The expression is “fall like a rock,” and corn prices did just that from mid-March to May 1, as the pandemic continued. Plummeting prices turned an already gloomy outlook for 2020 returns into a drastically more dire picture, says Michael Langemeier, a Purdue University agricultural economist and associate director of Purdue’s Center for Commercial Agriculture.

Several factors contributed, but the dip in ethanol demand and shuttering or slowdown of production at several Indiana ethanol plants played a role, Langemeier says. Future exports were also soft for corn.

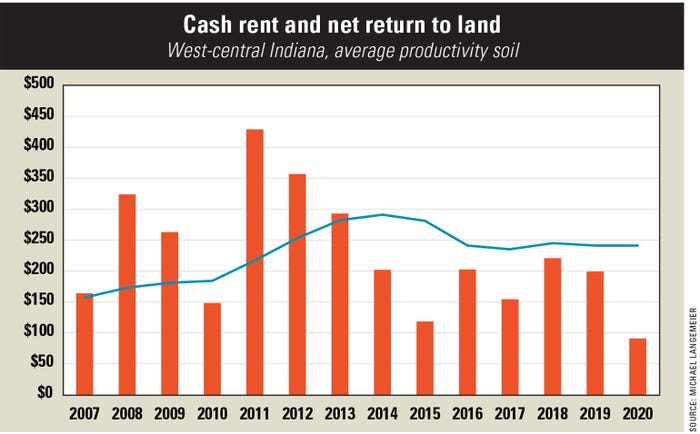

“When we plugged numbers into our west-central Indiana case farm in late January, the projected net return to land for a farm following a corn-soybean rotation was below the average trend line over the past few years, but was still not that far behind 2019,” Langemeier says. “When we ran the numbers recently, they fell about $80 per acre, largely due to very weak corn prices.”

While soybean prices are also on the weak side, they’re holding better than corn. In fact, Langemeier suspects the change in just over a month’s time might cause some people to plant more soybeans than corn. However, so close to planting and based on indications from seed dealers, it’s a mixed bag, with some, but overall minimal, interest in shifting crops. Don’t expect a large shift from USDA’s projections nationally of 97 million corn acres and 83.5 million soybean acres.

Net return to land

The net return to land for Langemeier’s west-central Indiana case farm was $221 per acre in 2018 and $199 per acre in 2019, but only $91 per acre in his latest 2020 projections. The long-run average inflation-adjusted cash rent for average productivity soil in west-central Indiana is around $220 per acre.

“If net return to land winds up anywhere near what we’re projecting now, we would expect some intense cash rent negotiations this fall,” Langemeier says. “We would also expect that cash rents would come down for 2021. That is just a significant drop in intended return to land.”

Unfortunately, without a weather scare, Langemeier doesn’t see the corn price rebounding soon. A trend-line yield at USDA’s projected planting acres would produce a record crop and huge carryout stocks after the 2020 marketing year.

With oil prices low and uncertain, ethanol may be slow to recover. It was a double whammy for the eastern Corn Belt, he notes. While ethanol demand was strong, there was a large positive basis for corn, which helped add to the local cash price. Now the basis is gone, and likely won’t recover soon.

Land prices

Lower net return to land prices would be expected to also push land prices lower. And while it may put some pressure on land prices, Langemeier believes land prices are in a much better position to retain strength than cash rents for three reasons.

“The stock market is unsettled too, and some investors may look to the land market to invest rather than risk everything in stocks,” he says. “Plus, interest rates are extremely low. Very low interest rates favor investing in land.

“Finally, it’s a thin land market. Unless some people are forced to sell land, we don’t expect much land to be up for sale this year.”

About the Author(s)

You May Also Like