Soybean bulls continue to keep a close eye on the truckers strike in Brazil. There's also more rumors that truckers in Argentina are talking about making a similar play if not guaranteed a +27% hike in wages. Keep in mind, this simply allows the drivers in Argentina to keep pace with their surging rate of inflation.

Bears on the other hand are pointing to another twist in trade negotiations with the Chinese. In case you missed the latest audible, President Trump says he is again moving forward with imposing tariffs on $50 billion of Chinese imports.

Last week it seemed like a cease fire had been agreed upon, now this week the trade war is back in full-swing. From what I understand, the White House has set a June 15 deadline for specifying which Chinese goods — up to $50 billion worth — will be subject to a 25% tariff. Obviously, this has the trade worried about retaliatory measures by the Chinese and the very real potential they place tariffs on U.S. soybeans. Here at home, traders are still debating if more acres will be planted in 2018.

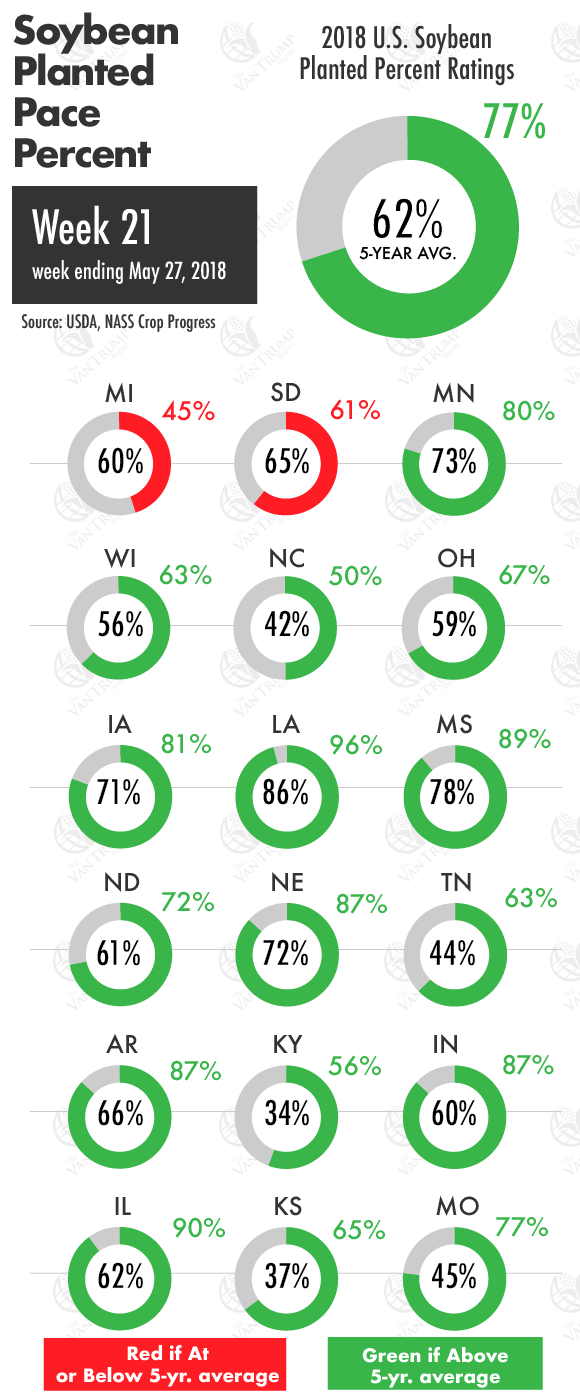

The USDA's most recent data showed about 77% of the U.S. crop as "planted" vs. the 5-year average of 62%. Keep in mind, top producing states like Illinois, Iowa, Minnesota and Nebraska are all running double-digits ahead of their traditional planting pace. In fact, I believe only Michigan and South Dakota are lagging their 5-year average.

The USDA also reported 47% of the crop is now "emerged" vs. the 5-year average of 32% by this date. In other words, the U.S. crop is off to a fairly strong start with perhaps an all-time number of acres in the ground. Record acres and a strong start to the season, along with continued uncertainty involving the worlds #1 buyer of soybeans, makes the trade believe there is adequate supply.

About the Author(s)

You May Also Like