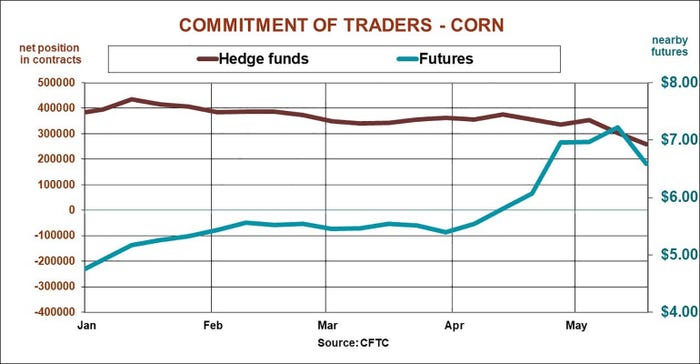

Big speculators weren’t the only force driving corn futures a dollar or more off their highs in May. But these so-called hedge funds certainly helped accelerate the downturn over the last two weeks, trimming bullish bets by more than 95,000 contracts worth some 475 million bushels.

Still, these professional gamblers may not be the real force behind corn’s ups and downs in 2021. Their net long positions actually peaked way back in January, just after nearby futures topped $5 for the first time since 2014.

Instead, activity by commercial traders may offer a better overview of both today’s market and prospects for the rest of the year and beyond.

Though it’s impossible to know precisely what this category of buyers and sellers are up to, data put out in weekly Commitment of Traders offers some important clues about not only end users, but how farmers reacted to the historic rally.

The CFTC reports detail both long and short positions of commercial traders, which include merchandisers like big grain companies, exporters and processors. Activity by farmers doesn’t show up directly, but can be imputed by what these large businesses are doing.

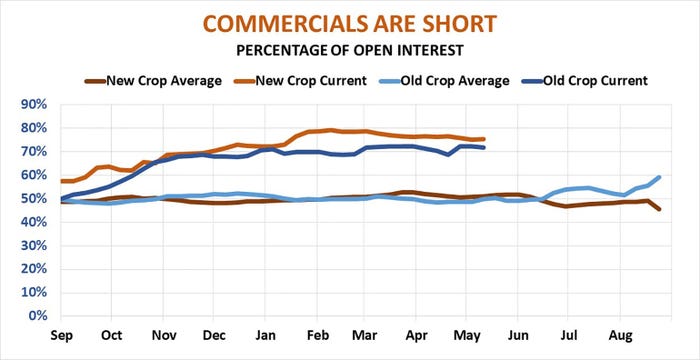

When farmers sell grain to an elevator, the merchandiser typically hedges the inventory until sale to an end user. One reason for the extremely strong basis this year can be found in the short futures positions of commercials. Typically, commercial shorts account for half of old crop open interest in in the third week of May. This year shorts represent 73% of the total, a record, reflecting active selling by farmers. That corn is in ”strong hands” now, owned by commercials who must force end users to pay a basis premium in order to make a profit.

Farmers are selling more than old crop in the bin, too. Commercials are short 2.84 billion bushels of 2021 and later crop corn, also a record for the third week of May that accounts for more than 75% of that category’s open interest. Those sales accelerated after the surprise end-of-March USDA reports on acreage and stocks sent December futures on a rally of nearly $2 a bushel.

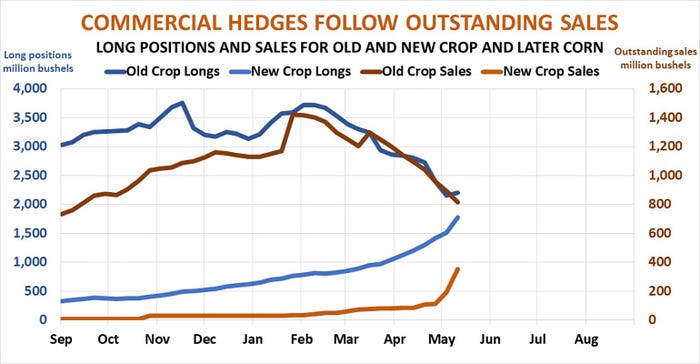

Commercial firms don’t hold only short positions. Buying corn and selling ethanol futures helps biofuel firms lock in profits, avoiding the red ink that until recently beset the industry even before the pandemic. But much of the recent activity likely resulted from the record pace of export sales, thanks to the presence of China as a major customer, which took advantage of the downturn to add to its purchases.

There’s a strong correlation between outstanding export sales and the commercials’ long positions, especially when looked at seasonally. Foreign buyers booking sales in advance may be buying corn the merchandiser doesn’t own physically, but instead hedges with a purchase on the board before the actual bushels shipped are obtained.

Just as with the short side of the ledger, new crop long positions are also on fire. Commercials own 1.87 billion bushels of new crop and later corn futures, including 356 million bushels purchased over the past two weeks when outstanding new crop corn export sales jumped by 242 million. These totals should increase sharply again in this week’s data, after China booked another 44 million bushels.

Record hedging by commercials is a sign of the times in today’s market, one suggesting farmers should look for strong basis on new crop forward cash sales if they don’t plan to use futures or hedge-to-arrive contracts. Watching activity by these grain companies can also provide clues about how much corn end users are really buying.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like