USDA had mixed news for the grain market in its monthly supply and demand report on Tuesday. Not surprisingly, the flow of money from investors and speculators reflected the divergence.

Here’s what funds were up to through Tuesday, April 9, when the CFTC collected data for its latest Commitment of Traders.

![]()

Split decision

Big speculators covered some of their bearish bets in grain futures into the USDA reports and added to long positions in hogs and cotton. The result was a reduction of 16,716 contracts from the hedge funds’ net short position.

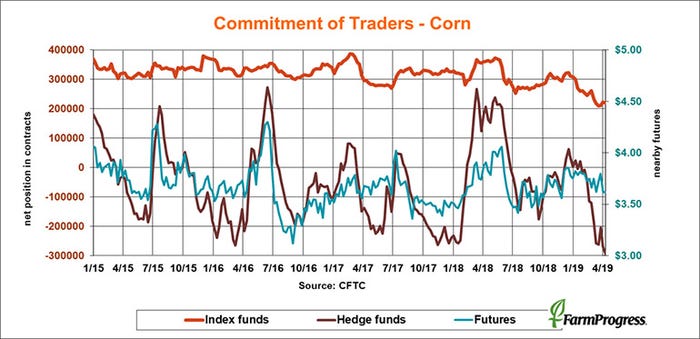

Wipe out

Big speculators extended their bearish bet in corn to another new record this week, reflecting the agency’s increase in projected 2018 crop carryout. Hedge funds added a net 24,525 contracts to take their net short position to 294,352 lots.

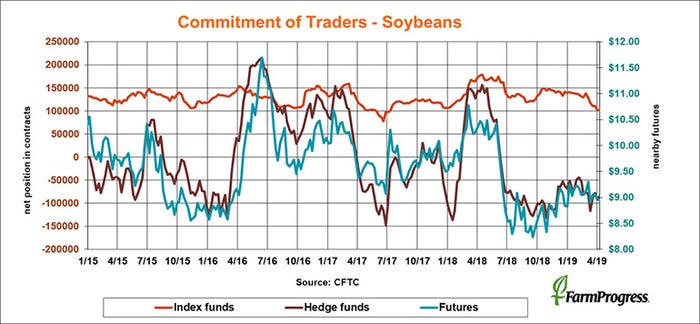

Booking profits

Big speculators took profits on some their soybean shorts this week, covering 6,767 contracts of their modest bearish bet, which is at 84,961 contracts.

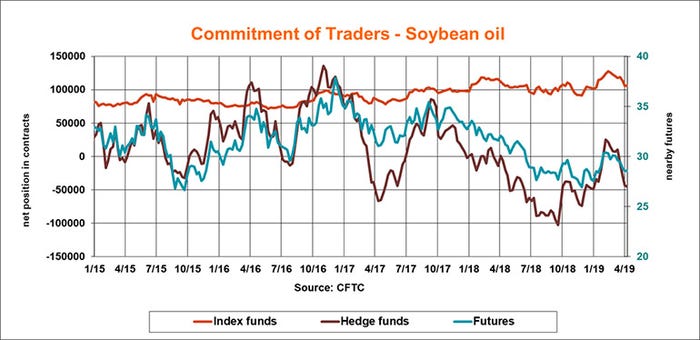

Sweaty palms

Big specs sold soybean oil this week, reflecting bearish sentiment on world vegetable oil markets. The hedge funds added 1,907 contracts to their small net short position.

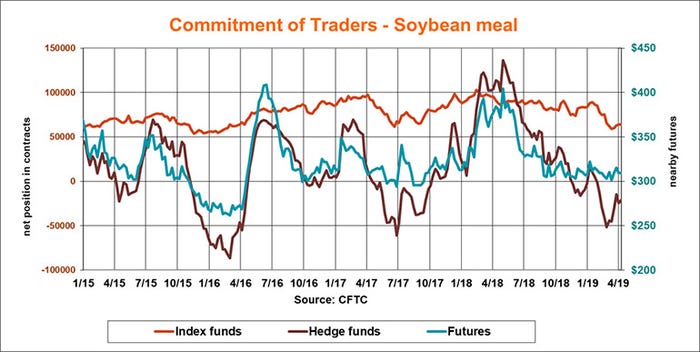

Small buyers

Big speculators bought back 3,829 contracts from their small bearish bet on soybean meal this week, taking it to 20,924 lots.

Weather cautions

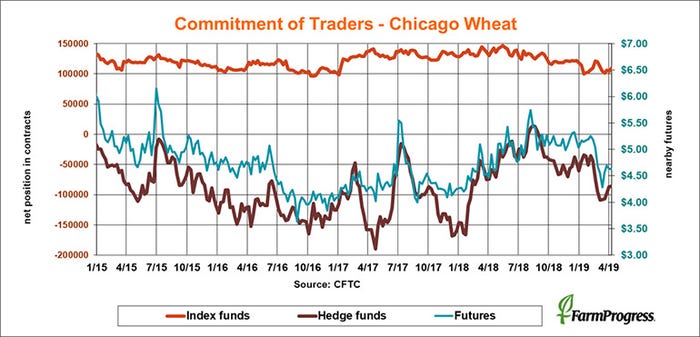

USDA had bearish news for wheat, cutting its forecast for old crop demand. But big speculators covered some of their net short position in SRW anyway, buying back 800 contracts.

Booking out

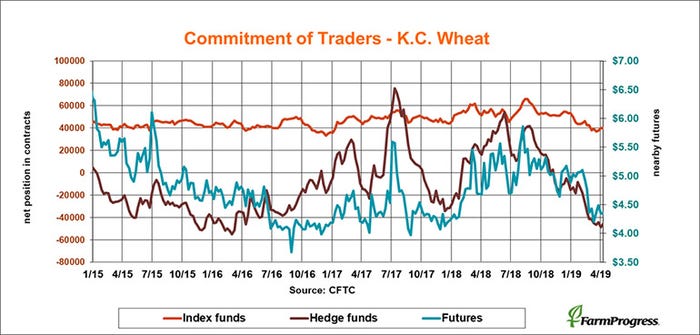

Big speculators also covered some of their shorts in HRW, taking 3,094 lots off their modest bearish bet.

Selling again

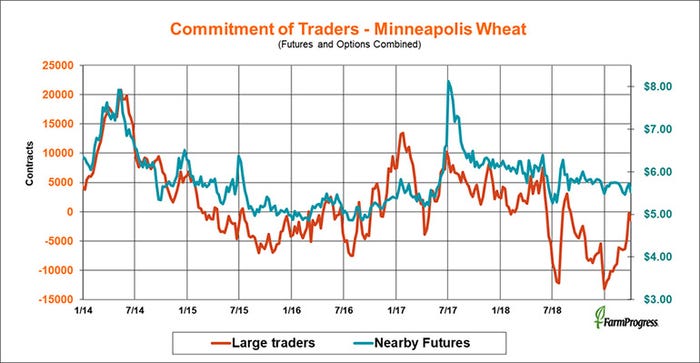

Large traders were selling in Minneapolis again this week, adding 1,246 contracts to their small net short position as weather forecasts turned dry for the northern Plains, which could get planting back on track.

Money loves company

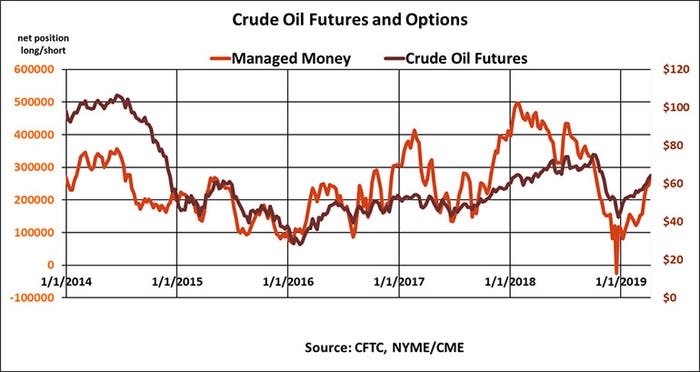

Money managers bought crude oil for the seventh straight week, and this time did it with gusto, adding more nearly $2 billion in crude oil futures and options to their net long position as prices surged above $64 a barrel.

About the Author(s)

You May Also Like