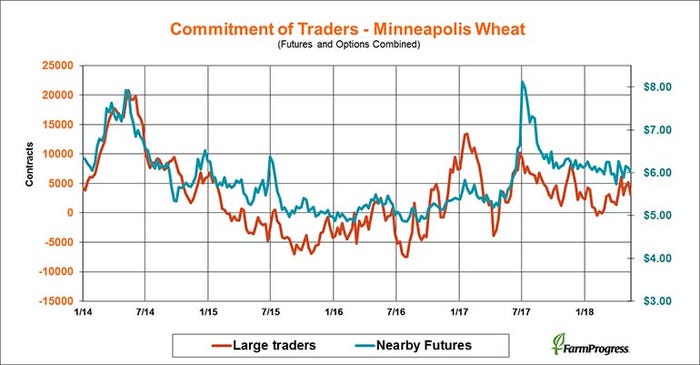

Baby bulls are back

Minneapolis rallied the wheat complex last year as drought baked the northern Plains. Though large traders sold a little spring wheat this week, they started buying again later in the week as concerns about dry weather turned charts positive.

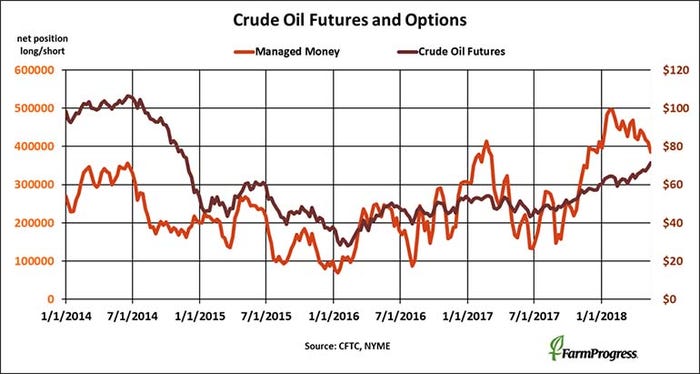

Bank shot

Crude oil futures made new highs this week on tightening supplies and concerns about Iran’s ability to export under revived sanctions. But money managers continued to book profits on their trades, liquidating a net $1.8 billion in futures and options.

About the Author(s)

You May Also Like