There seem to be few hints about what's in the trade deal President Donald Trump has proposed with China, but new data suggests China could really increase their consumption of meats, in part because their swine production has been hit so hard by Asian Swine Flu (ASF).

An October 10 report from USDA's Foreign Agricultural Service shows promising imports of beef, pork and chicken by China, as well as several other countries. It also shows nice export growth of all three meats by the US last year, this year and in 2020.

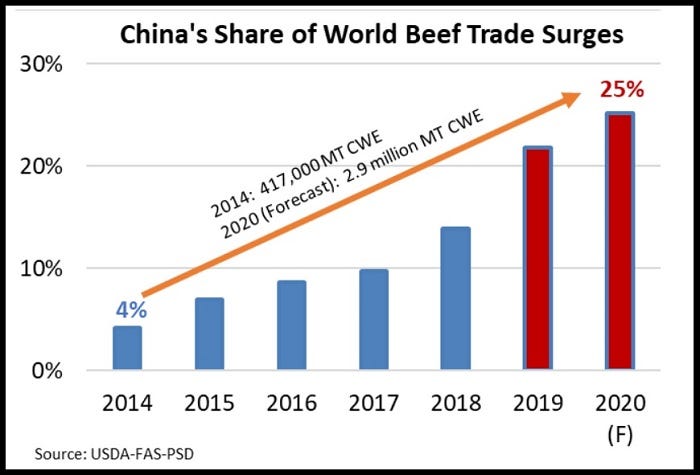

The report says China imported 1.47 million metric tons of beef in 2018, 2.4 million metric tons in 2019, and may import 2.9 million metric tons of beef in 2020.

It adds that China imported 1.56 million metric tons of pork in 2018, 2.6 million metric tons in 2019, and may import 3.5 million metric tons in 2020.

In poultry, China imported 342,000 metric tons in 2018, 625,000 metric tons in 2019, and may import 750,000 metric tons in 2020.

The Foreign Agricultural Service's expectations for beef is that global beef production is forecast to grow 1% in 2020 to 61.9 million tons. Gains will come from Brazil, the US and Argentina. These will more than offset production declines in China, Australia and the European Union. Brazil's rising production will be supported largely by exports, especially to China, and by growing domestic demand. Record production in Argentina is spurred by an increasing herd. Exports will be robust as domestic consumption remains stagnant. Australia continues to be negatively impacted by drought in key production areas, resulting in a 10% decline in production. Dry weather conditions in the European Union for more than a year have negatively impacted forage supply, leading to a decline in the cattle herd.

Global exports in 2020 are forecast nearly 4% higher, to a record 11.5 million tons on rising shipments from Brazil, India, the US and Argentina. Australia will be lower and the EU and Uruguay unchanged in exports.

Propelled by robust China demand, Brazil will capture the bulk of global trade expansion with exports at a record 2.6 million tons, says the USDA's FAS. Argentina and Paraguay are also well-positioned to benefit from record China imports. Strong demand from Asia, partnered with constrained exportable supplies from Oceania (the Australian region) will generate new or expanded opportunities in Asia for other exporters such as the US, India and Mexico.

USDA's FAS says US production is forecast up nearly 3% in 2020 to a record 12.6 million tons on higher slaughter numbers and heavier weights. The service also says exports are forecast up 6% to a record 1.5 million tons, using 12% of US production. The US is poised to expand market share in top markets Japan, South Korea and Taiwan at a time when key competitor Australia struggles to maintain its market shares because of reduced exportable supplies and its dominance in filling China demand. US imports will fall 5% to 1.3 million tons.

About the Author(s)

You May Also Like