Somehow, I got it backwards on pricing tools.

Back in September 2019, I started this Advanced Marketing series with a piece titled, “Why I like futures contracts.” Since then, I have written several more articles on pricing grain with futures and options. How is it possible to discuss the nuances of pricing grain with futures and options before discussing the most basic of cash pricing tools?

Well, better late than never and, with 2020 harvest hopefully wrapping up by now, I can’t think of a better time to compare and contrast the most basic of cash pricing tools: making a cash grain sale and holding unpriced grain storage.

Not many producers view a simple sale of grain as a pricing tool at their disposal. However, a cash grain sale features some important benefits. In contrast to a futures sale, where basis is uncertain and brokerage fees are paid, a cash grain sale is made at a known price and no fees are needed to make it happen. In addition, grain sold and delivered means no more storage costs. Since a cash grain sale involves the physical delivery of grain, this is, by definition, a post-harvest pricing tool. The pre-harvest version of a cash sale is called a forward contract, a tool we will discuss next month.

Game over

About the only negative aspect of selling grain is that, in terms of playing the market for more gain, it’s game over. The delivery and sale are final, and so goes your upside price potential. But there is a lot to be said for a simple cash sale of grain. This is, after all, the reason you produce grain. If the price works for your operation, it’s hard to go wrong with a cash sale.

Like a simple cash sale, producers might not think of holding unpriced grain after harvest as a pricing tool. They may have a point. For many producers, on-farm storage after harvest is not a choice, but an operational necessity. Many producers are located far from a market, making harvest delivery difficult.

In addition, many producers have state-of-the-art drying facilities in their on-farm storage facilities. If you have your own drying and storing capabilities, it makes sense to use them. And once grain is placed into on-farm storage, it tends to stay for a while.

Two benefits

Holding unpriced grain features two nice benefits, including no fees and unlimited upside potential. On the other hand, there is a cost to holding grain in storage (interest and shrink) and it exposes you to the risk of lower prices.

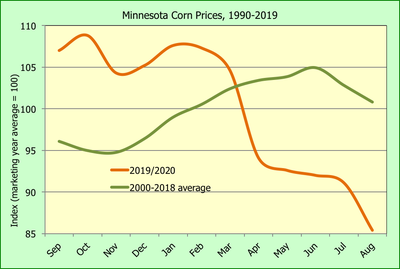

Let’s not downplay the risk of lower prices. For people holding their 2019 crop in storage, the pandemic-induced bear market led to the biggest October-to-May price decline in 30 years (see chart).

Now back to the most basic of cash pricing tools – making a cash sale of grain. As of early October 2020, cash soybean prices were up nearly 20% in the past two months. Soybean prices in the Corn Belt are at levels last seen before the trade war began in June 2018.

Why does that matter? Fancy pricing strategies using futures and options have their place, but I can’t help but think that the best strategy today could be a simple cash sale.

Does a cash sale today mean game over? Hardly. You have a 2021 crop to think about, and that gives you plenty of upside opportunity.

About the Author(s)

You May Also Like