It’s 100 degrees F out and you’re wearing a suit and mask like a hockey goalie, cutting sugarcane with a machete and piling the stalks up at the end of each row. You’re a sugarcane cutter in Brazil, and all the time you’re cutting, you keep on the lookout for venomous tropical snakes.

It’s back-breaking labor to say the least, and that’s why the government is pushing a move toward more machine harvesting over time. But one result of machine harvesting is that yields—Total Recoverable Sugars per hectare—go down. What does that mean for U.S. farmers?

The 2017-18 sugarcane season has just begun, with producers planting cuttings, and market observers saying attractive sugar prices combined with those lower recoverable sugars will mean Brazil may need to buy more of your U.S. corn-based ethanol this year.

After all, you can either make ethanol or sugar from a given load of cane—not both. With international sugar prices looking pretty good and getting stronger, total Brazilian ethanol production is forecast to be down 4.9% this season, at about seven billion gallons, while sugar production ought to hold steady, says the Brazilian government. All this while the total 2017-18 sugarcane harvested area drops 2.3%.

Brazil’s sugarcane complex

The sugarcane complex is Brazilian agriculture’s third-largest foreign exchange moneymaker each year, after the soy complex and meats, with sales last year coming to $11 billion. Out of that, 2016-17 sugar exports were worth $8.7 billion.

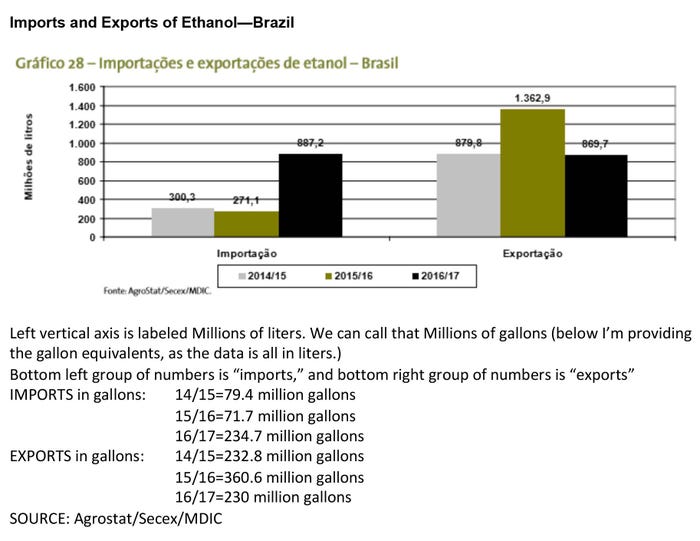

In 2016-17, Brazil imported 887,2 million liters of ethanol, and exported 869,7 million liters. That’s against reported Brazilian ethanol imports of 26.8 million liters in calendar year 2013 and exports of 153.5 million gallons just in the first quarter of calendar year 2017. Most of that came from the U.S., and nearly all of it between Brazilian cane crops, when domestic supplies get tighter.

The size of your market

Given that Brazil has just finished one sugarcane season and is just starting on 2017-18, the country has already snapped up an estimated 194.5 million gallons of ethanol just in the first quarter of this year, at a cost of nearly $150 million. Last year’s Brazilian first quarter ethanol imports, meanwhile, came to just $63 million, says Globo Rural, a Brazilian agricultural publication.

So with declining acres and more demand for sugar rather than ethanol, and lower Total Recoverable Sugars slated for the coming months, 2017 may turn out to be a good year for your ethanol exports to Brazil—at least until those folks in the hockey gear and machetes get back out into the fields.

The opinions of the author are not necessarily those of Farm Futures or Penton Agriculture.

About the Author(s)

You May Also Like