For the first time since 2014, the average value of ag land in Nebraska saw an increase this year. According to the 2020 Farm Real Estate Market Survey, the average value of ag land increased 3% over the previous year.

Each year, the University of Nebraska-Lincoln's Department of Agricultural Economics surveys land industry professionals across Nebraska, including appraisers, farm and ranch managers, and agricultural bankers. Results from the survey are divided by land class and summarized by the eight agricultural statistic districts of Nebraska.

Jim Jansen, Nebraska Extension ag economist and one of the authors of the survey, says three reasons noted in the survey include limited supply of land offerings for sale, an overall fairly strong demand for land, Market Facilitation Program payments due to disruptions in trade, and prevented plant insurance to help partially offset financial losses due to flooding.

“For the state of Nebraska, the MFP payments amount to $960 million,” Jansen says. “Some of the payments may have helped offset some of the financial losses and helped maintain the stability of the ag economy in Nebraska.”

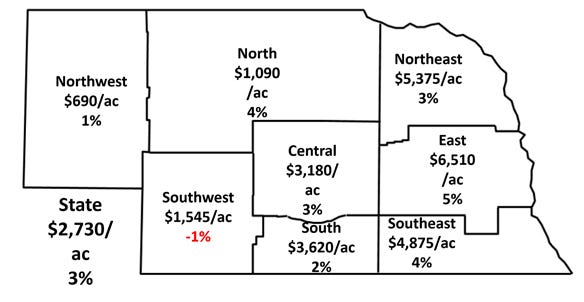

Average of all agricultural land values

Sources for charts: UNL Farm Real Estate Market Survey

However, not every part of Nebraska saw an increase in land values. Overall, the southwest region saw an average 1% decline in all ag land values. The northwest and southwest regions of the state saw a 5% and 6% decline, respectively, in dryland cropland values without irrigation potential. The northwest and southwest regions also saw respective 5% and 3% declines in center-pivot-irrigated cropland values, and 3% and 2% declines in gravity-irrigated cropland values.

According to survey participants, these declines may be due to some uncertainty in sugarbeet production in the northwest district weighing down on irrigated land values, and the availability of water in both of these regions.

However, the western districts, along with most of the eight districts in Nebraska, saw increases in pasture and hayland values — with the exception of the south and east districts, which saw a 3% and 2% decline in hayland values, respectively.

“Depending on where you were at in the state of Nebraska in 2019, the degree of flooding and related disasters varied greatly across the state,” Jansen says. “In some regions of western Nebraska, the flooding wasn't as great of an issue. There may have been fairly favorable weather-related production for hay and grassland in parts of the state.”

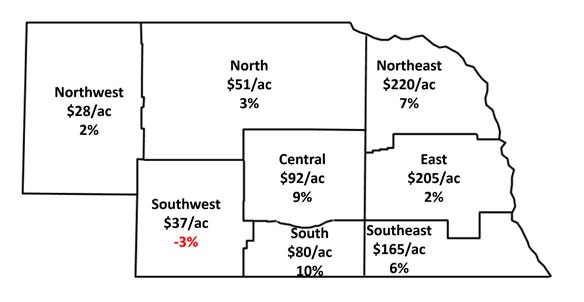

Dryland cropland rental rates, preliminary estimates

Unsurprisingly, the eastern three districts — the northeast, east and southeast — once again saw some of the biggest increases in land values, at 3%, 5% and 4%, respectively.

“The general market competitiveness of these areas remains high given expectations for crop yields, competitive basis levels and annual rainfall,” Jansen says. “For areas in the east and southeast, depending on where a farming operation is situated, there may be opportunities for competitive off-farm employment that may help sustain the cashflow of the operation or provide critical benefits for a family involved in a farming operation.”

Rise in rental rates

Rental rates for cropland and grazing land in 2020 also reported steady to slightly higher rates over those reported in the prior year.

Survey participants indicated a great amount of pressure existing between landlords and tenants when determining an equitable rental rate. Retired or absentee landlords try to achieve a certain amount of return on their asset while facing high property taxes. Meanwhile, producers seeking a positive return on rented properties face tight margins due to low commodity prices.

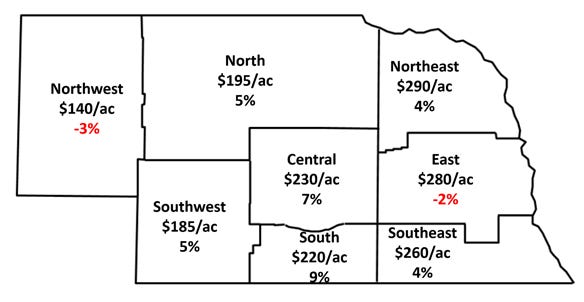

Overall, dryland and irrigated cropland reported steady to slightly higher averages across the state. The rise in dryland rental rates ranged from 2% in the northwest to 10% in the south. The exception was a 3% decline in the southwest district. Irrigated rental rates were more mixed as rental rates trended up on average from about 5% to 8%. The northwest district, however, saw declines of 3% to 5% for cropland irrigated by center pivot or gravity, respectively.

Center-pivot-irrigated cropland rental rates, preliminary estimates

Pasture and cow-calf pair rental rates trended up across Nebraska in 2020 ranging from 1% to 12%, with the biggest increases in the northwest, northeast, central and east districts. Survey participants noted the extent of flooding or damages from 2019 will still have impacts on stocking rates and grazing practices in certain areas for 2020.

With the rise in rental rates and land values, the question is, what will the future hold given the uncertainty in commodity markets?

“Expectations in land markets, farm real estate, cash rents may change depending on the general direction of the ag economy, particularly due to recent events of COVID-19,” Jansen says. “Efforts by the Federal Reserve to provide some degree of stability to financial markets may continue to provide lending rates at a fairly competitive fixed interest rate. Real questions remain on overall long-term profitability of major commodity sectors in the state of Nebraska given the events of COVID-19 and how those may affect the farm real estate markets.”

About the Author(s)

You May Also Like