Mississippi Land Bank chairman says agriculture among few bright spots in U.S. economy

After “gloom and doom” in the U.S. economy in 2009, last year was a good one for north Mississippi agriculture, says Abbott Myers, Dundee, Miss., grains producer and chairman of the Mississippi Land Bank, which serves 32 counties in north Mississippi. And while he sees the nation’s weighty debt and inflation as problems that need to be dealt with going forward, he told the bank’s stockholders at their annual meeting at Como, Miss., that the outlook for agriculture continues strong.

After “gloom and doom” in the U.S. economy in 2009, last year was a good one for north Mississippi agriculture, says Abbott Myers, Dundee, Miss., grains producer and chairman of the Mississippi Land Bank, which serves 32 counties in north Mississippi.

And while he sees the nation’s weighty debt and inflation as problems that need to be dealt with going forward, he told the bank’s stockholders at their annual meeting at Como, Miss., that the outlook for agriculture continues strong.

“Manufacturing and agriculture are about the only two bright spots in our economy, especially the grains sector,” he says. “The last three years have been good for grains; some are saying these are the golden years for U.S. agriculture. Even the livestock sector has turned around, and dairy is finally improving.

“But every year, it seems, prices for our inputs go up — for farmland, for land rent, seed, chemicals; all my costs keep increasing, and by a lot more than the government’s 4 percent inflation rate.

“But every year, it seems, prices for our inputs go up — for farmland, for land rent, seed, chemicals; all my costs keep increasing, and by a lot more than the government’s 4 percent inflation rate.

While some are worried about a commodity bubble, Myers says, “I don’t think we’re going to have a bubble. On the other hand, I don’t see $7 corn or $14 soybeans at harvest this fall. I think prices will retreat somewhat, although I don’t believe we’ll go back to $2.80 corn or $5 beans.

“The reason? We’ve had crop shortfalls in the U.S. and other countries around the world. The pipeline for the major crops is about empty and demand, particularly in China, is increasing. The U.S. used to be the world’s granary, but now all the stocks are at or near historic lows, except for rice. And a cheap dollar makes it easier for other countries to buy our commodities.

“Populations are increasing and people in China, India, Russia, and elsewhere are continuing to improve their diets. I don’t see them wanting to go back to the way things were before, which means demand should continue to grow.

“All this means a big opportunity for U.S. agriculture — if we can just manage to keep a lid on inflation.”

Higher commodity prices have increased investment in farmland, Myers says, and that has helped to push prices upward.

“With farmland prices reaching new highs — $9,000 an acre in Illinois, $13,500 in Iowa — many are wondering if there is potential for a land bust like we had in the 1980s?

“I don’t think so. I think land costs may retreat some, because $7 soybeans can’t support astronomical land prices. If commodities go down, land will also go down some, because it’s commodity-driven. But long term, I don’t think land prices will fall that much.

Farmland outlook is good

“If you can afford it and can buy at the right time, I think the outlook for farmland as an investment is good.

“There’s a saying: ‘The difference between gold and land is that land will pay you a dividend and gold won’t.’ A lot of investors, rather than putting money in gold, are putting it in Mississippi farmland because they think it’s a good investment.”

With the cyclical nature of agriculture, “We have to be prepared to meet changes, to cope with good times and bad,” Myers says.

The U.S. economy, after two and a half years, “is still in turmoil today,” he says. “Housing remains a disaster area, with foreclosures running around 14 percent, and an astounding 13 percent of the houses in the U.S. are vacant. Housing starts are the lowest they’ve been since World War II.

“Congress has just passed a $3.7 trillion budget. This fiscal year’s deficit is projected to be $1.65 trillion, and the total deficit is almost $14.3 trillion. Congress approved cuts of $38.5 billion in the fiscal 2011 budget, but the Congressional Budget Office says federal spending will be reduced by only $352 million below the 2010 rate, and that if emergency spending is included, the total is actually just $3.3 billion more than 2010.”

The $38.5 billion in cuts represents only about 1 percent of the federal budget, Myers notes, “which is pretty much spit in the ocean in terms of reducing the deficit.

The $38.5 billion in cuts represents only about 1 percent of the federal budget, Myers notes, “which is pretty much spit in the ocean in terms of reducing the deficit.

“Almost everyone is worried about interest rates, and I can tell you: they’re going up. Some economists think they’re only going to rise about 2 percent over the next two or three years. I think you’d better hold onto your chairs, because interest rates could go up significantly.

“It all depends on what the government does. If they actually manage to balance the budget — which I don’t see happening — all the projections could change. But from what we see, interest rates will go up, and we need to be prepared for it.”

Government analysts have made a big deal out of the recent drop in unemployment numbers, Myers says. “But the decline was only one-tenth of 1 percent; the overall rate is still around 9 percent, and the forecast is for unemployment to continue high for a long period.

“The economy is growing by 1 percent to 2 percent — but that’s too slow; it needs to be 3 percent to 3.5 percent.

All the traditional monetary policies that have worked in past economic downturns haven’t been working this time around.

“In the last two and a half years, we’ve had the lowest interest rates I’ve seen in my lifetime, and still the economy has not moved much. Overseas, the European Monetary Fund has had to provide bailouts for Greece, Ireland, Iceland, and Portugal because they couldn’t balance their budgets.

“The U.S. could face a similar crisis if we can’t manage to balance our budget. We can’t finance our massive debt by borrowing more money.”

Inflation or stagflation?

Economists differ as to whether the U.S. faces inflation or stagflation, Myers says.

“The government tells us the inflation rate is 4 percent, but I know on my farm it’s a lot higher than that. Gasoline and diesel fuel are more than $1 per gallon higher than a year ago — you don’t need an economist’s graph to see the impact of all these higher input prices. Inflation is a fact of life; it’s just a matter of how much we’re going to have.

“Stagflation is when the economy doesn’t move, but there’s still inflation. It’s the worst of both worlds, and I hope we don’t see it.

“We’ve got to get our economy to growing if we hope to deal with inflation and ward off stagflation. I think inflation is the big bear in the woods.”

2010 was a strong year for the Mississippi Land Bank, Myers says.

“We distributed $1.57 million in dividends to our stockholders, bringing the total to $16.6 million that we’ve paid since 2004. We’re growing, and our capital position is very strong, which puts us in position to meet the needs of our customers.

“We have a really strong loan portfolio. Our loan quality last year was 96.9 percent, and our loan losses amount to only two-tenths of 1 percent. We’re very proud of that.

“We have a really strong loan portfolio. Our loan quality last year was 96.9 percent, and our loan losses amount to only two-tenths of 1 percent. We’re very proud of that.

“Many of our borrowers were given the opportunity last year to reduce their loan interest rate. When was the last time you know of an insurance company or a commercial bank going to their borrowers and saying, ‘Would you like me to reduce your interest rate?’ We’re proud that we were able to do that.”

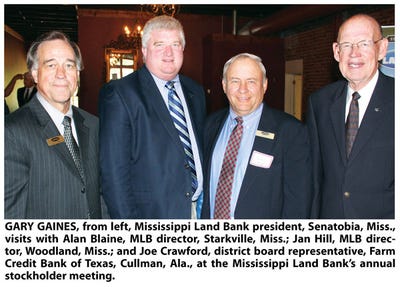

Gary Gaines, Mississippi Land Bank president, noted that “even in this difficult economy, our organization is thriving. Things are going really well from an operational standpoint, with an excellent income stream.

We have assets of $478.3 million and we’re in a very strong capital position, with a net growth of 5 percent. Our credit quality is outstanding.”

Gaines noted that the bank is continuing its awarding of an annual community college and a university scholarship in each of the bank’s 10 districts. “We’re pleased to be a part of furthering the education goals of these outstanding students,” he says.

About the Author(s)

You May Also Like