Soybean bulls are pointing to continued strong demand and U.S. crop conditions starting to pull back a bit. The market had a tough time holding the overnight gains so it will be interesting to see how we close today.

June's monthly NOPA crush data released yesterday showed another round of records for the U.S. soybean crush. The June data showed just over 159.2 million bushels were crushed, which stomped all over the previous June record of just over 145 million bushels. Bears point to the fact the number was slightly below trade expectations and also below May's record crush of just over 163.5 million.

Weekly soybean export inspections were also within the range of most guesses but down slightly form the previous week. Keep in mind, "demand" has to remain extremely strong in order to battle the wave of excess supply that is now forecast to be upon our doorstep very soon.

With another round of near record planted acres here in the U.S. it has forced the USDA to recently bump its production forecast higher by +30 million bushels to 4.31 billion. When carryover stocks are also included, total U.S. soybean supply expands to at an all-time high of 4.8 billion bushels. Throw in the uncertainties surrounding Chinese tariffs and total soybean imports and we have U.S. season-ending stocks now forecast up +195 million bushels to an all-time high 580 million. Also worth noting, the USDA’s Grain Stocks report last month indicated that June 1 soybean stocks totaled 1.22 billion bushels.

This season’s third-quarter inventory was reported as the largest ever and exceeds the year-ago level by +26%. The two debates now circulating inside the trade, are the next steps in U.S. and Chinese trade relations and the average U.S. yield. Trying to forecast and predict the geopolitical headlines has been next to impossible. We've heard some talk and rumors that the Chinese might be wanting to come to the negotiating table sooner rather than later, but we have no certainty or confirmation of that.

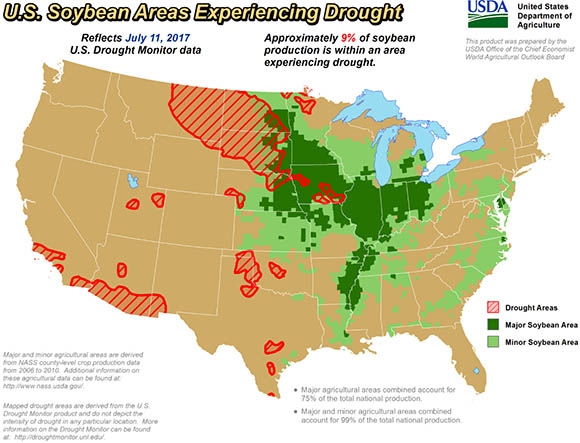

I suspect the biggest question is how long will the conflict drag itself out? Keep in mind, last year only 9% of U.S. exports to China were shipped during the April-August period. So what happens from September forward is the big concern. As for the U.S. yield, bears argue the current USDA forecast of 48.5 bushels per acre is too conservative and the estimate should be closer to 50 bushels per acre.

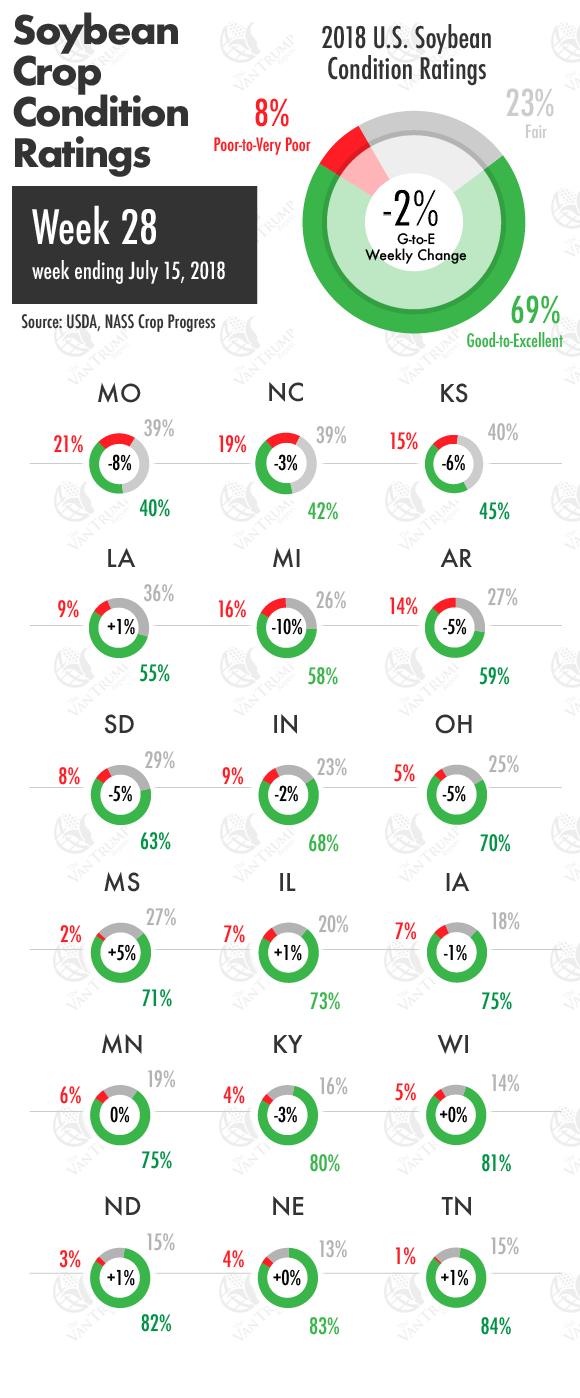

Bulls argue that growing conditions have been more difficult than the trade has been giving credit and that there is still a ton of weather risk left on the calendar. Bulls feel like the bears have stripped all "weather risk" out of the market way too early and may need to start adding some premium back in. The USDA might have just helped confirm that thought by lowering crop-conditions from 71% rated "Good-to-Excellent" down to 69% rated "Good-to-Excellent". States showing the biggest declines were: Michigan down -10%; Missouri down -8%; Kansas down -6%; Arkansas, Ohio and South Dakota -5%.

About the Author(s)

You May Also Like