While investors flocked to bonds for safety amid COVID-19 fears in recent weeks, farmers are resorting to their own version of a safe-haven asset: planting more corn acres.

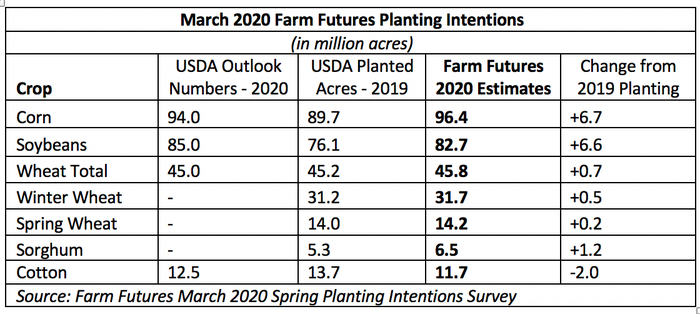

According to Farm Futures’ latest survey, U.S. farmers intend to plant 96.4 million acres of corn during the 2020 planting season as a record number of 2019 prevented plant acres come back into 2020 production. Acreage projections for the 2020 season are the second highest planting on record after 97.3 million corn acres were planted in 2012. The USDA releases its Annual Planting Intentions survey next Tuesday, March 31.

Our result is over 2 million more corn acres compared to USDA’s forecast of 94 million acres, released February at USDA’s Annual Outlook Forum. In the time between the two forecasts, the COVID-19 pandemic upended the global economy. Increased economic uncertainty, historically cheap input prices, and weakened soybean demand from China appears to have made corn the most optimal production choice amid limited options for Midwest farmers.

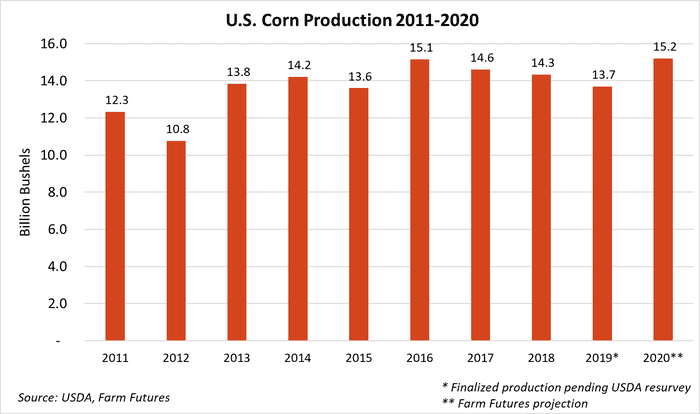

Survey respondents expect U.S. corn plantings to increase 6.7 million acres from last year’s planted acreage. Using a five-year average yield from 2014-2018, 2020 production could top out at a record-high 15.2 billion bushels, inflating domestic supplies following a lackluster year of exports.

Soybeans up as well

Farmers responding to the March 2020 Farm Futures survey also expect to plant 82.7 million acres of soybeans in 2020, up nearly 6.6 million acres from 2019 plantings. Survey results were 2.3 million acres shy of USDA’s February Outlook projection as farmers exhibited strong preferences for corn acreage in lieu of soybeans. But that could easily shift in the next couple weeks, depending mainly on weather factors.

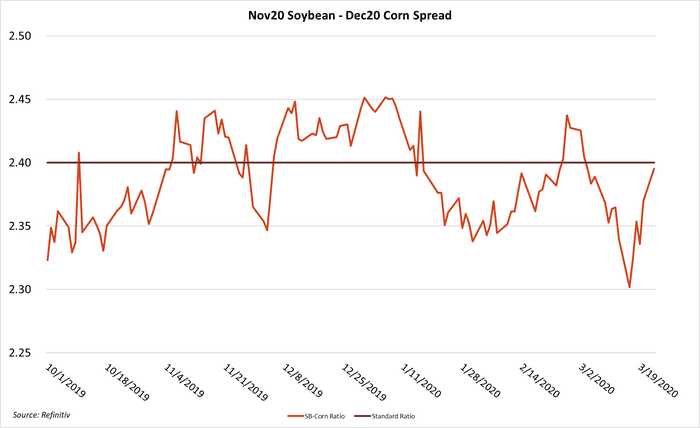

The benchmark soybean-corn ratio has hovered at or near the pivotal 2.4 mark for much of the year. At its current level below 2.4, the markets favor corn acreage. But corn prices have lost strength in the last week amid corn basis collapsing across the Corn Belt last week on reduced ethanol demand.

The ratio is increasingly moving towards a preference for soybean acreage as ethanol plants across the country make downward production adjustments to offset shrinking profit margins. Potential purchases from China as part of the Phase 1 trade deal could further strengthen soybean prospects in 2020.

Weather will continue to be the dark horse in the race for 2020 planting acreage. Farmers in the Dakotas, Minnesota, Wisconsin, and Michigan are still scrambling to harvest the last of 2019 crops left in the fields following a cold and wet 2019 harvest season.

If early showers continue to saturate Midwest soils in upcoming weeks, soybean acreage and corn prices alike may get a boost; farmers may be further delayed finishing 2019 harvest and beginning 2020 planting. If rain continues to plague the Midwest, corn and soybean acreage may both end up lower this year.

Wheat gets demand boost from pandemic

Respondents also expect to plant more wheat acres. Those surveyed indicate 31.7 million acres of winter wheat had been planted, half a million acres more than USDA’s official estimate. Surveyed growers expect to plant 14.2 million spring wheat and durum acres, up 1% from last year. Farm Futures’ final wheat estimate of 45.8 million acres is approximately 800,000 acres more than USDA’s February Outlook estimate of 45.0 million acres.

Wheat demand received an unexpected boost in recent weeks from panic buying as consumer stockpiling increased demand for bread, pasta, and flour. An unexpected Chinese purchase of 12.5 million bushels of hard red winter wheat last week was a strong windfall for the wheat markets.

The uptick in demand could position 2020 wheat acreage as an alternative to corn and soybean acres as winter wheat plantings remain at the second-lowest acreage in history amid record high global stocks.

Outlook for other crops

Sorghum estimates from the March 2020 Farm Futures survey placed 2020 planting intentions at 6.5 million acres, up nearly 1.2 million acres from 2019 plantings following a rebound in Chinese exports.

Global cotton manufacturing was an early casualty in the initial days of the pandemic and its bleed will likely continue through the 2020 growing season. Cotton growers in the Farm Futures survey projected a 2 million acre drop in 2020 acreage to 11.7 million acres as the industry recovers from the simultaneous supply and demand shocks incurred by the pandemic.

Forecasts in February could not have predicted the economic collapse witnessed in the past several weeks. With that in mind, remember that next week’s report is merely an indication of what farmers want to happen, not necessarily what will happen. Markets are at the mercy of uncertainty and volatility, which means significant factors today may shift by the time the 2020 crop is put into the ground.

The Farm Futures March survey was administered to 1,083 respondents on March 4-20 via an email questionnaire. During that time, the COVID-19 pandemic wreaked havoc on global markets and commodities. The U.S. energy and biofuel industries have become casualties in an oil price war between Saudi Arabia and Russia within the same period.

About the Author(s)

You May Also Like