April 1, 2012

If only there was a guru to ask or an application to calculate whether to buy land at lofty prices. Any magic formula would certainly have to consider long-term prospects, the interest rate outlook and your current financial position.

Let’s look at the past 100 years as a road map for the future. There have only been two times when the national average land prices experienced major setbacks. But they were violent when they occurred and lasted a combined 23 years. According to the USDA, average agriculture land values in 1920 were $69/acre. By 1940 they had dropped 56% to $30/acre. From 1941 through 1984, land values rose to $801, and by 1987 fell to $599 – a 25% drop.

Today, U.S. land prices average $2,350/acre. Bear in mind that local areas may have experienced quite different setbacks and rallies. For example, in Iowa the setback began in 1980 with a high of $2,066 and the low of $948 in 1985. That was a 55% decline compared to the 25% national drop.

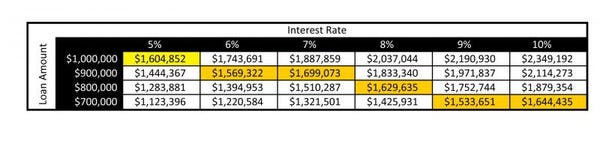

Looking ahead, I think most people believe another setback is likely at some point. Many feel that interest rates are due for an increase, as well. What happens if both occur at the same time? I’ve laid out some scenarios below. The total cost over 20 years of a $1 million loan at 5% interest is $1,604,852 (yellow).

If land prices drop and you could purchase that piece of land for $700,000, it might feel pretty good. However if interest rates climb to 10%, there would be no benefit compared to buying more expensive land today at a lower interest rate. The gross payments over 20 years for that $700,000 farm would actually be $40,000 more over the life of the loan than the initial example of a $1,000,000 farm at 5% interest.

So, let’s examine whether a land purchase will be wise given a current financial position.

If a farmer has $1 million in cash, he can put it in a bank CD and earn a measly 1% interest rate. On the other hand, if he buys 160 acres of cropland at $6,250/acre and grows an average corn crop of 155 bu./acre, he can make $350/acre or $56,000 across the whole farm (based on $5.20 cash corn and expenses of $2.95/bu.). After property taxes, that’s a potential return of 5% on his investment.

Without cash, a farmer would have to borrow $1 million to buy the same property. With an interest rate of 5% on a 20-year loan, his payments on principal and interest will be $80,000, or $500/acre. If expenses are $2.95/bu. and the land payment is another $3.23/bu… that new farm would only be profitable if the farmer could rely on $6.18/bu. corn for the next 20 years.

Developing an outlook for land prices and interest rates is one thing. But even then, as an individual, you must look at your operation and determine if it is financially feasible to take on another piece of ground that will require strong market opportunities for the next 20 years.

About the Author(s)

You May Also Like