April 29, 2016

This chart updates one found in the ERS report, Debt Use by U.S. Farm Businesses, 1992-2011, April 2014. (click to enlarge)

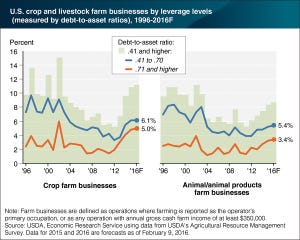

The share of U.S. farm businesses that are highly leveraged (defined as having debt-to-asset ratios greater than .40) has trended upward since 2012 and is forecast to increase slightly in both 2015 and 2016, according to a USDA Economic Research Service report.

Farm businesses specializing in crops are forecast to have higher shares of both highly and very highly leveraged operations (with over .70 debt-to-asset ratios) than those specializing in animals/animal products.

In 2016, the share of very highly leveraged crop farms is expected to reach the highest level since 2002.

Debt-to-asset ratios measure the amount of assets that are financed by debt, and are an indicator of the level of a farm’s solvency.

Because lending institutions consider debt-to-asset (along with other measures reflecting the chance of default) to assess credit worthiness of farms, some of these highly and very highly leveraged farm businesses may have difficulty securing a loan.

Farm businesses — those farms with at least $350,000 in annual sales or farms with lower revenues where the operator’s primary occupation is farming — account for more than 90 percent of U.S. farm sector production, and hold 71 percent of all farm assets and 80 percent of farm debt, according to USDA’s 2014 Agricultural Resource Management Survey (ARMS).

You May Also Like