Farm sector earnings forecast to rise in 2010

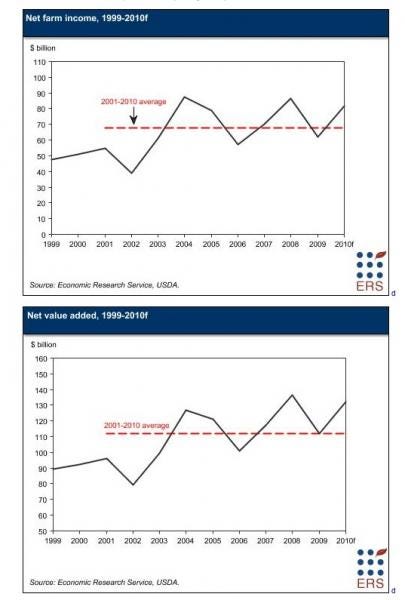

All three measures of farm sector earnings are forecast to rise in 2010, rebounding from double-digit declines in 2009.Net cash income is expected to rise nearly 34 percent from 2009, and 28.8 percent above the previous 10-year average.Net value added, at $132.0 billion, is expected to be up $20 billion from 2009, and will be 22 percent above its 10-year average. An increase in the value of livestock production accounted for almost all of the upward movement in net value added. The value of dairy production is projected to rise by 29.6 percent, meat animal production by 16.4 percent, and poultry/egg production by 9.9 percent.Net farm income, while forecast to be $5.9 billion below its all-time nominal record in 2004, has shown a rebound from 2009, a year in which demand for agricultural products fell worldwide due to the global recession.

December 1, 2010

Net farm income is forecast at $81.6 billion in 2010, up 31 percent from 2009 and 26 percent higher than the 10-year average of $64.8 billion for 2000-2009. Net cash income at $92.5 billion would be a nominal record, 2.3 percent above the prior record attained in 2008. Net value added is expected to increase by almost $20 billion in 2010 to $132.0 billion. The net value added of agriculture to the U.S. economy in inflation-adjusted terms reached its two highest levels since the mid 1970s in 2004 and 2008. Inflation-adjusted net cash income has reached levels not seen since the mid-1970s for the fourth time since 2004, including the forecast for this year. The mid-1970s was the last comparable period when U.S. farming enjoyed multiple years of sustained levels of high output and income.

A second feature of the 2000-2009 decade is the high and persistent levels of volatility in agricultural commodity and input (feed, fuel, and fertilizer) markets. The volatility is reflected in the patterns of farm income during the decade. Net farm income increased in 6 of the 10 years, posting an average increase of 26.6 percent in the years with increases in farm income and an average decline of 23.5 percent in the other years (2002, 2005, 2006, and 2009).

Net cash income includes only cash receipts and expenses and is generally less variable than net farm income. Farmers can manage the timing of crop and livestock sales and of the purchase of inputs to stabilize the variability in their net cash income. Nonetheless, during 2000-2009 net cash income showed a significant degree of variability. In the 6 years when net cash income rose, the average increase was 10.4 percent. In years when net cash income decreased, the average decrease was 15.9 percent.

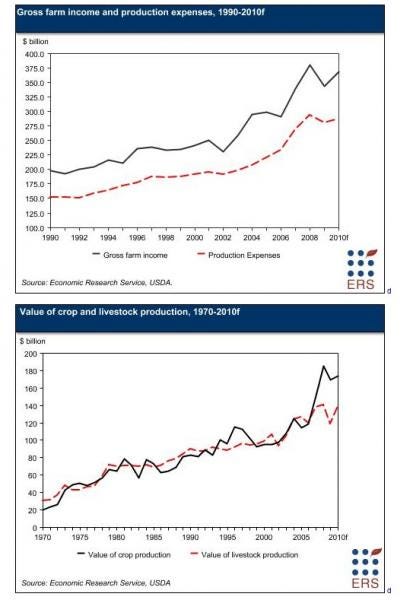

The values of both crop and livestock production have trended steadily upward over the last decade. However, the year-to-year movements in the two measures have not always been synchronized. In 2010, the rise in the value of livestock production (16.6 percent) is expected to be more than more than five times the rise in the value of crop production (3.1 percent). The forecast for higher farm income in 2010 is responding to increases in cash receipts for all the livestock categories, led by double-digit growth in meat animals and dairy products. Net value added and net farm income have followed the value of commodity production over both the long term and in year-to-year fluctuations. Because farmers typically do not vary their production mix dramatically from year to year, purchases of production inputs have been relatively stable. Expenses for purchased inputs are projected to show a moderate increase of 2.5 percent, after posting a 6.4-percent decline in 2009.

Farm sector earnings rebound

All three measures of farm sector earnings are forecast to rise in 2010, rebounding from double-digit declines in 2009.

-Net cash income is expected to rise nearly 34 percent from 2009, and 28.8 percent above the previous 10-year average.

-Net value added, at $132.0 billion, is expected to be up $20 billion from 2009, and will be 22 percent above its 10-year average. An increase in the value of livestock production accounted for almost all of the upward movement in net value added. The value of dairy production is projected to rise by 29.6 percent, meat animal production by 16.4 percent, and poultry/egg production by 9.9 percent.

- Net farm income, while forecast to be $5.9 billion below its all-time nominal record in 2004, has shown a rebound from 2009, a year in which demand for agricultural products fell worldwide due to the global recession.

Total expenses are forecast to increase moderately.

- Total production expenses in 2010 are forecast to be 2.0 percent higher, reversing the 4.1-percent drop in 2009. This is in stark contrast to the 15.7-and 8.8-percent increases in production expenses recorded in 2007 and 2008.

The 2010 forecast is for a rise of 10.4 percent in cash receipts from sales of farm commodities.

- Crop receipts are expected to increase $9.4 billion with cotton, soybean, and corn receipts expected to show the largest gains.

- Livestock receipts are expected to increase $20 billion in 2010, led by surges in cash receipts for dairy and hogs.

Government payments are forecast to be $12.4 billion in 2010, a 1.5-percent increase from last year.

- Price-sensitive crop and milk commodity program payments are expected to decrease by a combined $2.3 billion in 2010.

- Other government payments are expected to increase by $2.5 billion led by a nearly $2.2 billion increase in disaster assistance payments.

See all Farm Income data files.

See monthly prices for crops and livestock.

See annual prices for commodities.

See our glossary for definitions of terms.

See the official USDA estimates and forecast tables.

Amounts in this article are in nominal dollars. Estimates and forecasts in constant (2005=100) dollars are available.

Large increase in U.S. cotton receipts

Cotton receipts in 2010 are expected to easily surpass 2009 as the 2010 U.S. lint price rises 24 cents per pound and quantities sold increase almost 12 percent. The quantity of cottonseed sold is expected to increase 48 percent, while its annual average price rises over $12 per ton. In the face of a world economic recovery, foreign beginning stocks are at a 7-year low, boosting the demand for U.S. exports in crop marketing year 2010. The U.S. upland crop is estimated to be almost 6.6 million bales above 2009, reflecting high yields, the lowest abandonment level in 60 years, and a large harvested area. U.S. cotton demand for the 2010 crop marketing year is expected to be well above last season, and U.S. exports are expected to be the second highest on record.

The anticipated increase in wheat sales reflects larger quantities sold at a slightly lower farm price. A rise in rice receipts is expected as an increase in quantity sold more than offsets an expected price decline. The USDA forecasts a record crop with total U.S. rice supply about 11 percent larger than the 2009 crop marketing year. Total exports are expected to be the second highest on record.

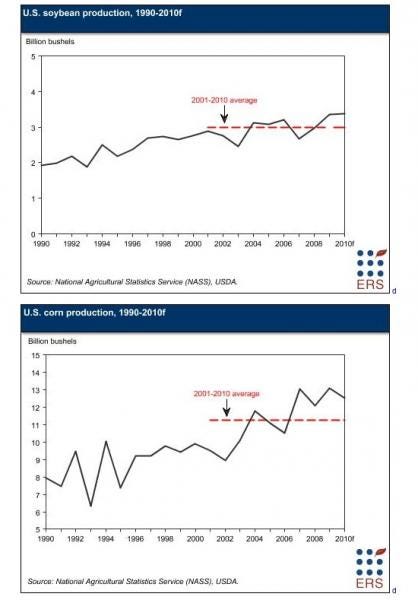

Soybeans are expected to exceed last year’s record crop. Strong foreign demand for U.S. soybean exports, especially from China, means that exports for marketing year 2010 are expected to break last year’s record. A forecast decline in the annual price of peanuts is expected to offset an increase in quantities sold. The 2010 yield is the fourth highest on record. Domestic food use of peanuts is expected to rise in crop marketing years 2009 and 2010 while exports, which declined in 2009, are expected to recover some of their lost ground in crop marketing year 2010.

Corn sales are expected to increase with expected increases in bio-energy demand. Declines are expected in both price and quantity sold for barley, while an increase in oat price will fail to offset a decline in its quantity sold. Oat production for the 2010 crop marketing year is down from 2009 and, if realized, would be a record low. A slight decline in hay receipts is anticipated as an increase in hay sold is expected to be more than offset by a decline in price. This reflects a decline in roughage-consuming animal units.

Potatoes are expected to experience declines in both price and quantity sold. Dry bean sales are expected to increase as increased quantities sold more than make up for a decline in their price. As a result of the smaller fresh-market storage crop and continued good domestic and export demand, onion prices may remain above year-earlier levels until next spring. Declines are expected in the quantities sold for apples, sweet cherries, pecans, and walnuts, while increases are expected for avocados, cranberries, and almonds. California is expected to produce a record navel crop, whereas Florida total citrus production is projected to fall 16 percent.

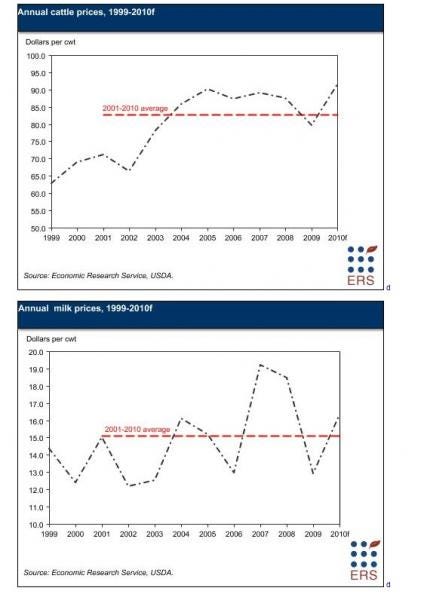

Dairy receipts are expected to increase by almost one-third in 2010 as average milk prices received by dairy farmers are expected to increase more than $3.50 per cwt. Meanwhile, cattle and calf cash receipts are expected to increase 13 percent in 2010 due to increased slaughter. Hog cash receipts are expected to increase 26 percent over 2009 due to stable pork demand and lower year-over-year pork production. Broiler cash receipts are expected to have increased almost 11 percent in 2010 over 2009 cash receipts due to an increase in prices and the gradual reopening of exports to Russia. Egg cash receipts are expected to increase slightly in 2010 due to increased production and slightly higher year-over-year prices.

Total production expenses rise modestly

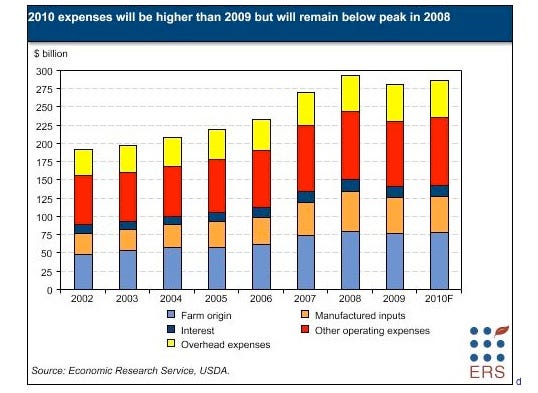

Total production expenses in 2010 are forecast to rise to $286.6 billion, $5.6 billion (2.0 percent) higher than the $281.0 billion estimated for 2009. This change is modest relative to increases of $36.5 billion (15.7 percent) in 2007 and $23.7 billion (8.8 percent) in 2008, prior to the $12.0-billion (4.1-percent) drop in 2009. The 2010 forecast puts nominal expenses at the second highest level ever.

On the price side, the prices-paid index for Production Items, Interest, Taxes, and Wage Rates (PITW) is projected to rise 2.3 percent in 2010. On the quantity side, total output is forecast to be almost exactly the same as last year, as crop output is down 0.6 percent and livestock output rises nearly 1 percent. At the current forecast level, total expenses would be 78 percent of gross farm income, 3 percent less than in 2009. Livestock/poultry purchases and fuel/oil purchases are both slated to rise more than $2.7 billion while miscellaneous expenses are expected to go up $1.9 billion. The only large-scale drop in expenses will be a fall of $2.0 billion in fertilizer and lime expenses.

After rising $18.9 billion (67 percent) from 2006 to 2008, feed expenses are expected to drop for the second straight year in 2010, but by only $300 million (0.6 percent) compared with a decline of $1.9 billion (4 percent) in 2009. The projected drop is the result of an expected 1.6-percent decline in prices paid for feed and the small increase in livestock output. Because corn accounts for around 90 percent of feed grains used for feed and soymeal is the principal oil crop product used as feed, prices paid for grain feeds depend mainly on the prices for these two commodities. The annual average price for corn in 2010 should be around 5 percent higher than in 2009 but most of that rise has occurred in the last half of the year. Soymeal prices are forecast to fall about 10 percent. The price of another important feedstock, hay, is expected to be down 6 percent, but, again, prices have risen during the last half of the year. The timing of price changes matters because changes in the prices paid for complete feeds, the most heavily weighted component of the feed prices-paid index, usually lag price changes in grains and oilseeds. On the quantity side, calendar-year Grain Consuming Animal Units (GCAU) are projected down around 1 percent. Feed and residual use of corn in 2010 is projected to be slightly above the previous year. Domestic disappearance of soymeal should be down slightly.

After falling $2.4 billion in 2008 and 2009, livestock expenses are expected to increase $2.7 billion (16.5 percent) in 2010. Since cattle and calf purchases account for more than 75 percent of this expense, the situation in this market has the biggest effect on these purchases. During the first half of the year, relatively high retail prices for beef were keeping feedlot returns profitable. Retail prices are being buoyed by a number of factors. First, improving economies are reviving demand for beef. Beef exports are expected to be 18 percent higher in 2010. Second, supplies of beef will be limited as commercial beef production is slated to remain low, and will remain so into 2011. Finally, prices for competing meats, pork and poultry, are relatively high. Feedlot margins have tightened during the second half of the year. However, as fed cattle prices have leveled off, the cost of feed has begun to rise above what it was at the beginning of the year, and feeder steer prices have remained stable. Farm prices for cattle are predicted to be higher in each quarter of 2010 and up 13 percent annually. This increase is occurring, in part, because tightened supplies of feeder cattle are finally having an effect on prices.

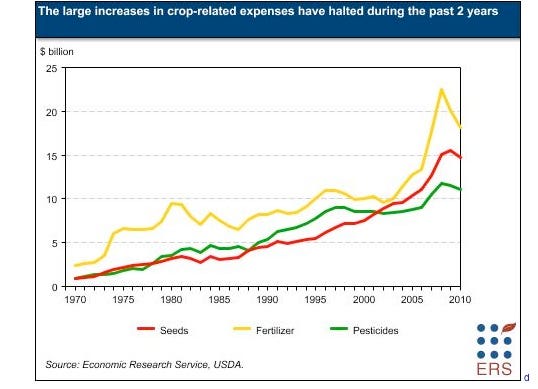

Following a $2.2-billion (4.4-percent) decrease in 2009, principal crop-related expenses are projected to be $44.0 billion in 2010, $3.2 billion (6.8 percent) lower than in 2009. A large decline in fertilizer expenses and smaller decreases in seed and pesticide expenses comprise the lower forecast. At this time, acres planted to principal crops in 2010 are estimated to be down 3.0 million acres (1.0 percent), the second straight decline. A 5.6-million acre decline in wheat planted was partly offset by increases in corn, soybean, and cotton acreage, all of which are heavier users of fertilizer and pesticides. Total crop production is calculated to be down 0.5 percent, with grain and oilseed production down 1.2 percent. Fruit and vegetable production will each be down more than 5 percent.

Seed prices have been rising rapidly because farmers have been making greater use of GMO seeds with their bio-technology advancements and improved yield potential. Since 1999, prices paid for seeds have risen 146 percent, with 64 percent of that rise occurring during 2007-09. Between 1999 and 2009, seed expenses increased $7.9 billion (110 percent). During the last 3 years, seed expenses rose $4.5 billion (41 percent). The price increases are forecast to end, at least temporarily, in 2010, with prices paid for seeds going down 3.9 percent. Combined with the decrease in planted acreage, seed expenses are forecast to be down around $750 million (5 percent) this year.

Fertilizer expenses are slated to fall significantly for a second straight year, declining $2.0 billion (10.1 percent) in 2010. Fertilizer prices rose steadily between 2002 and 2008, with the annual average prices paid for fertilizers climbing 264 percent. During this period, fertilizer expenses rose $12.9 billion (134 percent). In 2009, the annual average prices paid for fertilizer plunged 26 percent and is forecast to decline another 11.5 percent in 2010. However, fertilizer prices have risen from their beginning-of-year levels. One factor in that rise has been an increase in the price of natural gas, the primary source of nitrogen fertilizers. Higher crop prices, especially for corn, have generated increased demand. In response, prices for widely-used fertilizers began to rise more rapidly in July. However, most of the fertilizer used in 2010 was purchased before these late-year price increases. Projected use of fertilizer on planted acreage during 2010, measured as acres planted times usual per-acre application rates, was likely up slightly. (For the source of application rates, see Agricultural Chemical Usage.)

Pesticide expenses rose steadily from 2002 to 2008. In 2007-08 alone, they rose $2.7 billion (30.0 percent). Since prices paid for pesticides rose only 8.4 percent during those 2 years, it is likely that increased use was a factor in the increases in the expense. Even though prices paid for pesticides continued to increase in 2009, pesticide expenditures fell slightly. Another decrease of around $400 million (3.6 percent) is predicted in 2010 as prices paid for pesticides fall 2.7 percent and planted acreage declines. Projected use on planted acreage, measured as acres planted times usual per-acre application rates, was around 2 percent higher.

As with fertilizer, prices paid for fuel rose dramatically between 2002 and 2008. During this period, annual average prices paid for fuel jumped 207 percent and fuel prices registered 6 straight double-digit percentage increases. After falling 34 percent in 2009, annual average prices paid for fuels are forecast to be back up 23 percent in 2010. The decrease in acres planted should translate into less use of fuel during 2010. Combined, the price rise and drop in acres yield a forecast that is up $2.8 billion (22 percent).

Payments to stakeholders

Payments to stakeholders, the returns to nonowner capital, are forecast to be $50.4 billion in 2010, $0.6 billion (1.2 percent) higher than in 2009. The increase is due to a projected rise in hired labor and net rent to nonoperators that more than offsets a small drop in total interest expenses. Payments to stakeholders will constitute 18 percent of total expenses in 2010, nearly identical to 2009, and 38 percent of net value added, down from 45 percent in 2009.

Total labor expenses are projected to be about $500 million (1.7 percent) higher in 2010 based on a 1.7- percent increase in wage rates and the lack of change in total output. Employee compensation (hired labor) is expected to climb $650 million (2.6 percent). With cash receipts for the principal commodities that employ hired labor (vegetable, fruit, nut, dairy, and greenhouse/nursery operations) up 12 percent and with higher net farm income, operators will likely be less reluctant to hire workers than they were in 2009.

Net rent to nonoperators should be about $170 million (1.7 percent) higher than in 2009. Cash rent is forecast up 2.0 percent. Cropland cash rents per acre in the most recent Agricultural Land Values and Cash Rents were up 3.0 percent. That increase and the small drop in acres planted account for the cash rent forecast. Following the movement in the value of crop production in 2010, share rent should be up 3.1 percent. Other factors in the forecast equation hold the change in total net rent to less than the movement in the cash and share rent indicators.

Interest expenses are forecast to be down a little over $200 million (1.4 percent) in 2010. Both real estate and nonreal estate interest are predicted to decrease slightly. Both types of debt should decline more than $2 billion, while interest rates fall slightly. Debt and interest rates are discussed in greater depth in the balance sheet section.

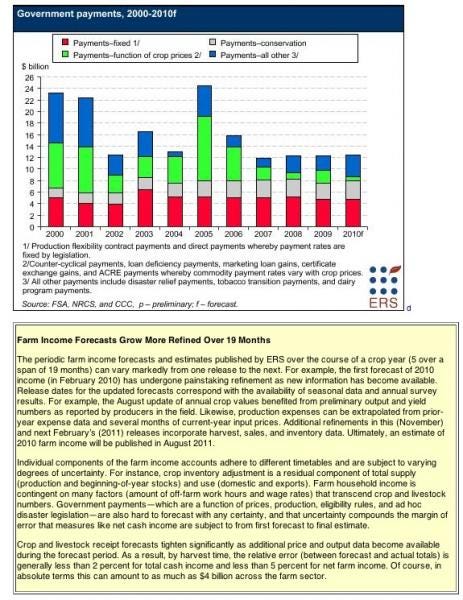

Government payments forecast at $12.4 billion

Government payments paid directly to producers are expected to total $12.4 billion in 2010, a 1.5-percent increase from the $12.3 billion paid out in 2009. This level would be 19 percent below the 5-year average for 2005-09. Direct payments under the Direct and Countercyclical Program (DCP) and the Average Crop Revenue Election Program (ACRE) are forecast at $4.81 billion for 2010. Direct payment rates are fixed in legislation and are not affected by the level of program crop prices. However, the 4-percent decline in direct payments forecast in 2010 relative to the 5-year average is due to producers receiving $430 million in revenue insurance payments from the ACRE program in 2010. Authorized under the Food, Conservation, and Energy Act of 2008, ACRE provides revenue insurance to producers in exchange for a 20-percent reduction in their annual direct payment allotments.

Countercyclical payments are forecast to decrease by 82 percent from $1.17 billion in 2009 to $210 million in 2010. Strong cotton prices are responsible for this projected decrease. Only upland cotton and peanuts are expected to receive countercyclical payments in 2010.

Marketing loan benefits—including loan deficiency payments, marketing loan gains, and certificate exchange gains—are projected at $120 million in 2010, down 89 percent from 2009 levels. Because of the high durum wheat loan rate, durum wheat producers are expected to receive 93 percent of these benefits—despite the recent run-up in global wheat prices. The other wheat classes do not qualify for marketing loan benefits. Prior to 2010, upland cotton producers realized almost 91 percent of the total marketing loan benefits. However, strong current year cotton prices are expected to remain too high for cotton producers to qualify for marketing loan benefits. The other crops receiving marketing loan benefits are barley, wool, mohair, and pelts.

The Milk Income Loss Contract Program (MILC) compensates dairy producers when domestic milk prices fall below a specified level. Rapidly declining milk prices, due to the global recession, generated $880 million in MILC payments in 2009. For 2010, rebounding milk prices are expected to reduce MILC payments to $55 million.

Forecast at $820 million in 2010, Tobacco Transition Payment Program (TTP) payments are expected to continue the declining trend beyond 2010, albeit at a decreasing rate. Payments reported here include both CCC payments and lump-sum payments. Begun in 2005, this program provides annual payments over a 10-year period to eligible quota holders and producers of tobacco. Since the inception of the program, lump-sum payments to individuals have been made through agreements with third parties in return for the producers' and quota owners' rights to the 10-year TTP payment stream.

Conservation programs include all conservation programs operated by the Farm Service Agency (FSA) and the Natural Resources Conservation Service (NRCS) that provide direct payments to producers. Estimated conservation payments of $3.15 billion in 2010 reflect programs being brought up toward funding levels authorized by current legislation.

Ad hoc and emergency disaster program payments are forecast to be $2.82 billion in 2010, an increase of 335 percent over the $648 million paid out in 2009. The 2008 Farm Act created a permanent fund for disaster assistance, the Agricultural Disaster Relief Trust Fund. Supplemental Revenue Assistance Payments (SURE) from this fund and from the 2009 Recovery Act are expected to amount to $1.93 billion in 2010. The Crop Assistance Program payments are expected to amount to $420 million in 2010. All other disaster programs—including primarily the Emergency Conservation Program, Livestock Forage Program, Livestock Indemnity Program, and Noninsured Assistance Program—are functioning at existing statutory authority and appropriation levels. Once a county is declared eligible for disaster relief, producer eligibility in these programs depends on the extent to which their crop or livestock losses meet a particular program's threshold.

You May Also Like