Remember, less than two weeks ago bulls took a high fastball directly to the dome. I'm not really seeing anything fresh or new this morning. Most inside the trade will continue to debate forward looking weather and how it will ultimately impact pollination and yield. I still don't think the market is fully understanding the difficulties and complications associated with planting and the overly wet conditions. I just feel like the early weather was such an anomaly and "tech equalizer" that it could create a much more dire and widespread ripple effect than the trade is currently recognizing. Bottom-line, I'm staying bullish and hoping the USDA tosses us a change-up over the middle of the plate in tomorrow’s report. Yes, I'm talking my position, but I truly believe this market has longer-term upside potential.

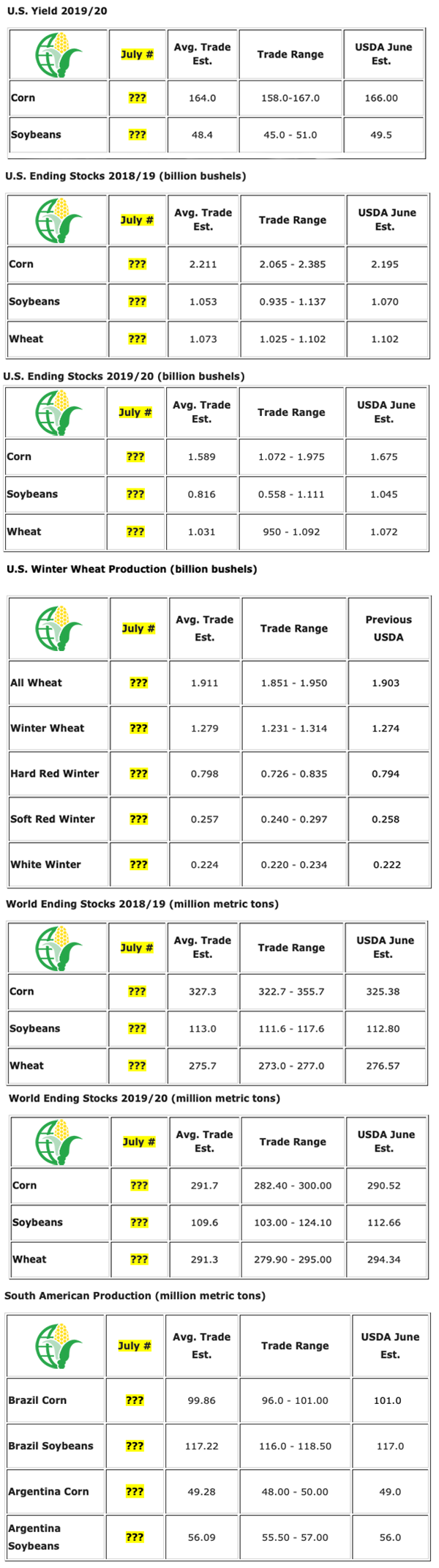

Demand is another wild card that could go in a multitude of directions. The USDA could reduce exports, further reduce corn used for ethanol, yet increase feed and residual. In the end however, I ultimately believe the balance sheet will continue to shrink.

Producers should be paying very close attention to basis in their respective areas. I've been hearing some amazing numbers ranging from 30 to 60 over in several parts of the country. Some ethanol facilities and feed lots are worried there might not be as much corn as the market is currently anticipating and they are willing to bid up for it now to try and get ahead of a shortage that could come later. Make certain you are paying close attention to the basis. I'm also seeing some strong jumps in the old-crop basis.

As a spec, I remain bullish! I'm thinking we could see a bullish USDA report tomorrow but am worried we could see some price pressure and headwind the next few weeks if weather improves. Ultimately, I'm still thinking we could see higher-highs, I'm just uncertain about how we get there.

Click here to receive my daily commentary!

About the Author(s)

You May Also Like